Exactly one week ago, I pointed out that while TRADENATION:GBPUSD strength persists, the pair is approaching a significant sell zone , starting at the psychological level of 1.30. This level was touched recently, and the pair is currently fluctuating within this range now. My view remains the same: GBP/USD is likely to experience a drop in the near future,...

Last Friday, for the first time in history, Gold printed a "3" handle, and since the beginning of the year, it has already climbed an impressive 4,000 pips. However, what matters most now is what Gold will do next. As we can see on the chart, after reaching a new all-time high (ATH) at 3005, Gold has started to pull back slightly and has recently formed a...

The recent peak for Solana, approaching $300, has proven to be a classic blow-off top. The subsequent decline has broken through three key support levels, retracing around 60% and ultimately reaching the $120 level—a price point that has acted as a strong floor over the past year, with multiple reversals from this zone. While this may seem positive, the chart...

In my early February analysis on altcoins , I noted that while a bounce was likely after the sharp drop triggered by Trump’s initial tax remarks, the $1.3T level would act as strong resistance. I expected another decline once this resistance was confirmed— which is exactly what happened, as the market reached that level and began to drop again. After multiple...

The Moving Average Convergence Divergence (MACD) is a versatile indicator that can help traders navigate the markets with precision. From trend identification to momentum assessment, the MACD provides multiple actionable insights. In this educational post, we’ll explore the key ways to use MACD effectively, with an example illustration accompanying each strategy....

Last week, USD/JPY reached my target at the 146 zone. After testing this support level, the pair began to reverse upward and broke above the falling wedge pattern, signaling a potential trend change. On Friday, the pair formed a higher low, followed by another one today. As of now, USD/JPY is trading at 147.75, just below a key horizontal resistance level. A...

The long-awaited Trump inauguration, which was expected to trigger an altcoin season, had the exact opposite effect. This once again proves that when the majority of market participants expect one outcome, the market often does the opposite. After several days of testing support, the "tax policy" announcement triggered a breakdown below the 1.3T level, causing...

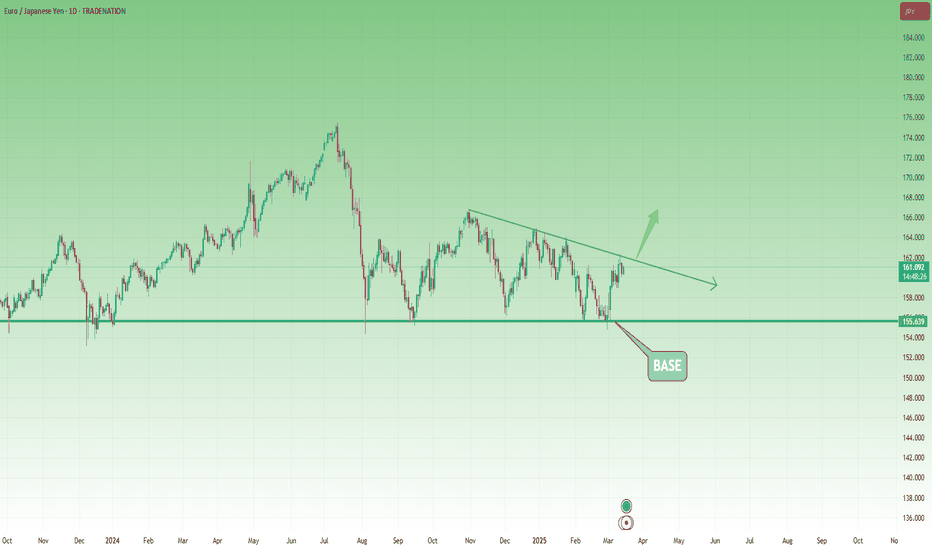

Since reaching a low around 155 at the beginning of August, EUR/JPY has been trading within a defined range. Earlier this March, the pair once again tested the lower boundary of this range and, as before, rebounded strongly. A higher low was established at the start of this week, suggesting that 159 may now serve as a new base of support. In my view, EUR/JPY is...

In life, anything is possible , and when it comes to crypto, everything is possible . But, as I mentioned in my educational post yesterday, there’s a big difference between what is possible and what is probable. In this article, I want to analyze the possibility of Bitcoin dropping below $40,000 and more importantly, what would need to happen for this scenario...

Yesterday, as expected, Gold reached a new all-time high, coming very close to the key $3,000 psychological level. Currently, the price is undergoing a minor correction, consolidating the strong gains from yesterday — which may present traders with a fresh opportunity to join the prevailing bullish trend. The $2,955 level, representing the previous ATH, now acts...

One of the biggest mistakes traders make — especially beginners — is confusing what is possible with what is probable. This confusion leads to poor decisions, unnecessary risks, and eventually, losses that could have been easily avoided. Possible and Probable Are NOT the Same Thing Let's make this very clear: • Possible means it can happen. • Probable means...

In the crypto space, influencers and self-proclaimed crypto gurus constantly tell you to " do your own research " (DYOR) while presenting coins that will supposedly do 100x or become the "next big thing." They always add, " this is not financial advice ," but few actually explain how to do proper research. On top of that, most influencers copy each other, get paid...

The Matrix is more than just a movie—it’s a mind-expanding experience that continues to offer new insights, no matter how many times you watch it. Beyond its philosophical depth and action-packed sequences, the film carries powerful lessons that can be applied to trading. Just like in The Matrix, financial markets blur the line between reality and illusion....

Finally, after a week of range-bound trading and a false downside breakout, Gold has found direction and surged to the upside. As expected, the inflation data served as the catalyst. With the reported figure coming in lower than anticipated, traders are now pricing in potential rate cuts. Technically, as mentioned, the price broke above the 2930 resistance level...

In my analysis yesterday, I argued that once the price broke below the 2900 support zone, further downside movement was likely. However, the price quickly recovered above this key level, prompting me to close my short trade with a minimal profit of 70 pips. More importantly, after reclaiming 2900, Gold continued its upward movement and once again tested the 2920...

Since reaching its all-time high (ATH) three weeks ago, NAS100 has dropped approximately 3,000 pips, hitting a low near the 19,000 zone yesterday. Currently, the CFD price is rebounding, and this recovery could extend into the New York trading session. Although my overall correction target remains around 18,000, I anticipate a short-term relief rally at this...

Similar to EUR/USD, GBP/USD experienced a strong rally starting in March, breaking above the key resistance level in the 1.2775 zone. Over the past three days, the pair has consolidated well above the broken resistance level, suggesting that another upward spike is likely. However, the 1.30 level is both a significant technical and psychological barrier. If the...

In my post yesterday, I mentioned that Gold would likely break below the 2900 support zone. Indeed, after multiple tests and annoying price action, the price finally dropped below this level, reaching an intraday low of 2880. However, it quickly reversed and is now trading back around the same level. To be honest, while my outlook remains slightly bearish, this...