Correction is happening inside a clearly defined channel. Price found support at 61.8% pullback, with bullish divergence, which I´m currently labeling as 2/B. Although the top of the channel served as resistance, the higher probability is that the channel (bull flag) will be broken, and price will target new recent highs.

Price broke the black descending channel, in an impulsive (motive) wave, which I´m labeling 1 or A. There is also bullish divergence present in the March low. Corrections for 2/B are buying opportunities. There is very strong resistance just above 4.50, (gray area).

Price looks like it´ll go for a classic ABC pattern. This thesis is supported by bearish RSI divergence on the top, lack of divergence on the bottom, and impulsive/corrective patterns for A/B respectively. First target is 100% extension at 311.46.

Green IV correction is in its final stages, and I still expect further lows for green V / blue C. My first downside target is still gray resistance n the 195-200 zone.

The pair was rejected by strong gray resistance, with bearish RSI divergence. The ascending wedge (green trendlines), is also about to be broken. Higher probability is for another leg down, initially targeting recent lows around 101.

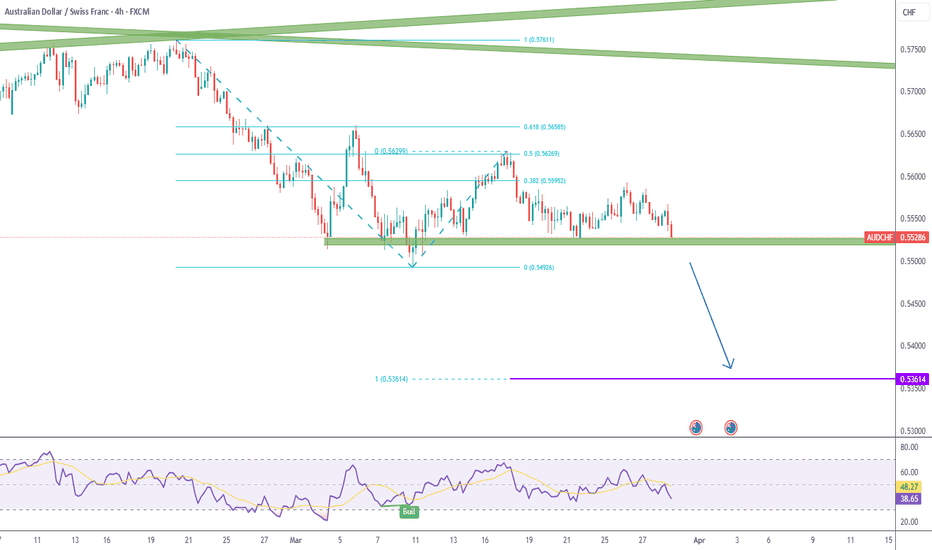

Price is being held by green support, but I believe it has a solid probability of being broken. This break could take us all the ways down to the 100% extension of the first leg down, around 0.53614 (purple line).

Price found support with divergence in the bottom trendline of the green descending channel for green V. The recovery effort found resistance at the green zone, which I´m considering to be wave a. Let´s see how the correction plays out (green b) for long trade opportunities.

For the next few weeks, I still expect BAC to make new lower lows, with the green zone just above 43 serving as resistance.

After the new low, bulls finally showed up and the green trendline was broken. I´m considering this to be the first leg to the upside (1 or A), and will be looking for longs after a correction (2 or B).

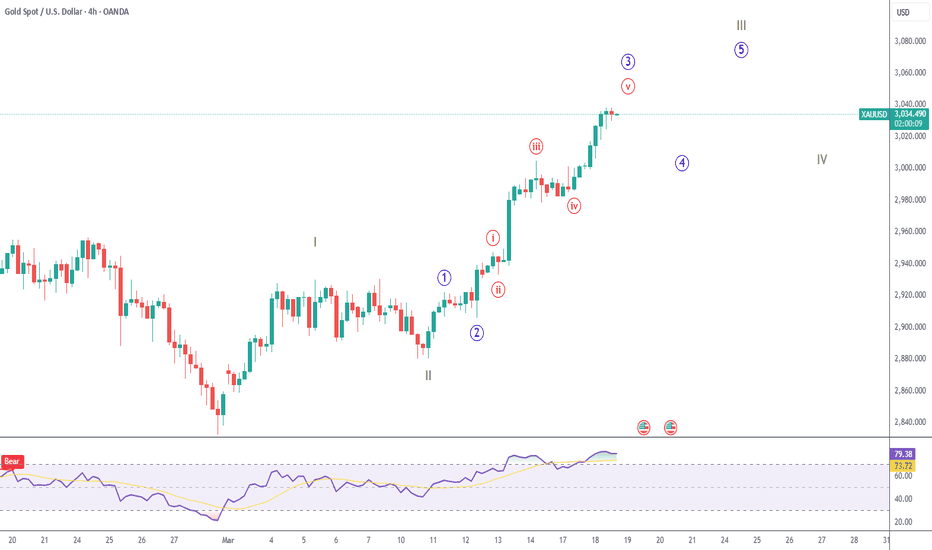

Gold´s rise doesn´t seem to be close to finished. In my primary count, we will soon finish blue 3 of green III. Pullbacks are buying opportunities.

The downtrend is losing strength, and we could be near the end of black C. RSI divergence has been present for the last month. A break of green resistance is a bullish signal. Gray resistance is a major hurdle for a continued upside.

The pair seems to be in the final stages of a 5-wave cycle to the upside (blue) 1-5. In my primary count, this will wrap up black C, and we would expect a corrective or impulsive move back to the downside. Right now, a break of green IV low (purple level), is my key to a reversal.

Ripple could be repeating the triangle pattern made in black 3-4 in a larger scale, for gray 3-4. My primary count considers we're currently in black D. Note that the resolution of the triangle could take a while.

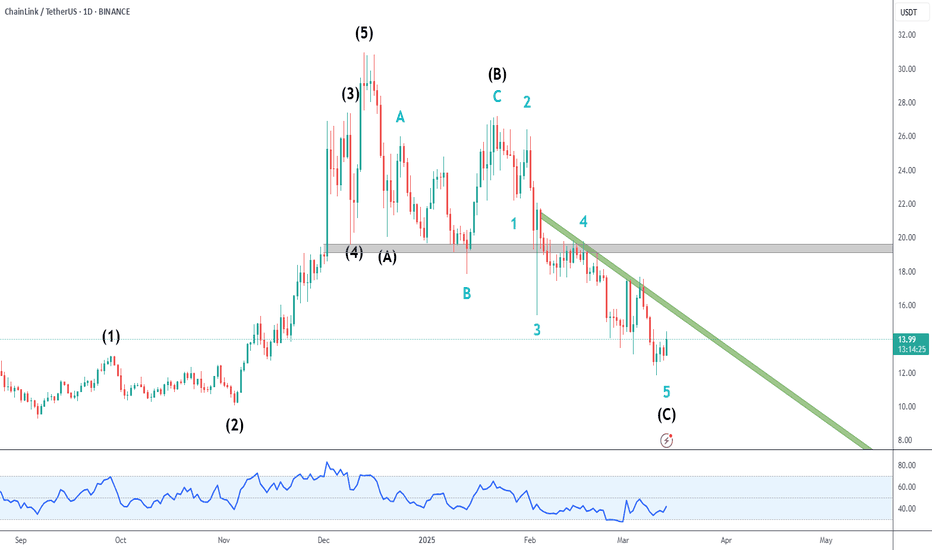

LINK is correcting the impulsive wave which began last September, and this correction could be in its final stages. Blue 5 / Black C is beginning to show divergence, which is a bullish indicator. But remember you don't trade divergence by itself. There is still no higher high and price has to face 2 hurdles: Green descending trendline Strong gray resistance...

On the Daily timeframe, we can see that a descending triangle pattern is being formed. Statistically, this pattern breaks more often to the downside, which aligns with my primary wave count. Let's wait for some resolution outside the triangle boundaries.

We have a short term reversal pattern in the 4H timeframe. A test of green support would be good for long trades Initial targets are the 2 blue resistance levels which match the 50% and 61.8% pullback levels.

After completing the 5 waves to the upside as shown in my previous analysis, Bitcoin went into full correction mode. In my primary count, we have finished Black A and are currently in Black B, which could retest 100k+ levels. Based on what happens on Black B we can have a better prediction for black C.

MKR is one of the better looking altcoins out there, currently correcting an impulsive wave which began early February. I'll be looking for long trades in smaller timeframes once price hits the 50% pullback. Strong gray resistance held price on the first try, but I believe it will be at least retested