Previous BOS has validated the OB, so now we can look to trade off that OB as price comes back to revisit. Tight SL as always and trading to a previous high to maximise the RR of this trade. Trade safe. markets open soon:)

Looking for price to push through and mitigate the 1h OB before dropping to the downside. Simple but could be very efficient, Trade safe:)

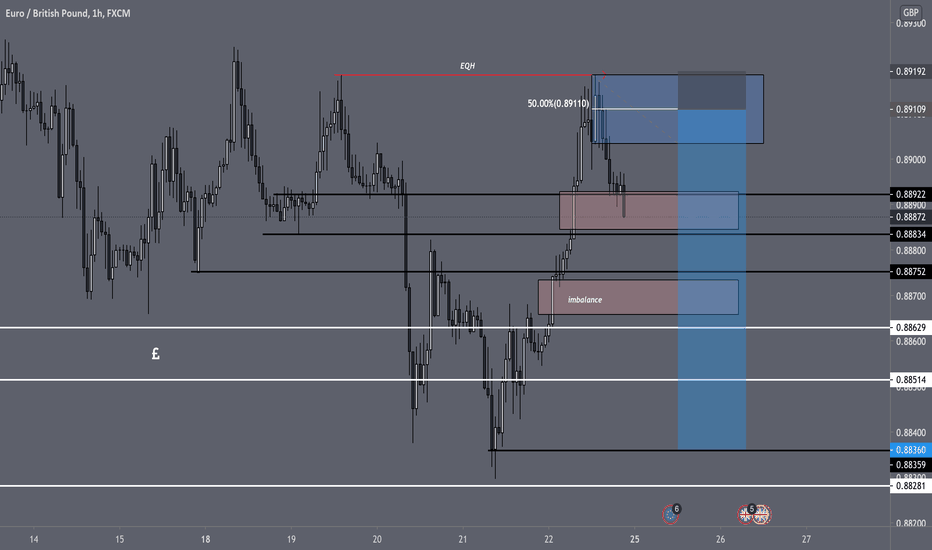

Took a more smart money approach to this trade, I will be keeping an eye open on this as the market opens tonight. I am expecting price to revisit 50% of the OB at the top of the chart. As it is unlikely that price will head all the way up to the open of the candle before coming down to fill in those imbalances. I could be wrong, price could just head down to...

Using smart money to mark up this pair, I am aiming for areas of unfair price as a target. With a tight stop loss just below the last down wick candle there is very little risk involved. lets see how this plays out, areas of liquidity underneath the trend line forming mean price could either drop straight through grabbing all those stops or shoot up at that...

Looking to ride this pair down as price fills in the final parts of the top end of unfair price (the red block). grabbing that last bit of liquidity and orders in order to push to the downside filling in those bottom imbalances. Keeping a close eye on this one. Thanks, trade safe.

Looking for a long position but aiming for a larger target, previous equal highs will be my target. Because of this this trade will be properly trade managed throughout. As price has rejected or pushed away from that bottom area more than enough times, there could stops below that area that once grabbed price will rocket back to the top. also filling those...

I am currently looking at a short term sell on GJ due to price pushing up through those equal highs grabbing them last few stop orders before making the move to the downside. Keeping in mind that price still has to fill in the imbalances marked in red and that the trend line has been broken and those traders buying the trend line will get stopped out as price...

If you wanted to trade imbalance and OB then this is one of the set ups i have marked up and am keeping an eye on. this idea is more educational that it would be tradable as this is mainly relying on the imbalance of price that has recently been created. Trading this you would just trade it until price has filled in the imbalance area and then wait and see what...

Looking to short this market a bit later on in the future, as price is currently creating and following the different phases of market structure using wyckoff logic to help me plan this trade. I will continue backtesting and doing some research on this but this is what I have marked up and will wait and see how it plays out. Until changes happen I will hold to...

I am looking to short this pair due to the overall market direction being down and other factors of the smart money concepts. We can see that price created an area of equal highs (EQH) and then right after created a lower high (LH), I am expecting price to re visit this area as I am seeing this as an area of liquidity.

This is what I have marked up as a potential smart money entry with very very little risk on board. You can see where the common occurrence is with the different levels as that is where price continues to stop itself and reject those levels. basically grabbing that liquidity needed in order to move the market.

This is a new thing I am trying out so I would not recommend diving in and copying this trade. But I am looking into the smarter money of this market and how it reacts to the lower time frame levels, I have used the term (stop chaser) at the manipulated candle breaking through the trendline. That is because there looks to be some liquidity sitting at that area...

I have been focussing on elevating myself and my trading. My ideas have changed and the way I look at the market has also changed.

After the bullish pressure on the H4 before the close on Friday we can see that price was generally trending to the upside creating higher highs and higher lows as it also breaks levels and creates new ones, the MAs are still very spread and I anticipate this continuing to the upside some more as we head into the new week, potentially revisiting a previous higher...

After taking a look at this pair before the market open, I can see that price is clearly trending up on all time frames but we have reached a stronger level of resistance on the daily time frame. This is because the area has been rejected multiple times in the past on the daily and has not formed a double top formation on the H4 and H1. That is a very technical...

This is what i am currently looking at for this pair set up wise. After a huge bullish impulse breaking out of the descending channel price had created you can see that price then created a double top formation as it rejects a much weaker resistance level, I would not class this as a key level therefore the previous impulse move is strong enough to continue to the...

If price continues with the bullish momentum and actually breaks and closes above the key level i have market up in red we could then potentially see price continue to rise to the previous high in the market. The technical side of this look on the market is that price seems to have formed a bullish flag on the H4 timeframe and if this then breaks to the upside...

I am currently looking at a set up like this for this pair, i am expecting price to rise a little more and for it to reject that previous resistance zone and then continue to the downside with the overall trend (bigger picture, daily) Price has recently been ascending in a channel and is heading towards the downside resistance trendline, if price gets to that...