AMEX:SPY April 28, 2025 15 Minutes. We had 3 days without any gap issues. So, Some consolidation. So, if we take the low 508.46 as bottom for the last fall then for the extension 508.46 to 544.44 to 533.8, we have 557 as initial target. A retracement to 538-542 levels will be good as averages will converge slightly for a move towards 563. For this holding...

Not much to share. I am waiting for a base between 480 to 530 to form. Maybe 1 or 2 weeks. Till then i will watch. No set ups

AMEX:SPY April 2, 2025 15 Minutes Downtrend intact as long below 200 in 15 minutes for the day. For the fall 570.02 to 546.87 AMEX:SPY has retraced to 61.8 level around 561. For the rise 546.87 to 560.69 holding 552-553 is important. For the day consider the last rise from 552.73 to 560.69. Holding 555-556 we can expect 561-563 as target for the day. It...

Looks like the structure is broken. No need to fight the trend as of now. 540 is the target for the last rise as marked. As long as below 200 in lower time frames. No buys for me.

AMEX:SPY March 27, 2025 15 Minutes. AMEX:SPY struggling to move upwards as expected. For the rise 561.48 to 576.42 it has retraced 61.8 levels to 567 levels. Not it is taking support at 200 averages in 15 minutes For the fall 576.33 to 567.92 570-571 is a good level to short for an initial target 565- 566 levels for the day. Since below 200 in 5 minutes...

AMEX:SPY March 26, 2025 15 Minutes. Sideways consolidation on for moving averages to catch up. For the moment upside is capped 576-579 levels which is also top of channel. 576 - 578 is a good sell for 571-573 levels target for today. Since 3 moving averages are nearby 9, 21 and 50. I expect a one-sided movement. So far, no trade for me for the week.

2nd Post. This chart shows oscillator divergence in LL and 100% extension around 580. Hence this also supports the previous post numbers of 579-580 at the moment for the day.

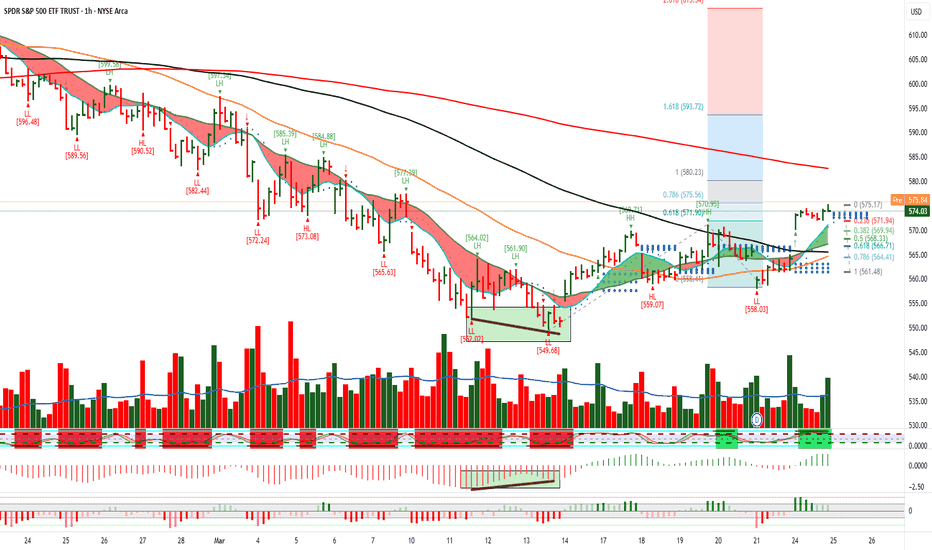

AMEX:SPY Marcg 25, 2025 15 Minutes. No trade for me yesterday as gap up and had no chance to enter. For the rise 561.48 to 575.17 i am expecting a retrace to 566-568 levels as too far away from movoing averages. On 60-minute time frame for the fall 597.37 to 549.68 4SPY has retraced between .5 to .618 levels. So, at the moment I expect upside to be capped at...

AMEX:SPY March 24, 2025 15 Minutes. Gap down open on 21st was not strong as gap was covered by close of day. The fib move for downside was achieved by gap down hence no trade. Now for the fall 570.57 to 558.03 566 is level to watch. For the rise 558.72 to 564.89 561-562 is number to watch. So, a short at 565-566 will have a target 562 -563 levels. I will...

AMEX:SPY March 21, 2025 60 Minutes. The downtrend LL was negated by oscillator divergence. Hence holding the low 559 is critical. We have 9,21,50,100 converging around 563-565 levels. For the fall 584.88 to 549.7 61.8% retracement done.

AMEX:SPY March 20, 2025 15 Minutes. For the extension 559.07 to 566.3 to 562.05 100% move is done yesterday making a high 570.95. For the last rise 562.05 to 570.95 holding 565 is important else i expect a side moving average consolidation around 562 563 levels so that 50, 100 and 200 gets sorted out in order.

AMEX:SPY March 19, 2025 15 Minutes. 50% retracement done for the move 549 to 569 Foe the fall 569.71 to 559.07 563-564 is good levels to short. But we have converging moving averages in 9,21,100 and 200. So 559 +- should be a strong support. As of now i am looking for longs above 568.

AMEX:SPY March 17. 2025 15 Minutes. AMEX:SPY near 200 averages in 15 minutes. Big resistance point. hence a pull back to 560.5 - 558.5 will be a good level to go long. AMEX:SPY forming HH HL pattern. A short I expect to be stopped around 556-558 levels. Not a good R:R setup. Sidelines today.

AMEX:SPY March 10, 2025 60 Minutes Last week we managed to hit 565 as projected. Now we are having LL with oscillator divergence. Also, we can see in the channel LL 566.63 is a green bar with close near top of bar. Now from Marcg 4 to 7 AMEX:SPY struggling to cross the mid channel line. Foe the fall 597.43 to 565.63 a retracement up to 585 is possible. 583...

AMEX:SPY March 7, 2025 Time frame monthly analysis. Monthly. The current move started from Covid low. So, for the move 218.26 to 613.3 holding 520 is important now as it represents 23.6% retracement. And for the extension 218.26 to 480 to 318 we have completed 100% move 614 levels. for the rise 218 to 480. Hence, we are having some resistance. Also 520 is...

AMEX:SPY March 6, 2025 15 Minutes. As expected, we had SPY around 575. Taking support and trying to form a base. Important because 570 is 200 averages in daily. Once 570 is broken we are in trouble. Now for the rise 572.74 to 586.58 to 573.08 we can expect 588- 594 as target provided 573 is held. We rea having oscillator divergence in 15 and 30 minutes but...

AMEX:SPY March 4, 2024 15 Minutes. Yesterday retraced near 200 averages and fell. So, for the fall 570 is the 1.618% extension which is possible as it is also 200 in daily. For the day or tomorrow my target is 575 levels first. If 575 is broken, we can go towards November lows. 586-588 is good level to short for the day.

AMEX:SPY March 3, 2025 15 Minutes. we had divergence in the last two LL at 583 and 582 levels. For the rise 582.44 to 594.74 holding 591-592 is important for short term uptrend to continue. For the fall 610.7 to 582.44 61.8% retracement is around 599 which is also 200 averages in 15 minutes. Hence that is the first target for the day, holding 592.