Nathan_The_Finance_Hydra

PremiumHello traders and investors! Let’s see how TSLA is doing today! It is correcting a little bit today, as we already expected, since we have an important resistance at this price level. Is this reason to panic? Not at all. TSLA triggered a bullish pennant, and the trend is bullish in the short-term, meaning, pullbacks are opportunities to buy/add positions. A...

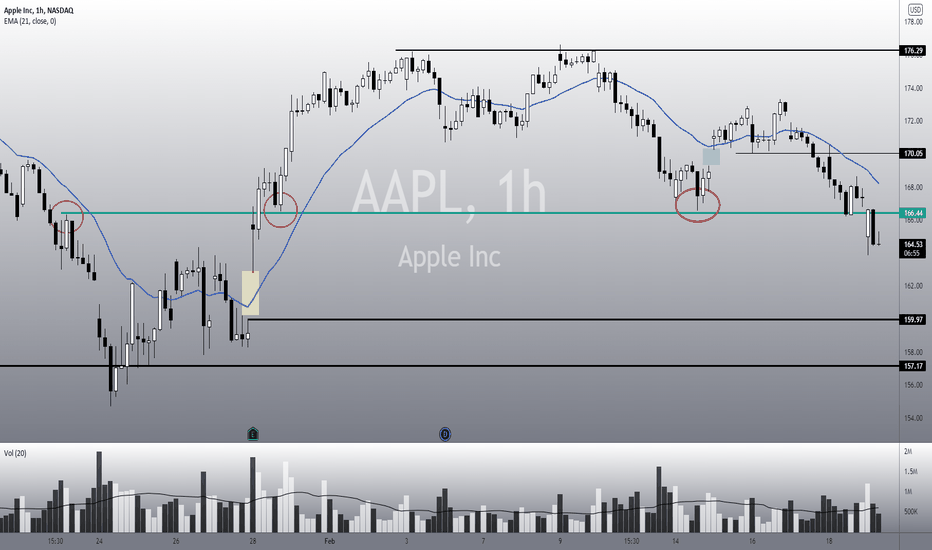

Hello traders and investors! Let’s see how AAPL is doing today! In the 1h chart, we see that AAPL filled its Exhaustion Gap, and it did a strong bullish leg afterwards. This indicates that the bear trend is losing strength, and for the first time since it started the crash, we see a possible bullish structure: A pivot point, a very nice reversal pattern. By...

Hello traders and investors! Let’s see how NVDA is doing today! In the 1h chart, it is breaking the pivot point at $ 242.14, which is great, but it seems it is losing strength now. There’s a reason for this, and I’ll explain later. For now, let’s keep in mind that the bias is bullish in the short-term, however, a pullback to the 21 ema again wouldn’t be a reason...

Hello traders and investors! For the surprise of no one here, TSLA is going up today, triggering an important bullish pattern that could reverse the trend. Let’s see what’s going on. First, in the 1h chart, TSLA did a sideways correction, just to form a Bullish Pennant chart pattern, a powerful pattern that usually reverses the trend when triggered. Bullish...

Hello traders and investors! Let’s see how the SPX is doing today! First, in the 1h chart, it is doing a pullback to the 21 ema, a natural movement that was expected by us. In my last analysis (link below) I mentioned that if you missed the last buy on SPX that’s ok, as eventually we would see another pullback, and only then, we might see another buy. This...

Hello traders and investors! The SPX is going up more than 2% today, which is not surprising at all to us, as we already identified yesterday that it was the moment to buy. But what about those who missed the opportunity? Many investors freeze in days like yesterday, and don’t have the guts to act. Is it now too late to buy? We’ll see. First, in the 1h chart,...

Hello traders and investors! TSLA is doing exactly what we were expecting, and we see some good signs around today. In my last study, we identified an opportunity to buy TSLA, and in this post we'll continue the study and update some key points. In the daily chart, we see that TSLA just did a brief retest of the $ 710 support area and it is bouncing back up...

Hello traders and investors! Let’s see how the SPX is doing today! First, in the 1h chart, it lost the support level we mentioned yesterday, however, it seems it just dropped to its next support, and now we see a very good reaction. In the 1h chart, the index filled the previous gap, making it an Exhaustion Gap, and it is triggering a pivot point as well. These...

Hello traders and investors! Let’s see how TSLA is doing today! Despite the crash, TSLA made a very technical move that shouldn’t be a surprise to no one. As we mentioned in our yesterday analysis (link below), the moment it lost its support level, it dropped more $ 100, and now it is reacting as expected. The support level that held TSLA today was the purple...

Hello traders and investors! Let’s update our thoughts on NVDA today! The market crashed, and it took NVDA with it. However, the drop was not that intense, as it seems the market already priced its main catalysts (or almost priced them). In fact, what NVDA did was extremely technical: A pullback to the previous support at the black line ($208.88), and now it is...

Hello traders and investors! Yesterday, AAPL hit our target and it filled the gap we mentioned in our last study. Now, what to expect next? Now that the markets crashed, we have some interesting key points to watch. In the 1h chart, AAPL is recovering nicely, and if it fills the last gap at $ 159.75, this will confirm an Exhaustion Gap, and that might be the...

Hello traders and investors! Let’s see how NVDA is doing today! In the 1h chart, we couldn’t fill the gap at $ 228, but we almost hit there. Now, we see the beginning of a reaction, and this might be something good. However, we don’t see a true reversal pattern yet, only a sideways correction. The trend is still slightly bearish, as we are under the 21 ema...

Hello traders and investors! Let’s see how AMD is doing today! We have some points to update since our last study. It is good to see how AMD looks resilient, as unlike many other stocks, it is not losing its key supports in the short/mid-term. I was hoping it would fill the gap at $ 105, and it still could do it, but we have a possible bullish reversal sign right...

Hello traders and investors! Let’s see how the SPX is doing today! First, it hit our target at 4,292, and it seems we see some reaction in this area. We identified the 4,292 as an important support level, and so far, it is working. The link to my previous analysis is below this post. The fact the index is stabilizing in a support area is a good thing, however,...

Hello traders and investors! Let’s see how TSLA is doing today! As we mentioned yesterday, TSLA is trading at the support area, around $ 792, which is the most important support level for the mid-term. Now, is the last chance for TSLA to react, and if it doesn’t, it could easily drop more $ 100 at least. Remember, the link to my previous analysis is below this...

Hello traders and investors! Let’s see how the SPX is doing today! In the 1h chart, the index is losing the 61.8% Fibonacci’s Retracement, as we mentioned last Friday (link to my previous analysis is below this post, as usual), and now it seems nothing can hold it. It seems we have two important support levels in the daily chart. First one, the 4,278 area, and...

Hello traders and investors! Let’s see how TSLA is doing today! First, in the 1h chart, it lost its previous support at $ 847, and it is trading at the $ 814 area, as we mentioned last Friday. TSLA is far from the 21 ema, looking oversold, but as long as we don’t see a clear bullish structure, we can’t call it a buy again. However, what if it reacts? What if we...

Hello traders and investors! Let’s see how AAPL is doing today! First, in the 1h chart, it lost the previous support at $ 166, which we mentioned last week, and now it is just seeking its next support levels. In the 1h chart, the next support is the gap, at $ 159.97. AAPL would need to do a very good reaction today or tomorrow, and a clear bullish structure in...