TheBeast_Castellano

Simple. Fib retracement tool use with resistance line. candle stick pattern of a morning star

FOLLOWING TREND. HITTING DOWNTREND RESISTANCE LINE. EXPECTED TO GO AS LOW AS PREVIOUS LOWER LOW OR CREATE A NEW LOWER LOW!

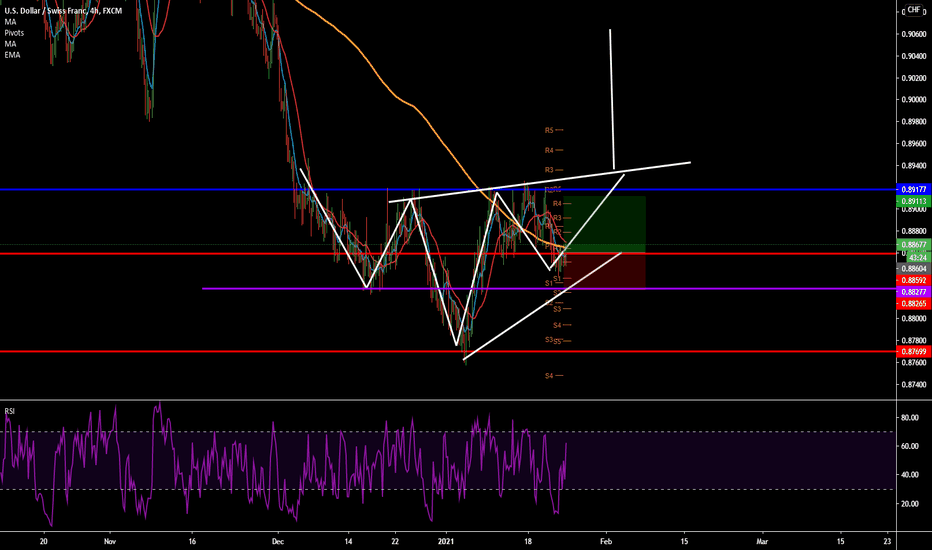

DOUBLE BOTTOM. RETESTING NECKLINE HITTING FIB LEVELS 50-61.8

WE CAN OBSERVE IN THE TECHNICAL ANALYSIS THAT THE PAIR HAS CREATED A DOUBLE BOTTOM. IT IS BETTER SEEN IN THE 1HR TIME FRAME. HOWEVER SHOWING ON THE 4HR SINCE YOU CAN SEE PRICE IS REJECTING OFF MA 200. THIS CERTAIN MOVING AVERAGE HAS BEEN A SUCCEFUL INDICATOR SHOWING THE PRICE TO BOUNCE BACK LIKE A STRONG SUPPORT OR RESITANCE LINE. RSI DIVERGENCE SHOWING THE...

SELL IDEA. MARKET PATTERNS. QUICK SELL WHEN SPOTTING POTENTIAL ENTRIES IN THE 15 MIN TF YOU CAN EXPECT TO POSSIBLY HIT YOUR TAKE PROFIT OR STOP LOSS AT A MUCH FASTER RATE. SINCE MOST LIKELY THE MOVEMENT IS MUCH SMALLER THAT A 1HR OR 4HR ANALYSIS. HERE YOU CAN SEE I SPOTTED A BEARISH FLAG. FOR A QUICK HOPEFULLY 17 PIP. $$$

DOUBLE TOP FORMED ON A STRONG SUPPORT BROKE NECKLINE RETESTING NECKLINE FIB LEVELS ARE HITTING THE 50-61.8 GOLDEN ZONE IT ALSO BROKE UPTREND SUPPORT RSI DIVERGENCE SHOWING PRICE GETTING WEAKER

REJECTING OFF STRONG HORIZONTAL RESISTANCE CREATED A LOWER HIGH. CAN MEAN DOWNTREND CONTINUATION IT IS REJECTING OFF MA200 HITTING FIB LEVELS

HEAD AND SHOULDERS FIBONACCI HITTING 50-61.8 LEVELS HITTING MAJOR RESISITANCE RSI SHOWING PRICE GETTING WEAKER

HEAD AND SHOULDER PATTER FIB LEVEL 50-61.8

Broke MA200 Bullish Engulfing Candle Bottom Shoulder to the Big Reverse Head and Shoulder hit 50-61.8 FIb level

Head and Shoulder Fib Retracement Hitting Downtrend Resistance Hitting MA200

Confirmations for a sell: 1. 1hr TF forming a double top 2. 1hr TF Rejecting off MA200 3. 4hr TF RSI Divergence 4. Price is at strong Resistance/previous Support 5. Price is at downtrend Resistance 6. Price retracement is at 50-61.8 Fib level