NaughtyPines

... for a 1.61 credit. Comments: High IVR. Starting to ladder out here, selling the 25 delta put ... . Since I'm interested in acquiring more shares at 85 or below, I may let this run to expiry or approaching worthless (e.g., .05) ... . Can't believe it breaks 84.50 (which would be correspondent with a 5% yield on the 10-year T note), but you never know in...

... for a 3.74 credit Comments: High IVR/>21 IV. Starting to ladder out here, targeting the strike paying around 1% of the strike price in credit. Will generally look to roll up at 50% max to the strike paying around 1% of the strike price in credit if >45 DTE remain in the expiry and IVR/IV remains sufficient to collect 1% of the strike price in credit at 16...

... for a 4.04 credit. Comments: High IVR, >21 IV. Sticking a little pickle in here, targeting the strike paying around 1% of the strike price in credit which is quite a bit out of the money at the 8 delta. Metrics: Buying Power Effect/Break Even: 380.96 Max Profit: 4.04 ROC at Max: 1.06% 50% Max: 2.02 ROC at 50% Max: .54%

... for a 1.59 credit. Comments: High IVR; back in range of 52-week lows. Working both ends of the stick in 20 year+ paper with a covered call on one end of the stick, short puts on the other ... . Metrics: Buying Power Effect: 82.41/contract Max Profit: 1.59 ROC at Max: 1.93% 50% Max: .80 ROC at 50% Max: .96% Since I want to potentially pick up additional...

... for a 26.56 debit. Comments: Back in to XBI on weakness, buying the back month 90 delta and selling the front month that pays for all of the extrinsic in the long. (The back month 60C is shown at the 80 so that it fits on the chart). Metrics: Buying Power Effect: 26.56 Break Even: 86.56 Max Profit: 4.44 ROC at Max: 16.72% 50% Max: 2.22 ROC at 50% Max:...

... for a 26.25 debit. Comments: Buying the back month 90 delta and selling the front month strike that pays for all of the extrinsic in the long. (The long call is shown at a higher strike so that it fits on the chart). Metrics: Buying Power Effect: 26.25 Break Even: 71.25 Max Profit: 3.75 ROC at Max: 14.3% 50% Max: 1.88 ROC at 50%: 7.2% Will generally look...

... for a 15.04 debit. Comments: Fading this natural gas move here with a long put diagonal, buying the back month -90 delta put and selling the front month 25. The 35 long put is shown at the 21 strike due to the 35 being off the chart. Metrics: Max Profit: 1.96 Buying Power Effect: 15.04 ROC at Max: 13.03% Break Even: 19.96 relative to 19.68 spot Will...

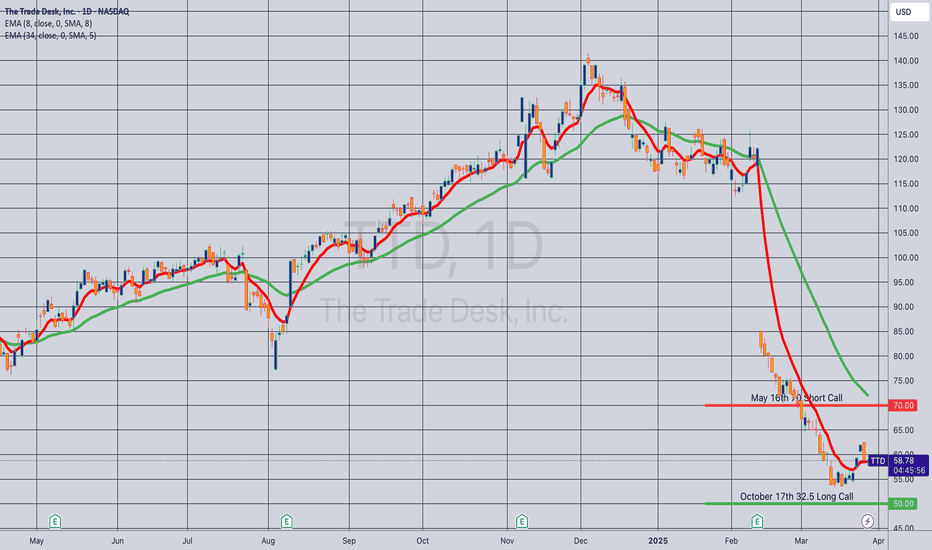

... for a 26.10 debit. Comments: At or near 52-week lows. Buying the back month 90 delta and selling the front month that pays for all of the extrinsic in the long. (The October 17th 32.5C is shown at the 50 strike to fit it on the chart). Metrics: Buying Power Effect: 26.10 debit Break Even: 58.60/share Max Profit: 11.40 ROC at Max: 43.7% 10% Max: 2.61 ROC...

... for a 68.05 debit. Comments: Starter position in the first weekly in April ... . Metrics: Buying Power Effect/Break Even: 68.05 Max Profit: 1.95 ROC at Max: 2.87% 50% Max: .98 ROC at 50% Max: 1.44% Will generally look to take profit at 50% max, add at intervals assuming I can get in at strikes better than what I currently have on, and/or roll out short...

... for a 57.91 debit. Comments: Adding at strikes better than what I currently have on ... . Here, going lower net delta by selling the -84 call against shares to emulate the delta metrics of a 2 x expected move 16 delta short put, but with the built-in defense of the short call. Metrics: Buying Power Effect/Break Even: 57.91/share Max Profit: 2.09 ROC at...

... for a 34.04 debit. Comments: Adding at strikes better than what I currently have on, selling the -84 delta call against shares to emulate the delta metrics of a 16 delta short put, but with the built-in defense of the short call. Going lower net delta here as a personal choice, since I've already made goal for February, so don't see the need to take on my...

... for a 29.98 debit. Comments: Starting a run at April (56 DTE) at strikes better than what I currently have on. Metrics: Buying Power Effect/Break Even: 29.98/share Max Profit: 1.02 ROC at Max: 3.40% 50% Max: .51 ROC at 50% Max: 1.70% Will generally look to take profit at 50% max, add at intervals assuming I can get in at strike prices better than what I...

... for a 28.28 debit. Comments: Adding at strikes better than what I currently have on. Selling the -84 delta call against shares to emulate the delta metrics of a 16 delta short put, but with the built-in defense of the short call. Metrics: Buying Power Effect/Break Even: 28.28/share Max Profit: .72 ROC at Max: 2.55% 50% Max: .36 ROC at 50% Max: 1.28% Will...

... for a 10.45 credit. Comments: High IVR. After having taken small profit on the setup I put on before "Liberation Day," back in with a more symmetric setup in a higher IV environment. Metrics: Buying Power Effect: 19.55 Max Profit: 10.45 ROC at Max: 53.45% 50% Max: 5.23 ROC at 50% Max: 26.73% Will generally look to take profit at 50% max, roll in untested...

... for a 151.04 debit. Comments: Selling the -84 call against shares to emulate the delta metrics of a 16 delta short put, but with the built-in defense of the short call. (In all honesty, this is just an attempt to keep my theta/net liquidity ratio above .05, which is kind of the minimum of where I like to have it). Metrics: Buying Power Effect/Break Even:...

... for a 26.85 debit. Comments: High IV; starter position. Selling the -75 delta call against shares to emulate the delta metrics of a 25 delta short put, but with the built-in defense of the short call. Metrics: Buying Power Effect/Break Even: 26.85 Max Profit: 2.15 ROC at Max: 8.01% 50% Max: 1.08 ROC at 50% Max: 4.00% Will generally look to take profit at...

... for 22.48 debit. Comments: Starting my run at April, adding at strikes better than what I currently have on. Metrics: Buying Power Effect/Break Even: 22.48 Max Profit: 1.52 ROC at Max: 6.76% 50% Max: .76 ROC at 50% Max: 3.38% Will generally look to take profit at 50% max, add at intervals assuming I can get in at strikes better than what I currently have...

... for a 15.68 debit. Comments: Laddering out a smidge here, selling the -84 delta call against shares to emulate the delta metrics of a 16 delta short put, but with the built-in defense of the short call. Metrics: Buying Power Effect/Break Even: 15.68 Max Profit: 1.32 ROC at Max: 8.42% 50% Max: .66 ROC at 50% Max: 4.21% Will generally look to take profit at...