TXN shows a cross-over on MACD at Fibonacci Retracement 0.500 and on 1 hr. chart likely having a short dip below $97 entry area. Recently increased their dividend nicely over last 5 years as well. Been watching them invest in R&D and they have chips in growing markets for 5G, automotive, communication and industrial. In the last 12 months, TXN has returned...

LSCC - $1B Mkt Cap, 1.2B Ent Value, no dividend. Profitable earnings all 2018, not prior. Has IP, growth, strong technology future in smart connectivity, video, and SaS, or high value logic devices. Strong recovery from recent drop at 238 Fibretracement and climbing. About to report strongest earnings, albeit $0.08/share, which is up 700% over prior Q1...

Some are waking the bear, this one is just about to catch Salmon in the mouth. Galv. steel infrastructure, EV, sign housing, etc. Small micro mining stock, MACD crossing on weekly chart and beated up for few years. Zinc futures up 6.99% today. Risky play, but safer to downside than like risks.

UX1! Where is the good yellow cake deals? Technology will be good for next 5 years here, so look at CCJ today for entry signals and pass along your ideas @Pokethebear (I'm not supposed to be here). When will V (Vanadium) get it's own futures symbol, anyone? What's the metrics here, when was last futures metal added? Why do you like and not comment. Not...

Sinopec crossing MACD and entering positive CCI just above $46 on weekly candles. $68 by years end?

WATT has Intellectual Property for high growth, sales and issue is cash flow and time to profitability, as well competitive players which a couple exist. Watch for weekly candles, MACD cross (blue over orange), and CCI crossing 0. Volume would also be a good signal on this one for cash flow.

TGODF on weekly showing nearing entry point for MACD cross and CCI crossing 0. Keep watching here @Pokethebear. TGODF , TLRY , NYSE:ACB , NYSE:CGC , NASDAQ:CRON , AMEX:HEXO

Mongo DB is off 18% this week due to Amazon making announcement they will offer similar cloud data services. Watch for basing at 74 back up to $80 on fib retrace on next week. MACD showing blue crossover this week. MDB AMZN

12/26 MACD cross-over with CCI entry crossing 0 on weekly candlestick chart. Solaredge Technologies is down from peak of $68 and showing entry point at $38.03 on chart. Market Cap value $1.65B Enterprise value $8.4B Total debt -0- Free cash flow $150M Sales growth rate: 22% Expected value: $3.3-3.5B About: SEDG Israeli Solar company SolarEdge...

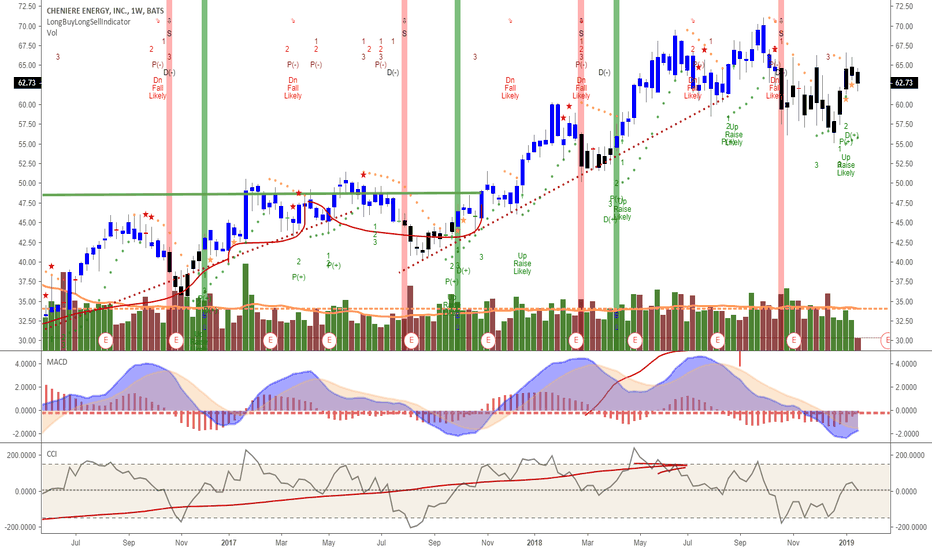

On weekly candlestick chart, MACD is shown crossing over and CCI at 0, but on downward slope at $62.73. Await 2nd LNG port set-up and exports looking positive as cold weather driving use. LNG will also be a growing industrial energy fuel to replace coal and oil energy plants, as 30% lower CO2. Nuclear and solar are only better ones and solar equipment costs...

Tilray is currently $71.74/share and falling in this weeks sell off and good chance to drop near full retracement to $65-66 range. Great time to buy half and have standing order 8% below this for full retracement, or just wait. $65.50 target with MACD cross-over on 12/26 and CCI about to cross positive.

Need some snack food stocks. 5G chip manuf. QCOM at full retrace from recent rise. Buying some and setting 20% lower standing offer good til May. Make you own decisions. Robotics, AI and other uses. Awaiting CCI pushing over 0 on weekly chart for strong wave up.

Teledoc medical billing is crossing over the weekly MACD after recent drop. Entry point just over $63 on 618 Fibonacci Retracement. Software + Medical billing. Make own decisions and let me hear your opinion on this company. Total debt <$10 of Mkt Cap, no dividend, and healthcare through any mobile device.

Here a chart of S&P500 from late 1993 to late 2018 on a monthly chart as indicators for major pullbacks. MACD has fastest response, CCI next, DPO also good but laggard for people still holding.

Paladin Energy is So. African Uranium miner and chart shows it has not corrected to Uranium futures pricing. Easy to see going up the gap. NYMEX:UX1! WSTRF UUUU NYSE:MGA TSX:URE AMEX:UEC CCJ AMEX:DNN

NVS Novartis owns or makes a slew of pharmacopial needs for a variety of medical needs. Little dip during recent pullback. Watching Friday ads, all brand names no companies. All Novartis or made for another company by Novartis.

CBOT:UD1! The UD1! is on up trend and explains where all the stock market money has gone the past week...lol. I think I understand yield curve, but missed this one. ; )

TSX: TSX:HRT OTC:HRTFF * Harte Gold Corp is an Ontario Canada-based company engaged in the acquisition, exploration and development of mineral resource properties with a focus on gold properties located in the Province of Ontario. It has interests in gold exploration projects, including Sugar Zone Property, which is located approximately 60 kilometers east of...