I've been analyzing price action on ASML for a few months and am very excited to finally be entering a position here once all the confluences line up. Lots of chop recently and price is still deciding where it wants to land. Luckily, utilizing algorithms and known S&D, we can get a good picture of which way and where that will be. Happy Trading :)

*99% in my mind which can mean 1% in someone else's. That being said, I invite you to watch this video and then tell me where I'm mistaken... Hope to see you there soon!!! Happy trading all :)

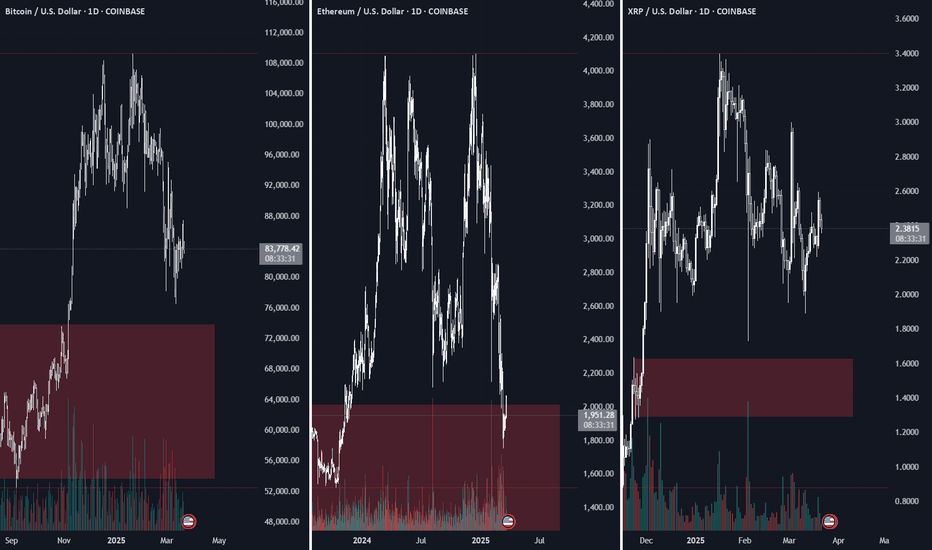

Let me be clear - I am BULLISH on crypto! But for your wallet's sake, be patient! All (most) crypto investors want to be millionaires by next week on XRP and the like. I won't argue whether you will be or not - but please just give yourself a better entry! Maybe we pop again before falling, maybe we never fall again, but with the broader markets in a bad place,...

This short but sweet video clip says it all for me. The market repeats itself - if it repeats algorithms (which I've proven over and over again), then the subsequent movement repeats itself too. I don't mean to make this look easy because obviously it's one thing to analyze something that's happened and "might happen" in the future - but to actually trade it is...

Beautiful chart, beautiful algorithms, beautiful view of the basics of market dynamics. Please leave any comments, questions, or thoughts below - if this type of video is helpful for you, I am here for you! Happy Trading all :)

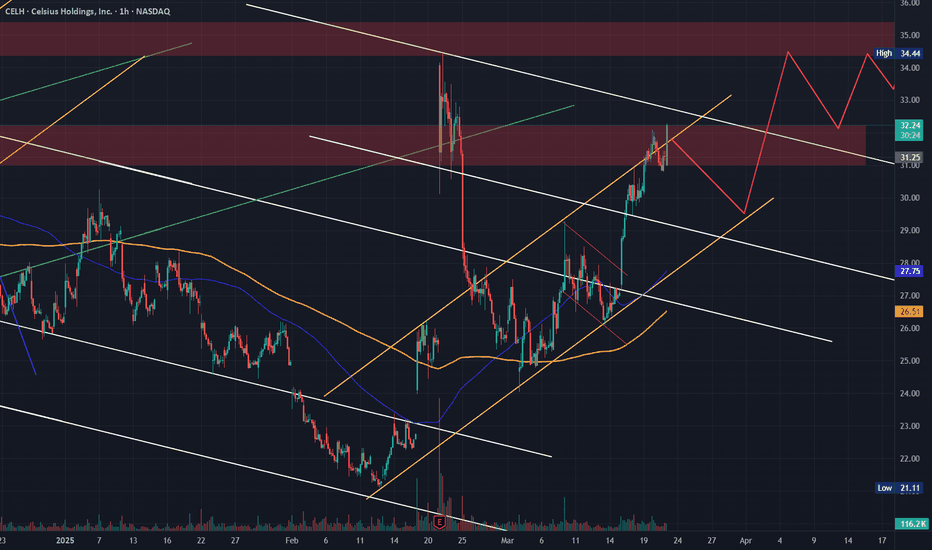

As you see from all my linked CELH videos below, I've been watching this and playing this name for the past few months considering the PA and strength of this company (in relation to where it's being valued atm). Could have kept this video much shorter by simply showing the supply & demand battle that's been going on above us. Mainly the supply levels at $34...

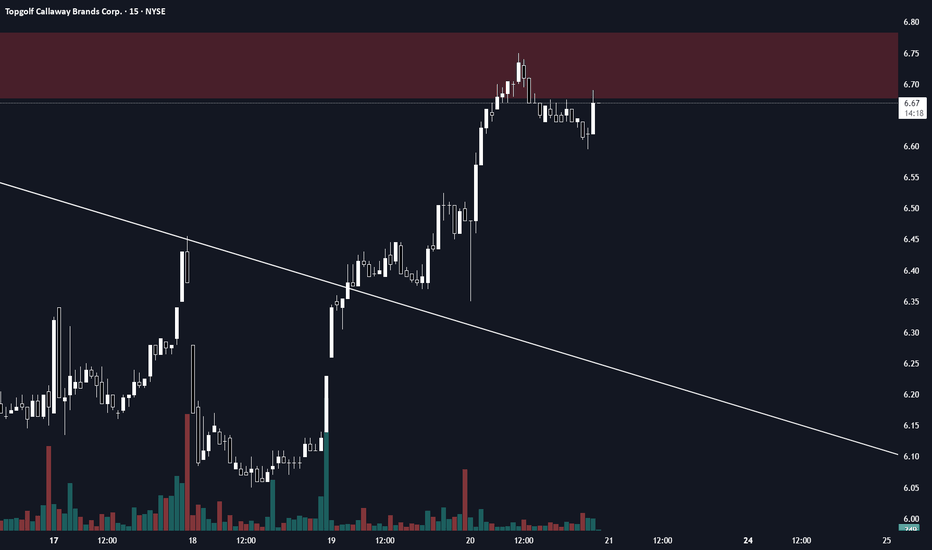

Here's a quick idea and how I could simply analyze a potential trade like this short on MODG: 1. Higher Time Frame intentional target 2. LTF Supply zone (level where known sellers exist) 3. Certain technical confluences within the algorithms, volume, and price action 1-2-3 punch and we've set ourselves up with a potential 1:12 Risk-Reward trade! Happy Trading :)

Please do your own research on this company because it's extremely interesting and enticing! I first got introduced to this company mid-last year before our strong move into the $17+ and since then we've seen a consistent downtrend. Starting to see signs of tapering and recovery now as we tapped into HTF demand so definitely a chart to keep an eye on - especially...

Market wide we are seeing massive dips on big names - and obviously the same here for LULU. I am posting this updated analysis while on vacation (apologies for the bad sound and mouse work as I am working on the fly) because I know many are following my analysis on this name and I'd love for everyone to keep an eye on the macro point of view which is always...

This has been an interesting start since the massive 80%+ downfall. I'm always looking to start building positions in companies that are sitting in undervalued territory and although that doesn't necessarily mean we're going to jump tomorrow, it is how you build a solid longer term portfolio of value. Happy Trading :)

Thank you all for the love and support on my recent videos! It's a real pleasure to be able to share knowledge with those interested in learning - and especially on a platform like TradingView where I've had the pleasure of learning so much from you guys! As we laid out in the last video, LULU gave us an opportune entry at the $330 level and although this isn't...

This chart has seen some interesting movement in the past few weeks and I believe, pending a quality liquidity build, that we'll see ourselves back in the $30 range fairly soon. Happy Trading :)

How can we get involved to the downside if we missed the initial dump? Well, here's how! Look out for guiding algorithms and keep in mind larger/higher time frame algorithms at play as well. Even though we take the elevator down, you don't want to get stuck bagholding puts when a necessary pullback/liquidity build comes! Happy Trading :)

I will be so happy if this continues to dip and wants to fill the gap at 351/340. This thing is poised to explode and I am scooping it up every chance I get. DO YOUR OWN RESEARCH and let me know what you think :) I am excited about this one because I love the company and I love the chart. Happy Trading :)

Video says it all. I've wanted to short this countless times but I think i'll finally follow through in the coming days if I get the right opportunity. I guess this just speaks to a larger market-wide short bias? Idk you tell me. Happy Trading :)

Helps my case that price targets are all in the $18 range... But yeah, from a very few basic factors, WBD just seems to be undervalued still. Happy Trading :)

I did a video on DPZ and why I was bullish a few months ago but this video is regarding a more recent snipe trade - post earnings getting filled on shares at a level that I had sitting and waiting. That's the beauty of shares and algorithms! Within day 1 the position was up upwards of 5% because of the confidence we have in our algos! Happy trading :)

Don't let one big green candle confuse you. Is this the takeoff into ATH's? Maybe. Is it worth being wrong? No. Be patient, identify what "makes sense" for price to do - Meaning: If price came to _____ point, I would put all my eggs in the basket because all the stars (i.e. market dynamics) align. That's what I've identified here on XRP. But that's just me. If...