Most of my posts will have a lot more verbiage associated with them than this one but in this case I think a careful analysis of the chart will reveal everything I want to convey. SPY is toppy here with Fibonacci extensions from two separate impulse wave together in a confluence zone. I see 315 as a potential top if we manage to get there. As always anything is...

Needless to say SPY has been on an epic run for roughly a decade but as anyone of age knows all good things come to an end. The Fibonacci timing tool used in this chart uses two high points and a low in between them. The tool has been accurately predicting trend reversals but one week late 2 times in a row (look at how SPY reversed trend 1 week before the 1...

BABA has been in a clear uptrend with a series of higher highs and higher lows but there are signs that it needs to correct to the downside short term- 177 is a reasonable target. We see from the graph several signs; price is above the point of control (red line on the volume profile, sufficient Fibonacci extensions from the most recent impulse wave have been met...

From the impulse wave down in Q2 we see HBI made a .382- retracement before making a 1.27+ extension. Again from the impulse wave down in Q3 Hanes retraced again .382- it is now consolidating and interestingly we are one day away from the time period it took for HBI to breakdown in late June, early July; will history repeat itself?

A question traders ask themselves a lot, especially options traders is WHEN exactly price will hit certain targets. By using a Fibonacci timing tool that uses a high as point 1, a second later high as point 2, and the low in between them as point 3, we can project Fibonacci extensions that indicate potential trend reversals, or in this case aggressive extensions...

Thanks for checking out this post, sorry about the right side of the graph, if you take your time with it I think it'll make sense, everything there is important, and I'll answer any questions you may have. I think right now we are in a B wave of an ABC to the downside, details are in the chart visual and verbal.

Thanks for reading this post. For several reason it seems SAM needs to drop, we see from history that it doesn't like to leave gaps unfilled (see three thin grey rectangular shapes across the graph) and it currently has one at 366. There is also a 1.27 extension of the most recent impulse wave down from its high at 364. Using time symmetry (you can see it in the...

OK friends, please note that to get a cohesive view of this Elliot Wave analysis of GLD you would have to see my first post (Gold is going down soon- then up) on Mar. 13 as the scope of the wave count is tool large to represent in 1 chart. In that post I was of the view that GLD needs to dip to complete a 4th wave then head up and I was right, one week after...

This chart is clearly based on Elliot wave theory and represents my humble opinion of where we are on the daily chart. I believe we are in the B leg of an ABC correction within a 4th wave, will top out soon, and descend into the Fibonacci extension region denoted by a target symbol to complete the C wave before embarking on a 5th wave up. For the record GLD should...

If we look closely at BTCs drops last year we see a pattern, each one is smaller than the last. This implies the worst may be over but if the selling is not over then I think the grey rectangular box (very thin) may represent a strong bottom based on 3 factors; price symmetry, Fibonacci extension confluence zones based on two different impulse waves, and a strong...

It is crystal clear from this chart and various types of analysis that JNJ is in a zone that will probably lead to at least the 147 range. We can see a shaded channel that the stock has been ascending in for several months. We can also see that volume has been steadily increasing at a sustainable pace. From the wave count (please study Elliot Wave theory if you...

Dear all, there are a few points I want to note from this chart (each candlestick represents 2 days) but the bottom line is that the 250s are in sight for AAPL. From recent price action we've seen a correction that most likely represents the end of a wave 4 preceding a wave 5 that will start very soon. There are a few reasons I think AAPL is bottoming. Studying...

Dear all, the long-term charts and a forward looking ~year long time frame (markets are relatively timeless/ respect support and resistance levels more than anything) are looking very interesting. From the plain Fibonacci spread which spans Wave 3 (late Dec. 16 to late Jan. 17) and the two orange arrows we see that wave 4 has retraced almost exactly 50% of wave 3....

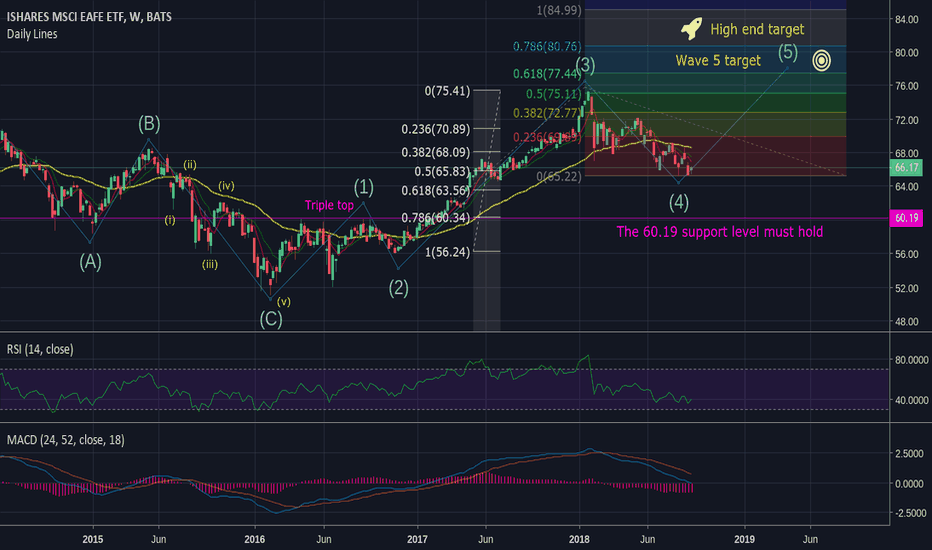

Dear all, from the years long chart with weekly candlesticks we can see that after completing the 5/15 - 2/16 correction EFA made a triple top on April as well as September (twice) 2016 before finally breaking out in March of 2017 into a powerful 3rd wave that has since given way to a wave 4 down. With EFA currently at 66.17 Wave 4 has retraced near perfectly to...

With respect to the tradingview community there are several instances when the majority of opinions on any given security are sell when it is probably time to buy and vice versa. In my humble opinion the former scenario is in play as far as BABA is concerned, short term at least. We see a loosely formed inverse head and shoulders (there is not a clear right...

Dear all, it should be evident from IWMs recent price action that this level and pressure of selling is not consistent at all. She is way oversold and ripe for an upward bounce please see verbiage in the chart to see exactly why. While I would not be surprised to see sideways consolidation or potentially even a new bottom (not likely) it should be clear the path...

Dear all, with regards to context if you don't understand the concept of Elliot Wave theory please take a few minutes to study it or my analysis will not be clear. I believe we are in the final wave of a bullish 5 wave structure in NFLX which started back in Dec. 17. I have not displayed the beginning of the wave count because there is more important recent...

Based on the price behavior of GOOGL since April I think we are in the final stages of a 5 wave impulsive structure to the upside. I think we are probably in a 5th wave that will send GOOGL to the 1320s and potentially even the 1350s. The former is based on the notion that wave 5 will be equal to wave 1 in magnitude; the latter on the notion that there is a 70%...