In my analysis yesterday, I explained that XAU/USD is significantly deviated from the mean, with its 20-period moving average nearly 1,500 pips below the current price. This level of divergence is unsustainable. As always, trading against the trend is risky—especially when there’s no clear guide, such as a resistance level, to structure the trade. Although my...

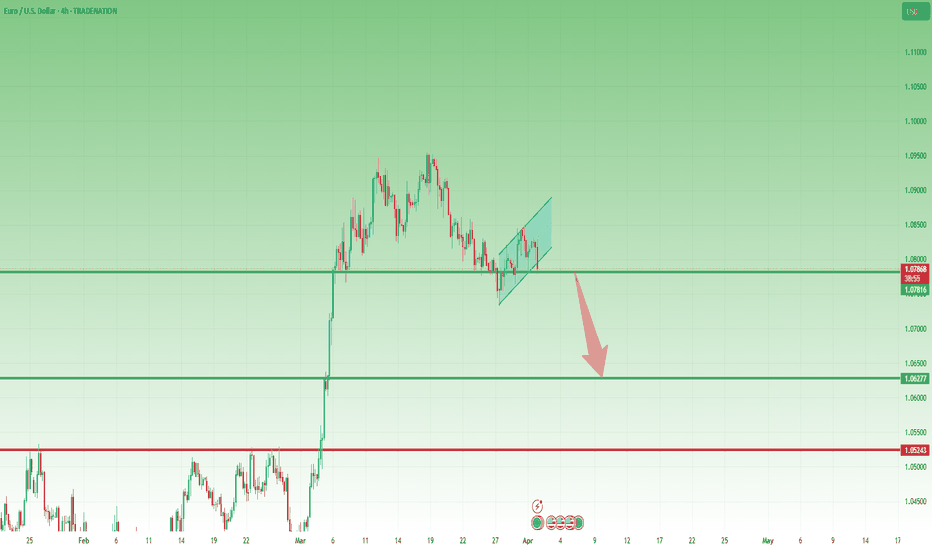

Two weeks ago, I mentioned that while a new high was possible, the bigger move in EUR/USD should be to the downside. Indeed, the pair dropped from above 1.0900 and recently found support around the 1.0730 zone. The recent recovery appears corrective, unfolding in a flag pattern, and I expect another leg down toward 1.0600. Bearish confirmation comes with a...

After breaking below the 104 support and hitting a low of 103.75, TVC:DXY staged a strong recovery, reclaiming support and signaling a potential false breakout. The overnight retest of 104 established a higher low, suggesting further upside potential. As long as 104 holds, I remain bullish and will look to sell EUR/USD and GBP/USD.

As I’ve mentioned many times in my analyses, my trading approach focuses on identifying the next big move (500 to 1,000 pips) rather than chasing small gains of 30-50 pips, which often feels more like staying busy than truly making money. In this post, I’ll explain why I believe the next major move in Gold is downward rather than upward. I’ll take a slightly...

One of the most common questions I get from beginner traders is: What leverage should I use ? And every time, my answer is the same: The leverage offered by the broker is irrelevant. What truly matters is the position size you control in the market. Understanding Leverage in Trading Leverage is a tool that allows you to control a larger amount of money in...

In my analysis yesterday, I mentioned that Gold would likely reach a new all-time high (ATH), but for that to happen, it was crucial for bulls to hold strong at the 3025-3030 support zone. Indeed, Gold made a new ATH, reaching my target zone of 3080 overnight. I closed my buy trade with a profit of 550 pips. Now, the key question is: What’s next? In my opinion,...

Last week, TRADENATION:EURUSD reached a high of around 1.09 and has been consolidating ever since, now for the fifth consecutive trading day. Despite some weak upward spikes, the pair remains in a range-bound phase. From a technical perspective, multiple resistance levels lie ahead, with the psychological 1.10 mark acting as a key barrier. Given the current...

For quite some time, I have been highlighting the possibility of a strong correction in the Nasdaq 100 ( TRADENATION:USTEC ), with the 17,500 level remaining a realistic downside target. In my more recent analyses, I argued that while a reversal from the 19,100 support zone was likely, it was merely a dead cat bounce , and the index could decline further from...

After reaching its recent all-time high exactly one week ago, Gold began a correction, dropping to $3,000, where buyers stepped in. This led to a recovery, pushing the price above a key resistance zone at $3,025–$3,030. At the time of writing, the price is sitting at the upper boundary of this support zone. If it stabilizes above this level, a new ATH could be on...

As I explained before, when I trade TRADENATION:XAUUSD , I aim for targets of 400-500 pips , sometimes even more. That’s why I always try to determine where "the BIG move" is. In Gold’s current situation, I believe this move is down, not up (though, of course, I don’t have a crystal ball). Let me explain... Since the beginning of March, Gold has surged by...

I was thinking about something fascinating—the way traders approach different markets and, in my opinion... One of the biggest mistakes traders make is failing to calibrate their expectations based on the market they’re trading. 📌 In crypto, traders dream of 100x gains, refusing to take profits on a 30-50% move because they believe their coin is going to the...

After its recent impressive rally to $3, XRP has shown remarkable resilience during the correction, establishing a strong support level around the $2 mark. Despite the broader downturn in the crypto market, XRP has held up well, demonstrating significant strength. Last week, XRP tested this $2 support level once again and rebounded, reinforcing its stability....

One of the biggest obstacles for traders who want to become consistently profitable is the mindset of chasing small 20-30 pip moves. While it may seem appealing to enter and exit trades quickly for immediate profits, this strategy is often inefficient, risky, and unsustainable in the long run. Here’s why you should change your approach if you want to succeed in...

Exactly one year ago, FET reached its all-time high of $3.5, but since then, it has experienced a steep decline of over 80%. However, the coin has recently found strong technical support around the $0.45 zone, which, in my view, signals a potential rebound on the horizon. Currently, FET is trading near $0.52, and from a psychological standpoint, being around a...

During past bull markets, a simple HODL strategy worked wonders. Bitcoin and Ethereum set the market trend, and altcoins followed with explosive gains. If you bought the right project before the hype wave, the profits were massive. However, today’s market is vastly different: ✅ Liquidity is unevenly distributed – Only a handful of major projects attract...

Yesterday, TRADENATION:XAUUSD broke the $3,000 mark, a significant achievement from multiple perspectives. As I mentioned yesterday, I didn’t expect the price to revisit the $2,950 support level, as it seemed too obvious. Unfortunately, my pending order at $2,970 wasn't triggered either, as the bulls were too strong, quickly forming a new support at $2,980....

Gold has been surging, and while I expected it to hit $3,000 this year, I definitely didn’t anticipate it happening in the first semester... So, let’s address the big question: Can the bulls maintain this level? Looking at the chart, since early March, TRADENATION:XAUUSD has climbed 2,000 pips (around 7%), but what stands out is that 1,500 of those pips...

In my BTC analysis last week, I outlined the reasons behind my decision to enter short exit and detailed my expectations for a corrective move. As projected, BTC broke below the $80,000 level. Although my initial downside target at $75,000 has not been fully met, I opted to manually close my short position to secure profits. Currently, I am monitoring price...