In my view of June 3 I had said 1. Tomorrow is weekly expiry. Overall there are some tiredness signs visible for the rally, but I still wont short it tomorrow. 2. Tomorrow will be 7th day. I think there is one more push remaining for NIFTY in current swing before consolidation. 3. I'll mostly wait on sideline, and not take much bets in first half of the...

In my trade log for June 2, I had said 1. Tomorrow will be the 6th day of higher highs. NIFTY closed near high of the day and just below strong psychological level 10000. 2. If there are positive global clues, NIFTY can create massive gap and short covering. There is not much overhead resistance till 10383 - 10400. 3. The other thing that I sense is...

In my June 1 update, I had said 1. As NIFTY approached 9900, VIX rose and there was strong resistance in the zone. I believe this zone will be tested a couple of times in intra day movement before breaking above. 2. There is not much space for long trade until we clear the resistance zone and close above 9930. 3. I think NIFTY will form a consolidation...

In my trade log for May 29 I had said 1) BANK NIFTY is not leading the rise. So it may cause consolidation and ranges. 2) Overall trend is up and typical bear market rallies are fast. 3) So far this rally has not given any gaps, so next week some surprise gaps can start occurring. For point 3, we saw the gap today. Let us see if we get more gaps in the...

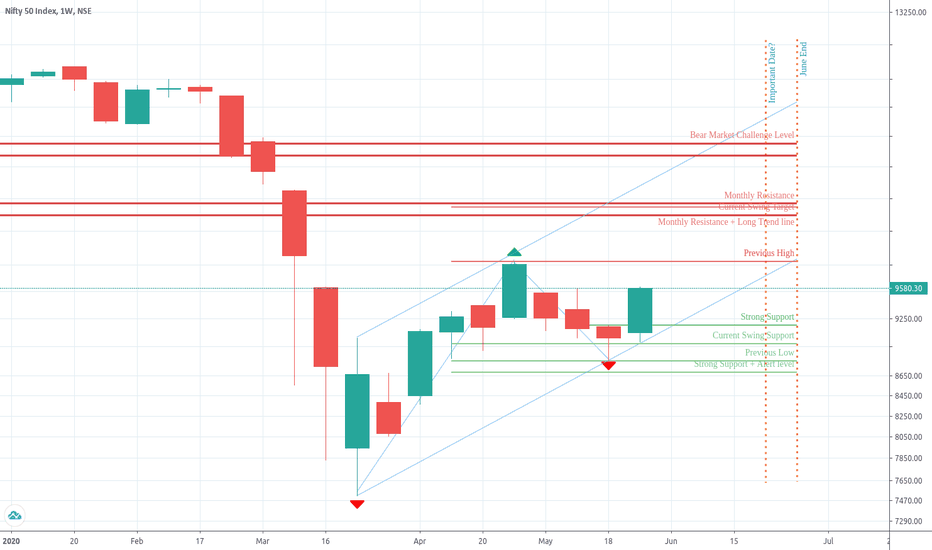

Dear traders, I had posted my monthly view on March 27 Now things have moved enough to create a monthly view for June. There are two things I want to mention which I try to tell myself every single day Technical Analysis if just a way of logical thinking and deciding your own course of action amidst market uncertainty. These lines , averages and...

First, I'll start with the review of my yesterdays post. Yesterday, I had posted my view and some important levels that I use on the chart. I had said 1) Trend is up on daily time frame. Weekly trend is up, provided we dont have huge down on Friday. I think NIFTY will gain / consolidate tomorrow. 2) Tomorrow strategy will be to see the consolidation rage. But...

First, I'll start with reviewing my yesterdays post I had said 1. I''ll trade light tomorrow and see how we consolidate, what kind of range we form. 2. I'll wait till Friday, or may be Monday, to really changing strategy clearly on long side. But obviously now Bias is on long side as long as we are above 9000. As per plan, I traded light and also stopped...

I do not trade BANKNIFTY much. But today's setup was great. And It turned out extremely well. It actually turned out sol well, that finally I go scared and booked profits. I'll explain why I was lurking for this trade for last 2-3 trading sessions. 1. BANKNIFTY has been constantly under performer for the last week. 2. It was extremely oversold and there was no...

In my yesterdays note, I had said 1. I had said , "Tuesdays price action should be taken as indicative of trend forward". I believe in that and till expiry, there could be down trend continuation. 2. I am not sure if 9000 will hold. 8970 - 8940 is key support region, if this fails, the bias is on short side. 3. Again 9150 - 8950 is the range we are looking...

My trades today 1. When initial gap up failed to cross 9160, I sold 9200 CALL, which I covered later in the day. 2. Since today's price action was very weak, I bought 9100 PUT for 4th June Expiry. Stop Loss for this is 9160. What I observe for today is 1) Starting the day, there was lot of positive global clues. Asian Markets and DOW higher 1%+. But NIFTY...

Before reading my point of view on the week of May 26 - 29, Lets review my monthly view posted on March 27 Monthly picture is unchanged. NIFTY is still in long term downtrend. The some much anticipated surprises like stimulus package, lockdown extension and release are no longer market driving items. Corona virus issue is progressing, but not at shocking...

My trades today. I stayed away from the market for morning session becuase of RBI event. Later when NIFTY broke below 9000, I sold 9100 CALL which I squared off for loss. In my last post I had said 1. I am reluctant to jump on either sides for long term future. For tomorrow, I maintain my bullish bias in NIFTY . 2. I'll change my view when NIFTY drops...

My trades today. 1) I had entered credit spread (Sell 9000 Put / Buy 8800 Put) for 71 rs. This expired in full profit. 2) Then as NIFTY was consolidating in the range, made a risky reversal trade and quickly got out. I sold 9100 call and covered it. 3) On breakout of 9145 I was able to Sell 9200 PUT and and squared it around resitance. This turned out to be good...

My trades Today 1. I sold 8900 PUT today as market opened with positive bias. When It faced rejection at 9000, I squared off the position. I was profited because IV dropped. 2. Then there was a consolidation in tight range. Since there was no follow through on short side after rejection, I was confident of selling credit spread. I'll let it expire/ close...

My trades today: 1. Due to positive global cues, I expected positive day today. Hence I sold 8700 PUT in first 15 minutes, with stop below yesterday's close. 2. When opening range was sustained and downward trend line break happened I sold 8900 PUT. 3. Around 11, NIFTY was already 2.43% up and started showing signs of momentum loss, that is candles with long...

Trades today: Simple trending day. I sold 9100 Call and covered it in few hours as first support appeared. Review of the Price Action Today In my weekly view I had said 1. NIFTY is likely to stay below 9450. 9000 is important psychological level and in the support zone . I wont short NIFTY aggressively till it closes below 8800. 2. I do not expect NIFTY to...

About my trades today I made two trades today. 1. NIFTY formed initial red candle taking it below 9130. I shorted 9300 CALL on retest and squared on first sign of weakness. 2. Since NIFTY was not breaking 9050 , last low, I took reversal trade and squared it off before EOD on first spurt. Overall, I followed the plan and price action and it was not a crazy...

About Trades today: 1. I sold 9600 CALLS intended to expire. Since market opened gap down, I did not sell PUTS. 2. Opening range of 15 Mins was broken , but could not sustain, hence I enetred the trade sell 9300 CALL intended to covered on touch other end of the range. 3. On touch of range , 9200 PUT of next week expiry was entered , but it was lacking strength,...