🟡 What happened with Gold (XAUUSD) yesterday? In yesterday's analysis, I mentioned that I was bullish on Gold, expecting a resumption of the upward move with targets extended to 3080 and interim resistance at 3050. Although the price rose, it found strong resistance at the 3020 zone, which prompted me to close my buy trade with around 400 pips profit (although...

When it comes to trading Gold (XAUUSD), I’ve learned one key truth: breakouts lie, but dips/rallies tell the truth. That’s why I stick to one rule that has kept me consistently profitable: I only buy dips in an uptrend and only sell rallies in a downtrend. Let me explain exactly why this approach works so well—especially on Gold, a notoriously tricky market....

1. What happened (recap): Last week, EURUSD reached the 1.1150 zone, a level that hasn't been touched since August-September last year. After that, the pair started a correction. Although the week started with a gap down yesterday, bulls took control and pushed the pair higher. 2. Key Question: Has EURUSD completed its correction, or is another drop coming? ...

Since the beginning of the year, Gold has been on an impressive uptrend, gaining over 5000 pips, culminating with last week's ATH at 3167. As I highlighted throughout last week's analyses, even though we're in a strong uptrend, the price was too far deviated from the mean, making a correction inevitable. ✅ Friday Recap: After testing the resistance zone formed...

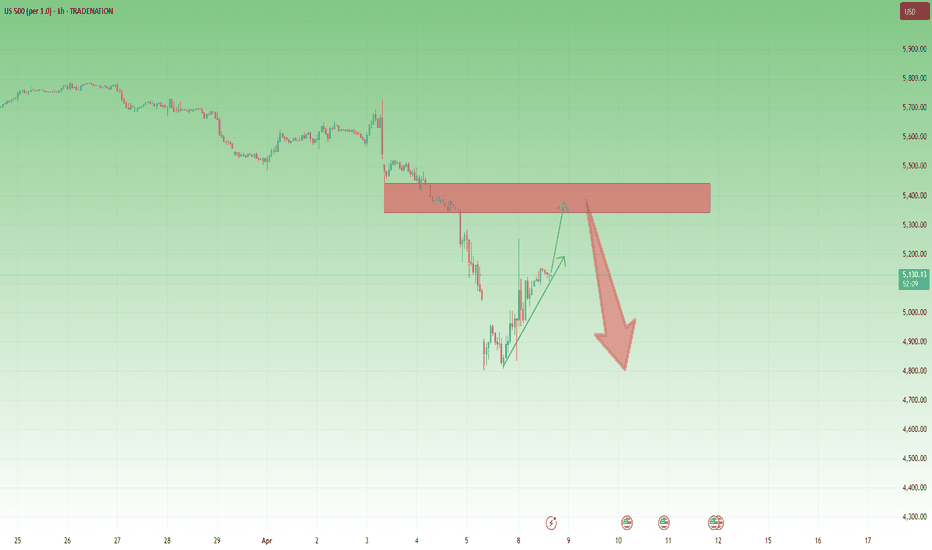

1. What happened yesterday? In my weekend analysis covering US indices , I mentioned that US500 (SP500) could drop and test the ascending trend line starting back at the pandemic low. This line is confluent with the horizontal support level given by January 2022 ATH, offering a good opportunity for traders to open long positions. Indeed, at least on CFDs and...

Without a doubt, Solana was the hottest topic in the crypto market last year and at the start of this one—especially with the meme coin craze. However, after peaking near $300, the price began to decline in what initially appeared to be a normal correction. But once Solana broke below the $200 mark, things turned ugly, and the price quickly dropped to the key $120...

Lately, the market has been in chaos – indices are dropping like there’s no tomorrow, and when it comes to Gold, what used to be a normal fluctuation of 100 pips has now turned into a 500-pip swing. In such a volatile environment, many traders feel compelled to be constantly active, believing that more trades mean more profit. But the truth is, there’s a time to...

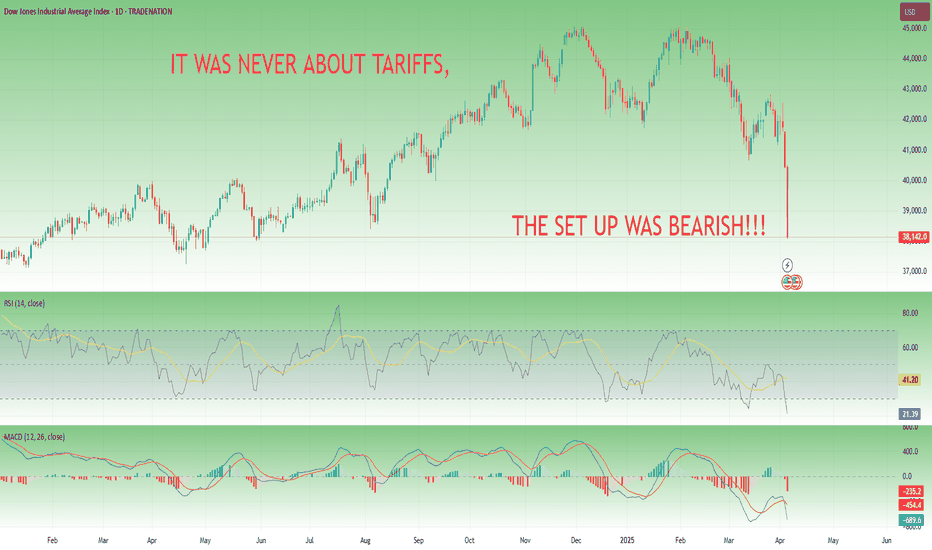

The indices have plummeted sharply, and whether you believe this is due to Trump’s tariffs or would have happened anyway, regardless of the trigger, the reality remains the same. Both the S&P 500 and Nasdaq 100 are officially in bear market territory— defined by a decline of more than 20% from their peaks . Meanwhile, the Dow Jones Industrial Average is down...

🚩 Intro: Markets Correct — They Don’t Need Permission Every time the market drops hard, the headlines rush in to explain it. This time, it was President Trump’s dramatic tariff announcement on April 2nd. The media called it a shock. I didn’t. I’ve been calling for S&P 500 to drop to 5,200, and NASDAQ-100 to 17,500, since early January. Not because I predicted...

The markets reacted strongly to Jerome Powell's latest commentary, sparking a notable rally. However, traders should be cautious before assuming this marks the beginning of a new uptrend. While there has been a slight shift in market structure, the broader trend remains intact. Overlooking the strength of the next resistance level could prove to be a costly...

Yesterday was an insane day for Gold—while I expected a strong drop to at least 3,080, I didn’t anticipate such a sharp reversal after the sell-off. Now, the big question is: Has Gold finished correcting, or is more downside coming? ________________________________________ Why I Expect Another Wave of Selling 📉 Gold Still Looks Vulnerable – Despite the...

I've been calling for a strong correction in the Nasdaq (and all major U.S. indices) since the start of the year—long before the tax war even began. I warned that a break below 20,000 was likely, with my final target set around 17,500. And indeed, the index has fallen—regardless of what the so-called "cause" might be. Right now, Nasdaq is trading at 18,400,...

Yesterday was a high-volatility day, and we all know why. Gold surged to yet another all-time high at 3,168, and luckily, I had already closed my sell trade around break-even—otherwise, my stop loss would have been triggered. ________________________________________ Gold Still Set for a Hard Drop? Despite the rally, my outlook remains unchanged—I still believe...

Lately, the markets have been in a downtrend, leaving many traders and investors wondering what comes next. Whether it’s stocks, crypto, or other financial assets, downturns are an inevitable part of the game. While they can be unsettling, they also present opportunities—if you know how to navigate them. Market declines happen for many reasons: economic...

As you know, I am bearish on Bitcoin in the long term. However, in the short term, the cryptocurrency could see a recovery. Yesterday, the price tested the 81,000 support zone once again and rebounded from that level. Now, Bitcoin is pushing against the 83,500 resistance, and I believe a breakout is likely. If that happens, we could see further gains, with...

There’s a well-known saying in trading: “The trend is your friend.” I firmly believe in this principle. However, when price movements become too extreme—too fast and too far—it’s wise to exercise caution, even if you’re not ready to take the opposite side of the trade. And right now, I believe that’s exactly the case with Gold....

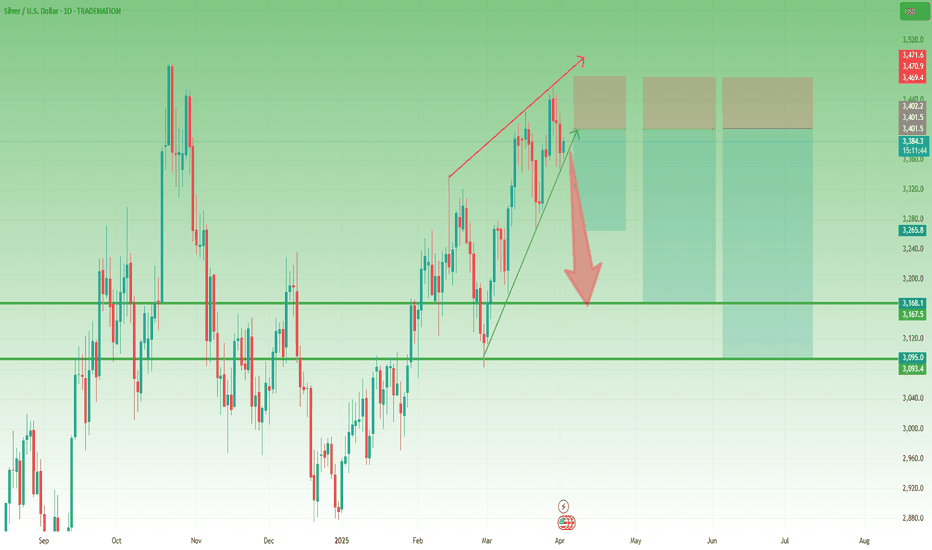

Silver has been on the rise recently, but unlike its big brother, Gold, it started rolling back down on Friday—even as Gold continued to print new all-time highs, culminating at 3,150 yesterday. This divergence between the two metals could be an early sign that Silver is losing momentum. ________________________________________ Technical Signs of Weakness 📉...

The internet has made it easier than ever to learn trading for free. You have access to blogs, videos, books, podcasts, and more. Yet, most traders still fail. Why? Because there’s too much information. It’s overwhelming, confusing, and filled with conflicting advice. So, if I had to start over from scratch, here’s exactly how I’d do it—step by step....