Tall_Short

Powells recent remarks gave the S&P the boost it needed to test the weekly bearish trend line and now price action is also at a strong horizontal area of resistance. Other indices such as the FTSE have retraced most of the drawdown from when markets started falling at the start of the year. The S&P also is currently testing its Weekly 50ema. The VIX,...

So i've been long VIX since from 29.3.... and I am only really using it as a hedging instrument, yet a profitable one. The economic factors which are at play due to Covid-19, but by just as much of the impact the economies of the world have suffered indicate to me that the VIX is an excellent hedging instrument in these uncertain times. As of recent, "bad data"...

Good hedging opportunity as the global stock market rally stalls. The FED has a sobering outlook for the US and global economy as parts of the world reopen. The recent stock market rally, fuelled by FED and other central bank stimulus and fiscal policy, along with investors not wanting to miss out has added $22 trillion to global markets. Now with the growing...

Since the March lows the SPX has regained a vast amount of ground, all while corporate earnings have had an awful Q1 in general. The US is experiencing exceptionally high unemployment figures and there are many uncertainties at current. The Wuhan province has seen a resurgence of Covid cases after lifting the lockdown. There has also been a mutation in the virus,...

Nice technical setup for shorting the GBPUSD. Head and shoulders pattern forming, with a satisfying R/R ratio. Has been an MACD cross on the daily chart into negative territory, and with the FED meeting early this week there could be more upside for USD. DON'T FIGHT THE FED

It's my opinion that the markets are acting irrationally and have regained losses very quickly when both the fundamentals and technical analysis show a more bearish view. The VIX has an inverse relationship with SPY as well as other markets. Currently at 40, but reached 80 near the end of March (24th,25th,26th). There is likely a recession coming for many...

Both a fundamental and solid technical opportunity with great Risk/Reward. The economy is in a dire situation due to Covid-19 pandemic, but also with an oil price crash due to a massive oversupply. Jobless claims in the US and UK are on the rise and it is highly likely that the economy is going into a recession. Estimates are that due to the entire world being...

With the conservatives winning a strong majority I believe the outlook for Brexit (and the UK economy) has improved. Running up to when Boris was elected and when the results came out the GBP initially rallied, then recently fell 4.35% since. As there is generally an inverse correlation between the FTSE and GBP (due to large cap FTSE companies making profits in...

Possible Long AUDNZD based on strong S&R, CoT reports, potential head and shoulders pattern, as well as a triangle pattern formation. After a long period of NZD strength against AUD the CoT report shows dealers have been placing more long positions on AUD whilst reducing long positions on NZD. Also, AUD is underpriced in a correlation strategy with JPY regarding NZD.

After a relatively long time with the Aussie gaining strength against NZD, the market now looks to be at a point of strong S&R. My personal view is Short AUDNZD due to correlation of both the currencies against the Yen. Also, on the daily chart on my broker platform shows an RSI of 80/81, which statistically adds to this trades potential. Overbought, relatively...

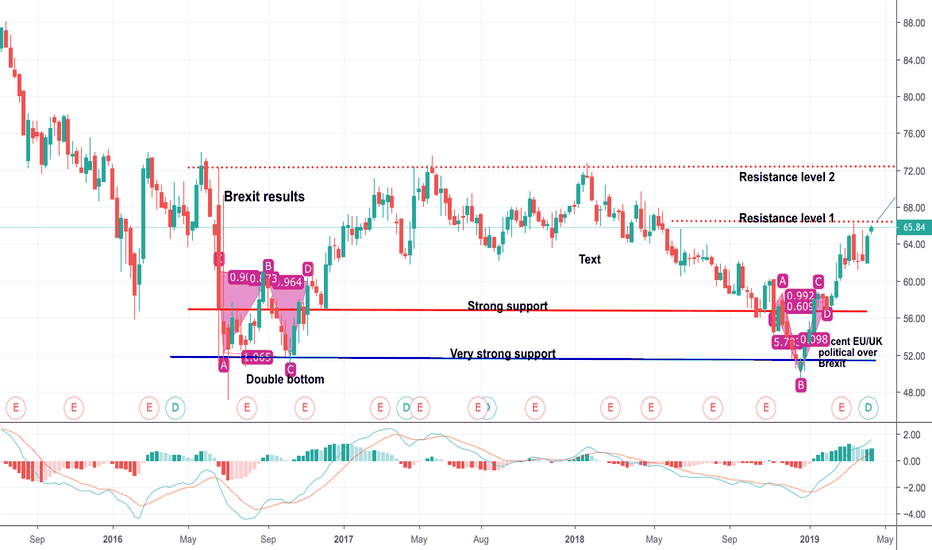

I've been watching an trading LLOY for the past 2/3 years. I believe the fundamentals to be excellent. 5% dividend approx and an internal revenue of 10 (forecasted to be 8 in 2019). The bank is highly profitable even with in this low interest rate environment. With the PPI repayment deadline in August 2019, this will only improve Lloyds profitability. And if a...

I have been watching and trading lloyds for the past 2/3 years. The fundamentals are great. Its internal rate of return is excellent, especially considering it pays out a strong dividend (Approx 5%). It also has a P/E ratio of around 8. So fundamentally I believe it to be a sound investment. However, this is not advice. LLOY has broken through 2 strong support...

Based on correlations NZDCAD is still overpriced in relation to JPY terms. After the recent decline (0.87%ish), I believe there is a chance of a slight bounce back due to support and resistance points.

Even though NZDCAD is still overpriced in a 6 month period when related to JPY, after the recent fall there seems to be resistance. Due to this I believe there is an opportunity for a tight stop loss with a good R0 ratio.

This trade is based on the 6 term trend pattern of correlation with both CAD and NZD and JPY. There is strong resistance at the 9200 level, hence the stop loss. However, I believe that based on 5 day,1 month, 3, month, 6 months, that NZD is overpriced in comparison to CAD in JPY terms.

Even with weak economic data coming out of Canada recently, the high correlation of both CAD/JPY and NZD/JPY indicates that NZD is overpriced compared to CAD when related to JPY. The the recent high did not break (Resistance at 9200), and the lowering MACD indicates to me that NZDCAD has further downwards movements to come.

Short trade idea on EURUSD. Based on technicals, correlation (with JPY) and also a weakening economic outlook for the EU. The US has the ability to lower rates whilst the ECB does not. With recent data coming out of Germany, and many other issues (Brexit, Italy etc.), I believe there is further weakness for EURUSD.

Analysis of NZDCAD using NZDJPY and CADJPY correlation in order execute trades with better timing.