Hard to ignore the fact that the move from Nov 21 high to the 0.50 on the fib retracement looks kind of corrective with an impulsive move away from that golden ratio. My bias here is up if we only look at price action and not the macro economy. Purely an observation of price action only. Could be a double top also. Nobody knows. But so far looks like a damn...

Everything is fractal in nature ... Total market cap including BTC, ETH and ALTS History seems to repeat itself over and over. No bias here as I am someone who understands uncertainty. I keep my day trading and my investing seperate. But if this was a smaller timeframe I would be looking to enter here or at the 0.50

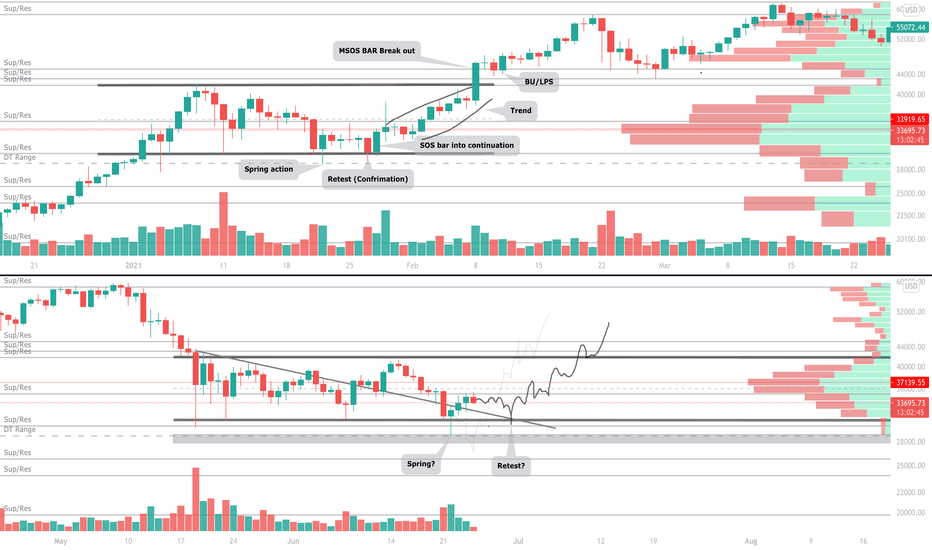

Personally I have been favouring lower prices and retest of 28K This set up mid downtrend is not my favourite scenario but it is getting a little hard to ignore now Can see a few days of volatility decreasing and supply exhausting. Hate to admit it but there are conditions for a spring action here Not being the bottom saint but this could very well be the new...

Had my eye on this beauty for some time now. Looks like BTC is maturing, throwing the cycle arguments out of the window, most of the crypto community are not ready for such big swings in sentiment its leaving them all a little confused hehe. Their poor emotions, sentiment swings are extreme :) Now as price action has developed we can see that we are potentially...

Yesterdays daily close did almost consume the supply wick of the daily bar before as we suggested. Confirmation of absorption on the way up as demand is clear and aggressive (change of character) . Next move is to overcome the top of the horizontal trading range and back up to it as support. We could retrace down as another LPS before overcoming this 40K level...

Todays bar is penetrating yesterdays supply wick. A close that matches the supply wick of yesterdays up bar would be another bullish signal and suggest absorption of supply is happening on the way up. A pull back is expected in the form as an LPS. Could Bitcoin possibly over shoot resistance and consolidate above? Or will we see a tame pull back to consolidate...

Bitcoin did make the move outside of its trading range with a significant up bar on the daily timeframe. This is a clear SOS (Sign of strength) and possibly a jump accross the creek. We still testing recent highs so we still need to see confirmation. Todays daily close will tell us more. Still not seeing signs of distribution.

Possible change of character over a weekend a usual time of low liquidity. We are currently testing the top of the trading range and the 50 MA on the daily for the first time since capitulation. Fundamental news driving demand? News of Jeff Bezos hinting a payment system with crypto currencies? We continue to cross the chasm...

BTC Crypto Market Update 22/07/2021 BTC showing some demand yesterday forming possibly what could be a higher low, this could suggest that supply does seem to be exhausting for now. A slight retest of the 31K area makes sense, maybe we can get some continuation to the upside. For now price spread is still narrow and within the trading range and I personally am...

BTC analysis. Counter Re-distribition argument continues. I am still yet to see any major distributional properties reveal themselves in the form of wide spread and ramp up in supply volume. Please comment your thoughts!

Daily market update. BTC still trading within smaller range inside of the larger structure. Key support and resistance levels still intact. Will larger operators might make a decisive move this week?

Daily Bitcoin / Crypto Market Update 02/07/2021 Low liquidity weekend coming up. Lets see how Bitcoin comes out on Monday

Daily Bitcoin / Crypto Market Update

Daily Bitcoin / Crypto Market Update

Here you can see a great analog for the Re-Accumulation After Decline argument for Bitcoin VS the Distribution structure. You can see how S&P became over heated before suffering a sharp reaction and forming a new accumulation range before continuing on its bull run.

January's structure from earlier this year as an analog and comparing to current price action which was also within this same trading range. We saw a penetration of the lower support in January followed by a few days of testing. The test resulted with a retest almost to the same low as the actual spring. In Bitcoin's recent price action we saw a huge spike in...

Todays daily Market Update 29/06/2021