The move down did not have enough volume to break the 100dma. This uptrend is yet to test the upper resistance from the top of the triangle or from the 200dma.

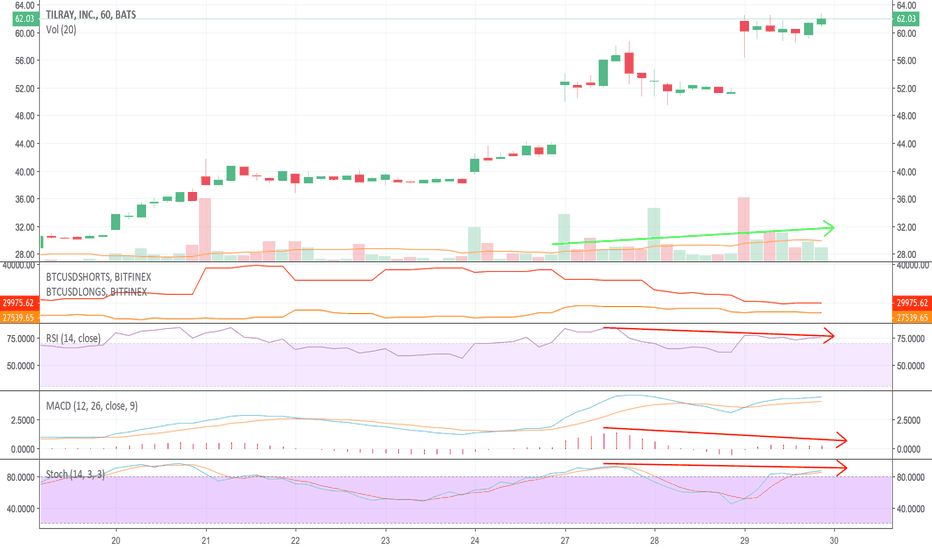

While volume still looks strong we are starting to see some divergence on multiple indicators. I'd wait for this to cool off before going long. Tomorrow might be the day to go short. I wouldn't be surprised if it was up PM and started heading down after open.

6K has been a very strong support but it has broken earlier this year and it is very possible that it may once again. I think the likely delay of the ProShares ETF should be just enough to push BTC lower below its current consolidation zone. With the best recent news (BAKKT) hardly move the market at all being an indicator of the level of negative sentiment abound...

Looks like we had a breakout of a decending channel with high volume indicating a possible reversal of this bear trend. It started to show some weakness with a backtest of the top of the channel likely due to overbought conditions on some of the oscillators. However, I think this reversal is likely to play out and play out BIG. Shorts are nearing their previous...

If we don't bounce off the 100dma then there could be a lot further to fall. Considering the big picture there is still a lot of growth in the Cannabis industry and with Canopy leading the pack I'd be surprised if we break through support here so I'm remaining optimistic for the time being.

I've seen a lot of people comparing the current price action to the 2014 bear market so I thought I'd take some time to do the same. There are definitely many similar elements as far as reactions to previous support and resistance zones. If expect a similar trend to play out I think that puts our bottom somewhere around 3K. I've also heard many analysts that...

Bitcoin has found support around 6100. We should see a rally from here. If this rally gains momentum we could see a break through the neckline of the H&S that has been forming. I would be cautiously long here.

This is my short term trade idea. Looks like we may have broken above a consolidation with the break above the downtrend line. I'm waiting for a break above the ichimoku cloud as confirmation.

I think that people commonly overlook the long term trend that can be seen on the log chart. Using that trend line as support I think we can clearly see where more recent supports will meet that trend line. I think it is at these levels that we will see a bitcoin reversal. Overall I think we are still yet to full cleanse the crypto market of weak hands and the...

These are the three reversal scenarios likely to occur. Bull Scenario: This is the least likely scenario due to the weakness we are currently seeing. It looks like we are still in a bear flag. Bearish Scenario: This scenario is possible but there has been a lot of positive news coming out and most of the FUD can already be seen in the current price. The last...

Please comment if you see flaws in this analysis. Contrary opinions welcome.