EUR/USD remains offered around 1.1350 EUR/USD trades well on the defensive for the second day in a row, revisinting the mid-1.1300s on the back of the continuation of the upside impulse in the US dollar. The move followed firmer US PMI data and news indicating the White House may be considering tariff cuts on Chinese imports.

EUR/USD holds steady above 1.1400 ahead of key US data EUR/USD struggles to gather recovery momentum but holds steady above 1.1400 on Wednesday following the mixed PMI data releases for the Eurozone and Germany. Markets await comments from central bankers and US PMI data.

EUR/USD holds steady above 1.1400 ahead of key US data EUR/USD struggles to gather recovery momentum but holds steady above 1.1400 on Wednesday following the mixed PMI data releases for the Eurozone and Germany. Markets await comments from central bankers and US PMI data.

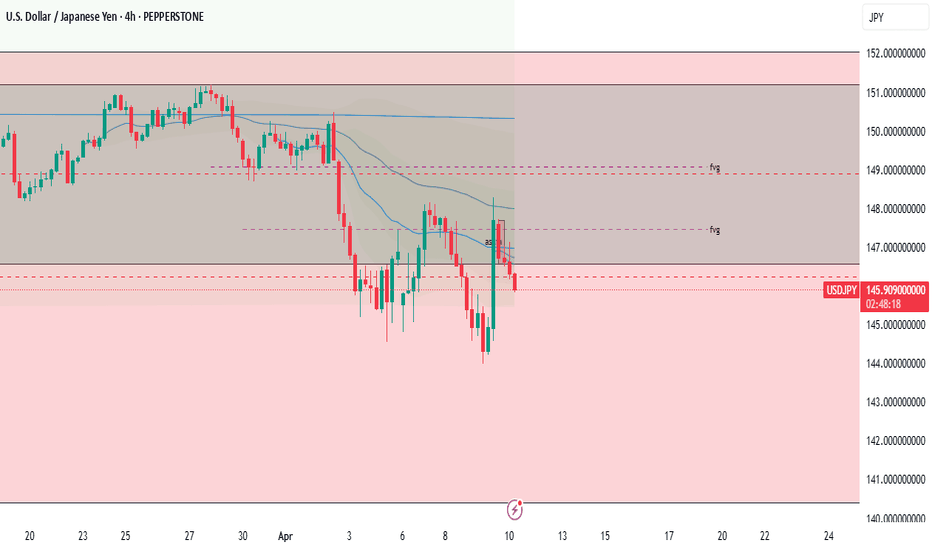

USD/JPY Price Forecast: At make or a break around 140.00 USD/JPY pares some of its intraday losses as the US Dollar strives to gain a temporary ground. The US Dollar has remained weak due to multiple headwinds. The BoJ is expected to continue raising interest rates.

The current rate of CHFJPY is 174.095 JPY — it has increased by 0.14% in the past 24 hours. See more of CHFJPY rate dynamics on the detailed chart. How is CHFJPY exchange rate calculated? The value of the CHFJPY pair is quoted as 1 CHF per x JPY.

EUR/USD holds firm above 1.1350 amid renewed US Dollar weakness EUR/USD is storngly bid above 1.1350 in European trading on Wednesday. The pair draws support from a fresh round of selling in the US Dollar amid persistent fears over US-China trade war and a lack of progress on EU-US trade talks. US consumer data and Powell speech are in focus.

Gold price approaches $3,300 mark amid persistent safe-haven demand Gold price continues scaling new record highs through the Asian session on Wednesday and has now moved well within striking distance of the $3,300 round-figure mark. Persistent worries about the escalating US-China trade war and US recession fears amid the ongoing US tariff chaos continue to boost...

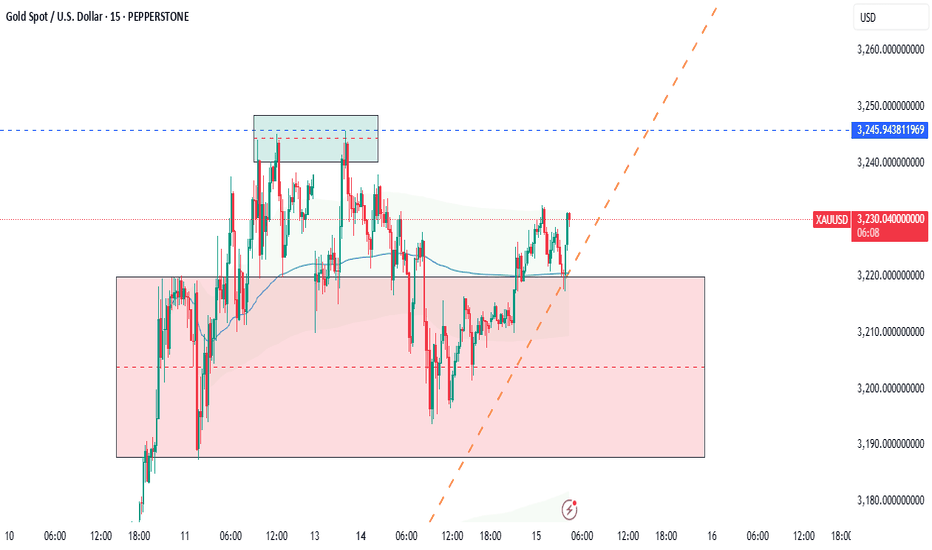

Gold embarks on a consolidative move around $3,200 Gold is holding its own on Tuesday, trading just above $3,200 per troy ounce as it bounces back from earlier losses. While a more upbeat risk sentiment is bolstering the rebound, lingering concerns over a deepening global trade rift have prevented XAU/USD from rallying too aggressively.

EUR/USD remains offered and below 1.1300 EUR/USD is feeling the squeeze, revisiting the area below its key 1.1300 support as the US Dollar gains extra momentum on Tuesday. Mixed domestic data hasn't done the Euro any favours either.

Gold price retains its positive bias above $3,200 amid US-China trade war, bearish USD Gold price regains positive traction as US tariff uncertainty continues to underpin safe-haven assets. Bets for aggressive Fed rate cuts in 2025 keep the USD depressed and also benefit the XAU/USD pair.

EUR/USD bounces off 1.1300, Dollar turns red After bottoming out near the 1.1300 region, EUR/USD now regains upside traction and advances to the 1.1370 area on the back of the ongoing knee-jerk in the US Dollar. Meanwhile, market participants continue to closely follow news surrounding the US-China trade war.

The Japanese yen is expected to strengthen by approximately 7% against the US dollar, according to Morgan Stanley. This prediction comes as a response to potential weakening economic data and the increasing likelihood of a US recession due to recent reciprocal tariff announcements. Morgan Stanley’s team, which includes Koichi Sugisaki and David Adams, suggests...

USD/JPY tumbles below 147.00, awaits US CPI for fresh impetus USD/JPY has come under intense selling presure and drops below 147.00 in the Asian session on Thursday. The US-China trade war escalation and the divergent BoJ-Fed policy expectations underpin the Japanese Yen and weigh heavily on the pair amid a renewed US Dollar downtick. US CPI awaited.

Gold clings to gains above $3,110, closes in on all-time high Gold builds on Wednesday's impressive gains and trades above $3,110 on Thursday. The broad-based selling pressure surrounding the US Dollar and retreating US bond yields on growing fears of a deepening trade war between China and the US fuel XAU/USD's rally.

USD/JPY tumbles below 147.00, awaits US CPI for fresh impetus USD/JPY has come under intense selling presure and drops below 147.00 in the Asian session on Thursday. The US-China trade war escalation and the divergent BoJ-Fed policy expectations underpin the Japanese Yen and weigh heavily on the pair amid a renewed US Dollar downtick. US CPI awaited.

EUR/USD holds gains below 1.1000 ahead of US CPI release EUR/USD is tirmimng gains while below 1.1000 in the European session on Thursday. The Euro gains on the German coalition deal and Trump's 90-day pause on reciprocal tariffs. Meanwhile, the US Dollar finds demand on profit-booknig ahead of the US CPI data release.

Gold price (XAU/USD) touches a fresh weekly top, around the $3,132-3,133 area heading into the European session as concerns about escalating US-China trade tensions continue to drive safe-haven flows. Moreover, fears that tariffs would hinder economic growth and boost inflation turn out to be another factor that benefits the precious metal's status as a hedge...

Gold extends rally to $3,050 area as safe-haven flows dominate markets Gold preserves its bullish momentum and trades near $3,050 in the second half of the day. Further escalation in the trade conflict between the US and China force markets to remain risk-averse midweek, allowing the precious metal to capitalize on safe-haven flows.