SUMIT_DHIMAN_MZN_UP

stock bounce from a strong support zone. If defense sector will be sustain and perform well in coming days that this stock also move .Keep watching.

Breaking an important level wit strong candle at daily and weekly timeframe.RSI also bullish.Add to your watchlist enter only with stoploss.

DMART is a Portfolio stock for long term Players.Currently trading at hugh discount.Add this to your portfolio.Last quarters numbers are very strong making it a good fundamental stock. 4000 is a down trendline support this level is best risk reward setup for this.

After correction stock trading at very important level> Respecting as support on at horizontal and trendline.Risk Reward also looking favorable .Add this to your watchlist and see how it perform in coming days.

Stock trading at bottom levels now chance to be bounce from these levels fundamentals are good.Increasing net profit every quarters. Add this to your portfolio for long term vision)

This stock trading at an important zone and above all moving averages for short term bullish move.Add this to your watchlist and define your Risk Reward.See how it perforn in coming days.

Super strong largecap corrected almost 45% from last high.Now trading at strong support zone.Add this to your watchlist and Portfolio for long term.Risk Reward is best.See how it perform in coming days.Thank You.

This stock trading at very important zone if sustain above level we can see a Rocket move in coming days.Add to your watchlist and see how it perform in coming days.

On daily timeframe stock trading above all EMA 10,20,50.Looking bullish for short term.Risk Reward is best Possible coming target 850,.......900,......950.Always keep stoploss.Because market is unpredictable .Thanks.

Stock trading a consolidation range from long time.Last time correction also not effected this.Now on weekly candle we can see it breaking a trend line.RSI also indicating a price strength.So study this before trade.And see how it perform in coming days.

In this correction stock was corrected around 50%. Now chart showing strenth in price.For long term players it is a good opportunity.Add to your wachlist and see how it perform in coming days.Always keep stoploss.

On daily candle it breaking a range with consolidation breakout.Finance sector also positive.YOY and QOQ company gaining it net profit and EPS.Currently trading at PE of 30.Add this to your portfolio for coming days.And see how it perform.Thank You.

With the attractive PE stock trading at valuation price.In this correction phase stock was trading in a range of 52 week low and IPO price.Every year stock ROE increasing.every year net profit also increasing.Last session candle and RSI show price strength.For coming days we can add this to wachlist for a swing trade.For the target of 550 and next...

GMBREW is a strong fundamental company with- PE = 10, PRICE to Book Value less than 2,Debt equal zero. ROCE and ROE around 20%. consistent net profit gainer every year. In this correction it trading at a best valuable price.And around 35% discount from last high.For long term player it is a best opportunity.Add this to your wachlist and find your own risk...

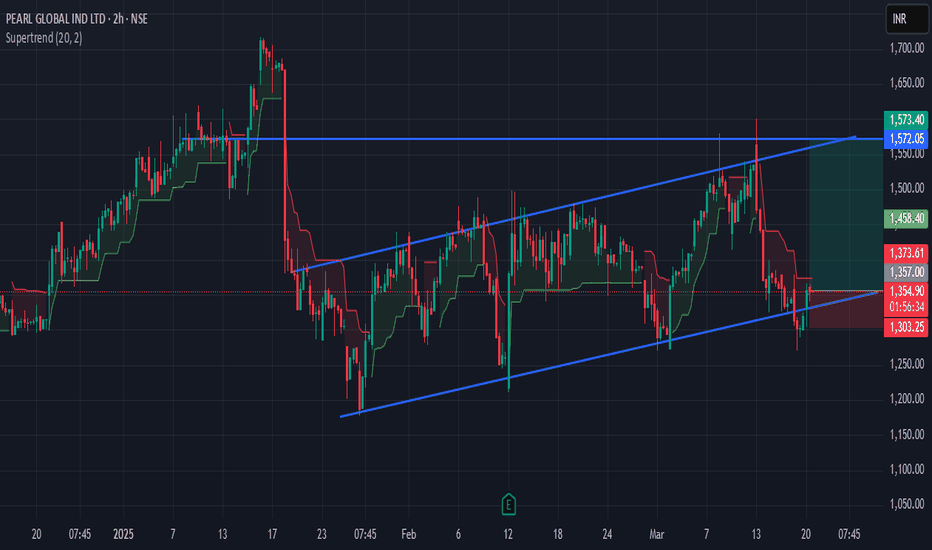

ON Hourly timeframe this tock makivg VCP Pattern which will be possible for a swing uptrend move.Risk and Reward also good.Add to your wachlist and see how it perform in coming days Thankyou.

PGIL Multibagger till covid with strong fundamentals.Consistent frofit generartor every year.Now in correction on hourly candels making a range.With higher lows it indicate strenth in price again.Now we can see this for a swing trade with strict stoploss.

Dont trade directly .First study chart and company fundamentals.Define entri exit and risk reward safely. I am not a sebi registered analyst .

SHRIRAMFIN With Strong Fundamentals. Price to Earning--15,Price to Book Value--2,Dividend Yield--2%. Strong Performer from YOY and QOQ.With heavy Institutional Holdings. In this correction This stock trading at best and Affordable Price for Investors and Long term Players.We can add this to Our Portfolio.For the targets-600........630......680........700.With the...