AMD is trading inside a Channel Down since November 1st 2024 and under a second layer of lower highs since December 4th 2024. Along with the 1day RSI that just crossed above its own Resistance level, the price crossed above that second layer of lower highs. This is the first sign of an upcoming bullish breakout but the last Resistance to confirm that is the 1day...

Aptos / APTUSD is trading inside a Triangle since its very first low historically and the price seems to be stabilizing after February's Low on its bottom. In the meantime, it is double bottoming on the 1.5 year Support Zone with the 1week RSI formation common on all prior bottoms. Buy and target 15.00 (Resistance A). Follow us, like the idea and leave a...

Bitcoin / BTCUSD has found the support it desperately needed on the 1week MA50 and rebounded. Now it faces the most important Resistance of its Cycle, the 1day MA50. Every time this broke in the last 2 years, the market started a strong rally. Buy and target 140000, which would be just under the Pi Cycle Top. Follow us, like the idea and leave a comment below!!

This is the unique ratio of the crypto total market cap excluding the top 10 against Bitcoin. The market is consolidating for 7 straight weeks after rebounding on the top of the former Triangle of the previous Cycle. Basically it this bearish leg is almost identical to October-December 2020. This kickstarted the Altseason of 2021. We expect a similar altcoin...

LINK is trading inside a 2 year Channel Up. The price is under the 1week MA50, which is about to form a Bearish Cross which the 1day MA50. Last time that happened, the bottom came 10 days later. If the waves are symmetric inside this Channel Up, then we're already at or very close to the bottom, given also that the 1day RSI got oversold and this has been an...

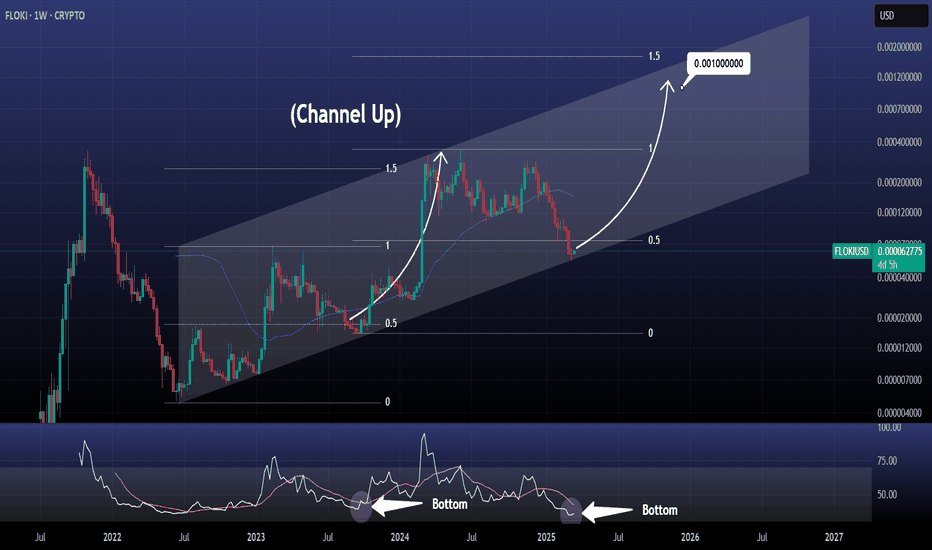

FLOKI is trading inside a Channel Up since the June 13th 2022 Bear Cycle bottom. As the 1week RSI touched 35.00 and is holding, this is technically a strong buy indicator long term. The price just broke below the 0.5 Fibonacci level and touched the bottom of the 3 year Channel Up. There is no better buy signal than this. Buy and target 0.001 (just under the 1.5...

Binance Coin / BNBUSD is trading inside a Cup and Handle pattern for the entirety of its Cycle. Right now it is forming the Handle part with the 1week RSI neutral. Technically that is an ideal long term buy opportunity. Last week could be the bottom and we expect another +98.69% rebound such as on August 5th 2024. Buy and target $1000. Follow us, like the...

Dogecoin / DOGEUSD has hit this month and so far holding its 1month MA50. This Cycle isn't that different from the previous two, although it is naturally a not as aggressive as the market has matured. According to the 1week RSI, the market is at the bottom of the final Bull Cycle pull back before the final rally for the Cycle Top. We expect it to reach at least...

Shiba Inu / SHIBUSD is rebounding at the bottom of the 3.5 year Triangle. The 1week RSI is on a similar sequence as February-May 2023, which eventually rose aggressively by +661.50%. Considering that the price made last week a Double Bottom with the August 5th 2024 low, this is a unique long term buy opportunity. Buy and target 0.00008450 Follow us, like the...

Sui / SUIUSD hit last week the Pivot Zone that marked the initial historic opening price, the Feb & Marhc 2024 Highs and October 2024 bottom. So far this week is reacting with a bounce. If the bullish trend is sustained, which is also the 0.618 Fibonacci and the 1week RSI bottom like July 2024, then we expect at least a +507.35% rise towards the 1.382 Fib...

Simple, yet highly informative especially in times of high uncertainty like the current one. Bitcoin / BTCUSD has a Full Cycle of 4 years. 1 year of Bear and 3 years of Bull. Right now we have entered the final year of the 3 year Bull Cycle, so we have a few more months left until the end of the year. Come October, we can start considering a top for...

PEPE / PEPEUSD is trading inside a Channel Up and this week's green candle suggests that we've most likely priced the bottom. Especially since the 1week RSI hit the bottom of its Channel Down. The Channel's first bullish wave hit the 1.618 Fib extension. Buy and target 0.0000795 Follow us, like the idea and leave a comment below!!

The altcoin market cap just hit its 1week MA200, right at the bottom of the 2.5 year Channel Up. This has completed a -57.89% decline from the most recent High, the same decline percentage as the ones that formed the August 5th 2024 and December 26th 2022 bottoms. The 1week RSI has also almost hit its 2 year Support. If bullish waves are as symmetric as bearish...

Dogecoin / DOGEUSD is trading inside a Falling Wedge pattern which hit this week Support A and immediately rebounded. The 1day RSI has made a Double Bottom and it is highly likely that we will see a steady recovery from now on. If a break out above the Falling Wedge takes place, Doge will most likely start its final rally for this Cycle's Top. We expect that to...

Ethereum / ETHUSD is under heavy pressure since the early December (2024) High and this week almost touched the 12 month Falling Support. Even though that's devastating news for short term traders, long term holders may remain bullish just by looking at Bitcoin's 2018-2021 Cycle, which ETH has been repeating very closely. A rebound on the Falling Support caused...

S&P500 / US500 is trading inside a 20day Channel Down that spearheaded the technical correction from last month's All Time High. The 1hour RSI is on a bullish divergence and within this pattern this has signalled a temporary rebound near the 1hour MA100 for a Lower High rejection. As long as the pattern holds, a tight SL sell position there is the most optimal...

EURUSD hit this week its 1month MA50 for the first time since October 2024. This is the first long term Sell Zone for the pair. The 1month MA50 - MA100 Zone has formed the last two major peaks of the market (September 2024 and July 2023), so it is highly likely to see a top getting formed here in March-April. Since however the 10year pattern is a Channel Down...

Bitcoin / BTCUSD is having a rebound after the price hit the bottom of the 10 day Channel Down. The bullish wave should attempt at least a +13.73% rise (similar to the previous one) and target 87000. That is the short term bullish plan as the price may be rejected again at the top of the Channel Down. If however the 4hour MA200 breaks, it will be the first time...