This counter appears to be on rising trend line - as shown in this hourly chart pattern. The technical indicator shows oversold region, will expect a re-bounce from this region. Potential trade is setup: Buy in range: 1.45 to 1.47 Stop loss: 1.40 Target Profit range: 1.59 to 1.65 Feel free to share your thoughts comments box. Note: This is not financial or...

- bounce off ~ 10.5 (current low is not lower than oct/nov 2018) - wave 1 (bullish trend) or wave 2 (bearish trend) - chalkin money flow +ve

Price seems to have bottom out. Possible formation of descending broadening wedge in progress.

Potential E.Wave 5 in progress EMA indicators all +ve Potential target reaching $14 Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop Loss in place. If you like the analysis, please give a thumbs up (at the bottom of the chart). Thank you.

Thus far, this counter has been trending within Fib channel. As of weekly chart, it shows bearish bias on potential short term retracement. Feel free to share your thoughts comments box. Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop loss in place. Thumbs up if u like the...

Hi folks, based on the TA of this counter, it appears that this counter is on ascending wedge. The targets of possible downtrend is indication when MA50 (purple) line is encounter. TA will be invalid if it breaks higher than the drawn wedge boundary. The support level is highlighted as red horizontal bar. If it break the lower of the possible support level at...

Target as shown - with stop loss indication. Feel free to share your thoughts comments box. Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop loss in place. Thumbs up if u like the analysis :)

Previously in Jan 2020, due to Cov-19 incident, the TA is invalidated. After 3 months, despite many negative news, the market is making newer highs. Price is above MA 20/50. Do you feel that we are back in bullish bias? Feel free to share your thoughts. Let me your comments in the box below. Note: This is not financial or investment advise. It will be good to...

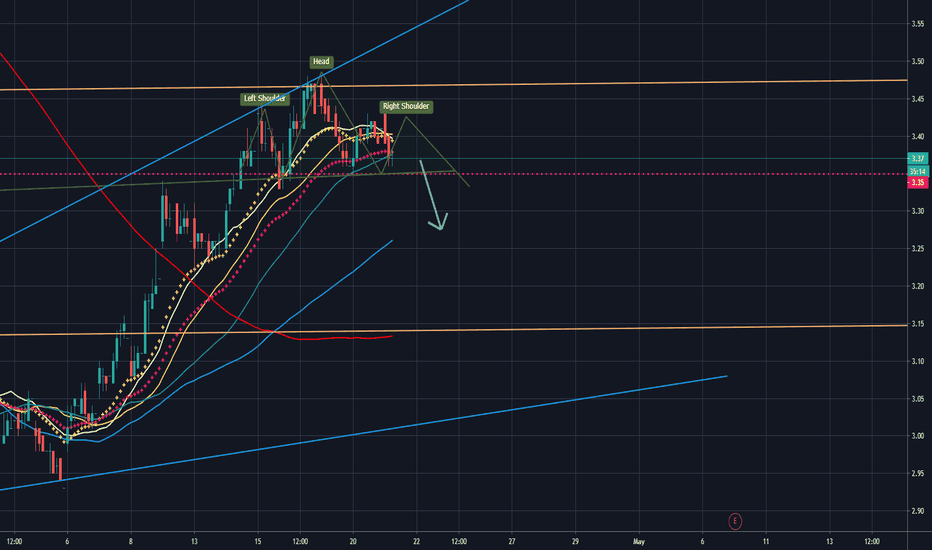

With the current oil crisis, market is in sort of jitters right now... this counter seems to follow the down trend (possibly) as well. Will the head & shoulder formation plays out in short term duration? or will it break out of the current formation and become bullish? Feel free to share your thoughts comments box. Note: This is not financial or investment...

Do you think the formation will play out nicely? if yes, prepare for a ride down as shown in the chart. Feel free to share your thoughts comments box. Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop loss in place. Thumbs up if u like the analysis :)

If my technical analysis is correct, we may be on a rising trend. The lowest dip on 23 Mar 2020 may be wave 3. Initial thought that 0.382 (STI of 2580) of wave 4 is the maximum but if wave 3 is extended wave, then the retracement of wave 4 will be much higher at 0.5 or 0.618 level possibly. FOMO does play a part and the analysis may be out, especially with many...

Long bearish candle Double Top pattern Oil price drop due to OPEC & non OPEC disagreement - Potential drop to next level @ 0.2 Feel free to share your thoughts comments box. Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop loss in place. Thumbs up if u like the analysis :)

On an hourly time chart, is this a fake uprise or true descending broadening wedge? The indicators looks positive on daily chart with short term decline on hourly chart. Projected targets with stoploss is shown in the chart. Let's find out in time to come. Feel free to share your thoughts comments box. Note: This is not financial or investment advise. It will be...

Based on past decade trading pattern, if history is a good indication, then possibly this counter has yet to reach the bottom in order for the next run up. Feel free to share your thoughts comments box. Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop loss in place. Thumbs...

P8Z has been in the falling wedge channel for the past months on weekly chart. Expected for break out of falling wedge channel. Will be great bullish momentum if it happens. - RSI appears to be bottom out in oversold region - PPO appears positive crossover soon Keep a good watch for opportunity.

Descending wedge breakout - bounded within downward channel Fib at 0.618 level RSI+ > 50 Above EMA 20 line on daily chart

S08 provides digital services, such as logistic services and e-commerce in Singapore and other regions. The stock has been in descending channel after the fallout of bearish 3 drives (not shown in current view). Current price is on MA50 with positive RSI. Volume trading appears to be in accumulation. Do you think this rise to $1 or pull back to $0.9? Let me...

Thomson medical - does it looks like an Adam and Eve formation? If its valid, get ready for an explosive ride up! Hold on tight =) Feel free to share your thoughts. Let me your comments in the box below. Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop loss in place. If...