Swiss_Forex

PlusDivergent Monetary Policies: The U.S. Federal Reserve has maintained a more hawkish stance, signaling potential for further rate hikes to combat inflation, while the European Central Bank (ECB) is seen nearing the end of its tightening cycle due to slowing economic growth. This policy divergence supports a stronger dollar and weakens the euro. Weak Eurozone...

On the 4H timeframe, USD/JPY has been respecting the uptrend, recently completing a retracement to the 0.618 Fibonacci level, aligning with the psychological support around 149.500. This level also coincides with the 50-period MA, suggesting strong support. Fundamentally, the Fed’s hawkish stance and robust U.S. economic data favor a stronger USD, while the BoJ's...

EUR/AUD has been in a downtrend on the higher timeframes. Since October 3rd, the price has moved bullish, respecting the 4-hour uptrend level. Last week, however, we saw a break in the uptrend, along with the formation of a double top on the daily chart. This technical shift coincides with weaker-than-expected economic data from the Eurozone, which has weighed...

Trading Idea NZD/CAD On the NZD/CAD pair, the price has previously reacted to the psychological level of 0.8400. Currently, after reaching this level, the price has made an impulsive move to the downside and formed a lower low on the 4-hour timeframe. I expect the price to continue moving downward, with the take-profit level aligned with the Fibonacci...

AUD/CAD The price has been consolidating since August 19th and has now finally broken out. On the 4-hour timeframe, I’m waiting for a retracement to the 0.5 - 0.78 Fibonacci levels to consider a short entry.

Looking to take a short Sell position on USD CHF CHF Currency is looking Bullish USD Currency is looking Bearish

looking to enter a 3 Position if price breaks the 1h Timeframe Support. CHF Currency still looking bullish CAD Currency still looking bearish

Looking to sell USDCHF on the smaller Timeframe. waiting for a fake impulsive move to the upside before taking a short.

Looking to sell CAD CHF Price is continuing with the Daily downtrend. on the 4H Time Frame a Impulsive move to the downside is already visible.

I expect EUR/CAD to make a continuation to the upside. We allready started with the move. waiting for the buyers to show up to execute a trade

Nice HH potential to the upside at this point the trades offers a nice 1-3 RR ratio

If price fails to creat a new HH there is a high propability for it to make a new Lower Low.

Break and reatest of W Downtrend Same thing on the 4H timeframe. I expect a nice upmove

Broken downtrend has been tested. Oversold conditions with DIV. price should move up from here

Looks like price is about to continue with the 4H uptrend to reach the daily Trendline!

We have miltiple Confirmations for a long entry Currently price is around the 0.38 FIB level of the 4H bullish push. 2 Potential Entries 1- Now after a Buy Entry Signal 2- Wait for price to retrace back to the 0.61 FIB of the 4H Bullish push and then wait for a Entry Signal If

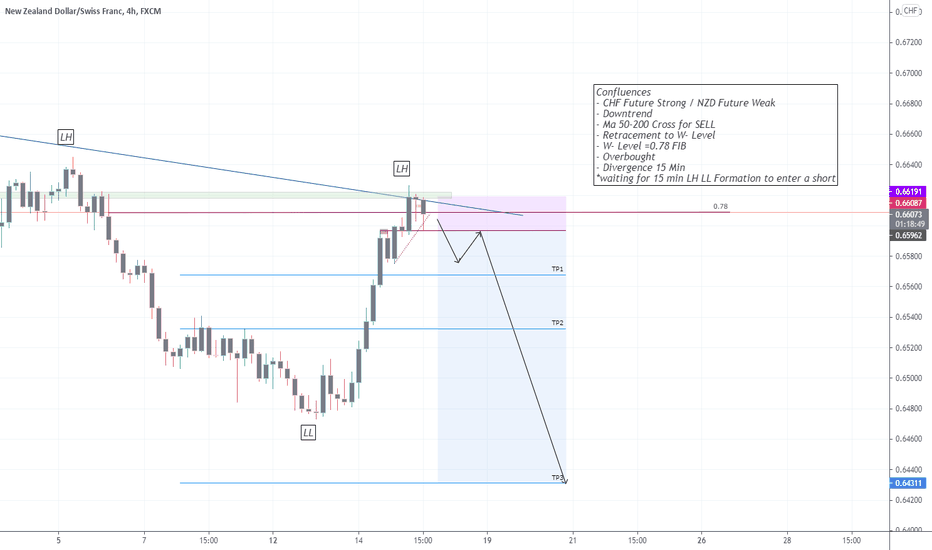

Confluences - CHF Future Strong / NZD Future Weak - Downtrend - Ma 50-200 Cross for SELL - Retracement to W- Level - W- Level =0.78 FIB - Overbought - Divergence 15 Min *waiting for 15 min LH LL Formation to enter a short