When looking at ETH/BTC from a Wyckoff perspective, it signifies accumulation events "To the T" on a large time frame(1M). The downtrend that began in September 2022 appears to be the beginning of the creek and a very large one at that. Price is currently in the 0:2.272 ratio band plotted by the previous distribution high and low. This ratio is a pretty strong...

COINBASE:SOLUSD When taking a look at the strength of Solana compared to Bitcoin, there are clues on the 4HR chart that suggest SOL may be in accumulation, rather than further continuation to the downside. Price is currently in the 1:272 ratio band of a larger time frame. On March 10th price hit the 1:1.382 overshoot ratio and printed what appears to be a ST....

COINBASE:ORCAUSD ORCA had a nice rally up from its previous LPS event showing its strength, bolting on a 10X plus. It looks to be sitting at the next LPS event (right at accumulation resistance); this is where smart money starts coming in. It could retrace deeper: I have the 1:1 extension window that signifies strong support with the 1:13 overshoot. And...

COINBASE:SUKUUSD SUKU has printed a ST in phase B of Wyckoff phases and events. However, because Phase B is still about building the cause, this asset may still experience more shakeouts or a deeper Spring before a true markup. I have a potential lower support structure (0:1.618 window) if that spring were to occur. With a Market Cap of 15.7M this volatile...

COINBASE:RBNUSD Ribbon Finance - Printing what resembles a Wyckoff Creek, possibly making a ST attempt. Price is inside the 1:0.618 GW extension. If it were to discover a lower low, it could stab down slightly lower than SC support. Or perhaps a bit further: I have a 1:1 extension as potential support if a deeper ST were to occur. With a Market Cap of 14.4M,...

Unicorn Fart Dust - Showing signs of accumulation with a Wyckoff Creek. Signs of accumulation are what I favor, rather than a "buy & hope" gamble, in the middle of a selling climax or Distribution end. This extremely volatile meme coin may be showing signs of accumulation rather than a continuation pattern to the down side. The creek suggests that this could...

CRYPTOCAP:TOTAL TVC:GOLD - GOLD has created some new highs recently. Breaking out of its previous buying climax resistance, it could be nearing the top; developing a UT in the 0:1.618 ratio band. I have TOTAL layered in this chart above to point out key observations that affected GOLD in the past and vice versa. When the Selling Climax began for GOLD at...

AVAX - Currently sitting in the 0.618 retracement window. A nice doji candle formed last week, with the bottom wick shooting through the POC. A potential Morning Star Pattern. Lower local low? There is a possibility: It has retraced slightly above the 1:1 extension. A further retracement to that pocket could be a likely outcome if lower local lows are in the...

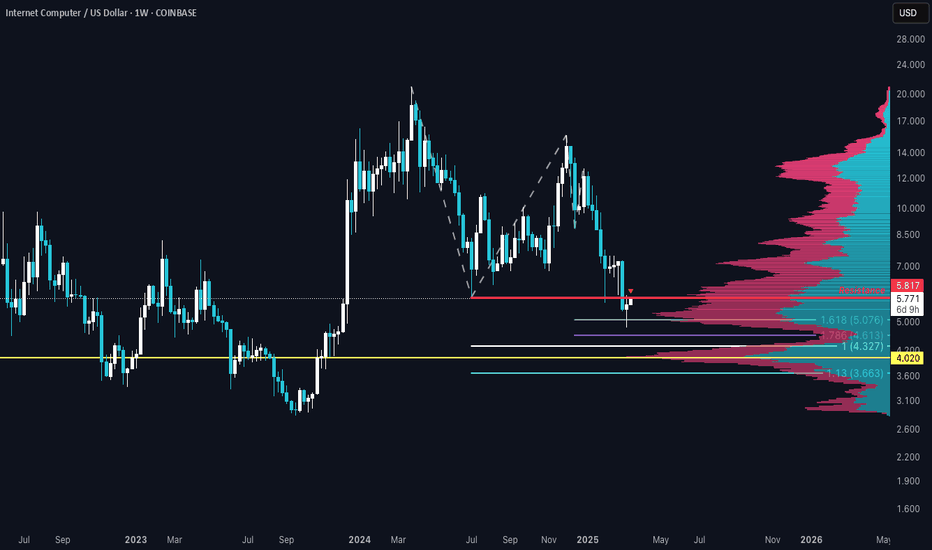

ICP has been a disappointment for many, I would imagine. Including myself... A lot of social media hype behind this one, but the time may be coming soon for a real rally up. A nice falling star through the 1:1.618 extension last week and currently fighting resistance from previous consolidation low. A small chance that we will see lower local lows for this...

DeFi found support at the 1:1 pocket as discussed in my recent TOTALDEFI publish. A wave up could be expected from here, and if this is the case, there are a few resistance zones I have in mind. Accumulation Resistance: Price could struggle to break out of this resistance structure. GW Resistance Structure: If price breaks through the previous accumulation...

I'm making a fresh publish/idea for XRP. XRP has been attracting a large crowd since its major rally up that started in November 2024. As demonstrated in previous posts of mine, I am a fan of EW theory. Although it can be tricky to plot waves, It is a practice that I aim to master. It appears that we may developing the 5th wave of a 5 wave structure that...

ETH tagged the 1:1.272 pocket recently and bounced right off. This pocket is a major support area; given the HVN (High Volume Node) that rests in that zone. This asset may start to show signs of strength compared to Bitcoin as we come closer to alt coin season (yes, I highly favor an alt coin season). But the question is when? That transition could start...

COINBASE:BTCUSD BTC has been quite the exotic hamster lately. I want to touch on some details regarding Elliot Wave theory, first. The first trend down that started March 2024; this was the first wave down of a 3 wave correction. Consisting of 5 waves; After the trend was through, counting the 5 waves were obvious and pretty straight forward. Afterward...

CRYPTOCAP:USDT.D CRYPTOCAP:TOTAL NASDAQ:MSTR In a previous post regarding USDT.D my updated 1:0.786 overshoot ratio target was reached. My original TA suggested that the 3 wave correction may be complete when my target was tagged. After further research into MSTR; the structure does not appear to have completed its correctional phase. Being that MSTR is a...

MicroStrategy has been the leading indicator for Bitcoin for quite sometime now; as well as TOTAL. It ran into some resistance at the 0.618 window on the 4th wave up. In terms of Elliot Wave, typically there are 5 connective waves inside each wave of a 3 wave correction. This is not always the case but sometimes it can provide potential clues. If I am...

COINBASE:LINKUSD As much as I would love to say " I believe that this correctional phase is over " ; I'm still seeing clues that could indicate otherwise. I've noticed quite a few assets that are in between high "reversal" potential fib zones. Chainlink being an example; It is between the 1:0.618 and 1:1 window. Price has already fallen through the 1:0.618...

DOGE may be getting ready for its rehearsal... Price is currently sitting in the 1:1 pocket; along side a High-Volume Node (HVN). HVN's typically act as strong support/resistance because they represent areas where a lot of market participants have already committed to positions. With these two support structures (the 1:1 and HVN) price has the potential to...

I'm making a new publish for AVAAI; I am having difficulties adding notes to my recent publish. AVAAI has held up well in the GW support structure so far. This pennant could be a cause building event for some price action to the upside. No Guarantees; Written or Implied -Not Financial Advice-