All Types

Type

All Types

Indicators

Strategies

Libraries

All Accesses

Script access

All Accesses

Open

Protected

Invite-only

Public & Private

Privacy

Public & Private

Public

Private

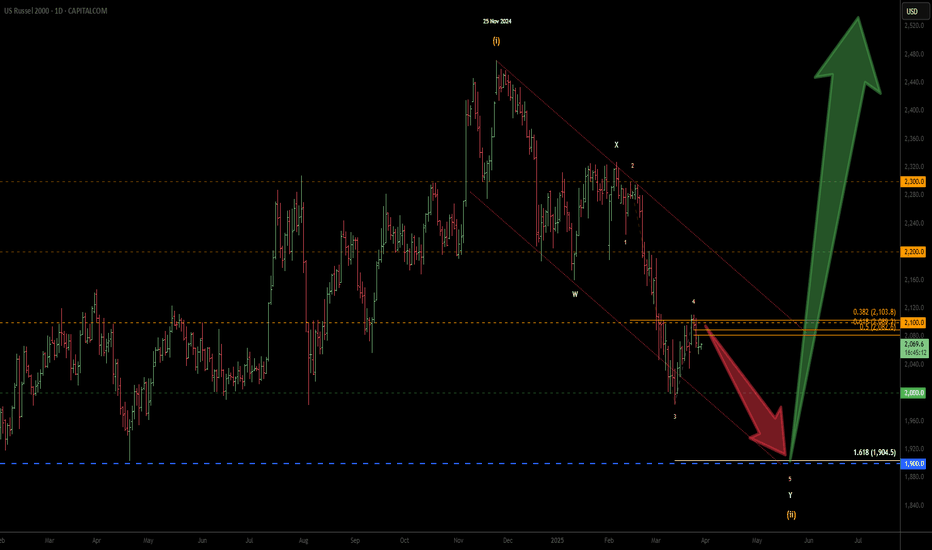

The rejection at 2100 price level also happens to be the 38.2% Fib of the decline from the 14th of February 2025. The decline from 6th of February 2025 counts beautifully as waves 1, 2, 3 & 4. If this wave count is correct, then the Russell is currently in wave 1 of 5 of Y of (ii). This is my primary wave count as long as the 2100 resistance is not...

1

Possible wave (ii) complex correction in the form of a WXYXZ still in progress. Expecting corrective rally to fail around the 2200 resistance zone. A final wave down from there should find a bottom around the 1900 support zone where wave (ii) should end. Expecting wave (iii) to commence from there... ------ *would appreciate feedbacks and thoughts on...

1

5

0

0

Message

Follow

Following

Unfollow

4760

1626

6398

Message

Follow

Following

Unfollow

1878

715

381

Message

Follow

Following

Unfollow

Type

Script access

Privacy