MoolahMaker

It's been 5 months now since EUR/SEK has been sailing under the Daily 50 EMA. It has now also broken the Daily 200 EMA. What we can expect to happen next is a complete breakout of the 200 EMA and the beginning of a long term bearish move. The confirmation that we need is for the price to fail to move and find support back above the Daily 200 or 50 EMA. If it...

NZDCHF has broken above the 50 and 200 EMA and has been in a consolidation for quite a while. As it finds its support and confirms it, we can expect a move higher up. This is a very probable continuation pattern. To be entered within the next 8-16 hours if everything goes as expected. *I'd personally let this short term push up happen and wait for the low test...

XAG/USD has been in a consolidation zone since the beginning of January. Although, the long term trend is bullish, we may have a little dip as the bulls take in their profits. Risk no more than 1% Trade safe.

DXY has been in a consolidation area sine the end of January and hasn't been able to go any higher. We could expect it to break it's current support to continue the bearish trend it's in and fall even further down as there is yet no signs of strength. Wish you all the best :) Happy trading!

SGD/CHF is not holding strong and broke under the 50 EMA on the daily timeframe. MACD daily has also crossed the zero line and we have convergence down. AS the pair goes down, we will see how strong the bearish move is and wheter we can keep holding to the next TPs. First TP: 0.7153 Second TP: 0.7105 Third TP: 0.7055 You must leave enough space for your SL....

EURUSD is breaking on top of the daily 50 EMA and is finding support on top of it. If the support holds strong, we can expect EURUSD to beghin it's reversal and bullish move. Wait for the close of the daily candle and take the trade once you have the signal on the 4H / 1H Timeframe. Trade safe.

Watch out for EUR/TRY. It is currently holding strong above the 4H 50 EMA. The next step could very well be a breakout of the consolidation to the up side. Trade safe.

Keep an eye out for EURNZD. It has dropped under the 1H 50 EMA. As long as the 50 EMA holds as resistance, we have a go for a move back down. Put your SL above the 1H 50 EMA with a little bit of space to it in case of volatility. Trade safe.

AUDCAD. AUD has not fallen against CAD while it has fallen against other currencies. It is currently weak. We can expect a short sell 100 more pips if the 0.97 level stays unbroken. *Let the 4H candle close and if it closes with a tick at least half the size of its body then we're good for a sell. Happy trading.

USDRUB. We have a symetrical triangle pattern above the 4H 200 EMA. If it holds, then we'll see the current resistance break and a move up higher happen. You'll have to put your SL below the 4H 200 EMA with just a little space to it in case of spread volatility since its an exotic pair. Happy trading.

NZD/CHF has broken under the 50 ema on the 4H chart. As long as the 50 EMA holds as resistance, the push further below is active. Wait for the close of the candle on the 8H chart. No trade has been opened yet. This is only an idea and expectation of what can happen. Therefore, we must wait until we have a good signal and confirmation. That would be to open your...

TRY/JPY is currently weak and could potentially break it's bullish support and fall further down. Place your SL above the high of the current consolidation zone. To play it safe, one can simply place a Stop Sell order right below the 50 EMA on the 6H chart or simply the current support line to catch the move as it breaks its current support. I would personally...

AS long as the current candle doesn't close above 82~82.10 then the move down is valid.

There is currently a bullish opportunity with EUR/ZAR. As long as it does not close under it's current support zone which is at ~1.1612 the bullish move is valid. Trade safe.

With the current situation going on in the world with trade wars among the highest economies and NATO and Russia kicking off some of the largest military exercises since the end of the Cold War, we can expect the price of metals to increase for the next few weeks as people would cash out their money from their banks and invest in a commodity because of the current...

NZD/USD has broken under the 50 EMA on the 4H timeframe and has failed to move back up. We can expect NZD/USD to fall further below down as long as the 50 EMA on the 1H Chart stays unbroken. Trade safe.

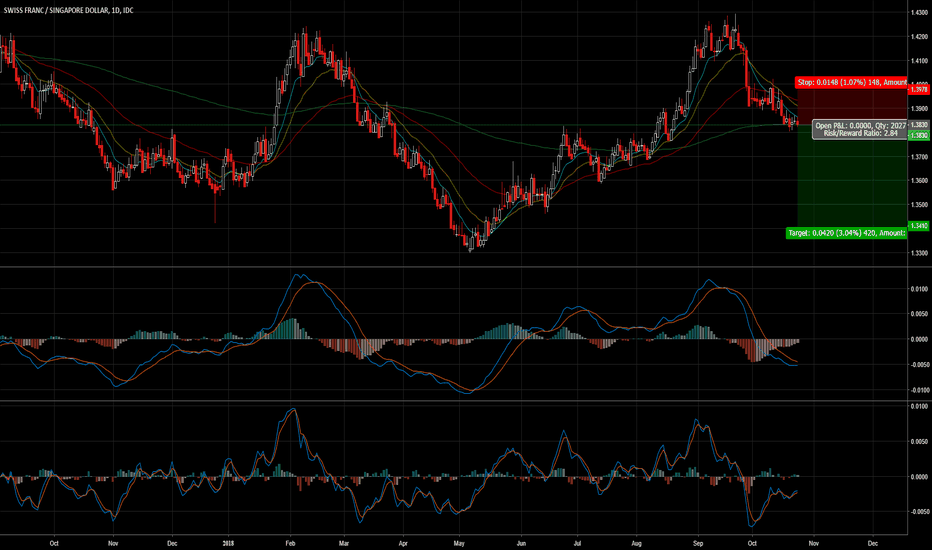

CHF/SGD is weak and we can expect it to continue it's bearish trend further below on the long term this next few weeks *as long as the 50 EMA holds as resistance on the daily timeframe. It may make some pullbacks up but it is nothing to worry about as long as it never finds support. The reasonw why I leave my SL higher than the 50 EMA just in case. This is a...

GBP/AUD has currently a strong bearish momentum and by the looks of the 4H chart, it is without support (Weak and can fall more). To catch this potential move, put your SL above the 4H 50 EMA. Tip: Always keep in mind that what matters in trading is to be profitable on the long term and not the result of one trade alone. Trade safe.