ThePatientTrader_

Looking at eur gbp it has been in a downtrend. It is about to test an order block (supply zone) if structure breaks on a smaller time frame then the trade is valid. targets previous lows.

looking at eur jpy it is currently testing a supply zone. If at this zone we can see a distribution or break of structure on the smaller time frame then the trade is valid. Target equal lows formed last week.

Usd cad testing a demand zone. If we can see a break in structure or accumulation then the trade is valid. Targets equal highs from last week.

Looking at AUD jpy from the previous analysis it did not retrace up and continue to break structure. It is about to test a supply zone on the 1 hr timeframe and expecting it to reject and rally lower. Target previous lows.

Due to the recent strength in the dollar and break of structure in USD cad looking for buying opportunities. Usd Cad tested a demand zone and rejected and broke the structure on the smaller time frame. In anticipation of higher prices then any retracement to any demand zone on the smaller timeframe is a valid entry scenario. Potential target equal higher created...

Aud USD trade in a downtrend which may be due for a retracement upward to test a supply zone. Once the structure breaks to the upside then an up move is validated. When the price gets to the supply zone we would be looking for a break in the structure before taking any short positions.

GBP USD has been in an uptrend. It is not testing a demand zone and printing an accumulation schematic. Waiting for a break of structure to valid any trades. Possible targets Previous highs.

Looking at the consolidation I'm seeing a distribution schematic play out confirmed with a break of structure. If the price would move lower good entries would retracement to the supply zone. Potential targets Demand zones on the way down

Looking at Usd cad it has been in a downtrend from the higher time frame. After creating a new lower high it broke structure to the downside and created equal lows(Liquidity). It also printed a nice supply zone on its way back. High probability that when the price gets to that zone it would sell off to take out the liquidity.

Just an update to my previous analysis playing out properly. A good area to sell is the order block formed before the move to the down side.

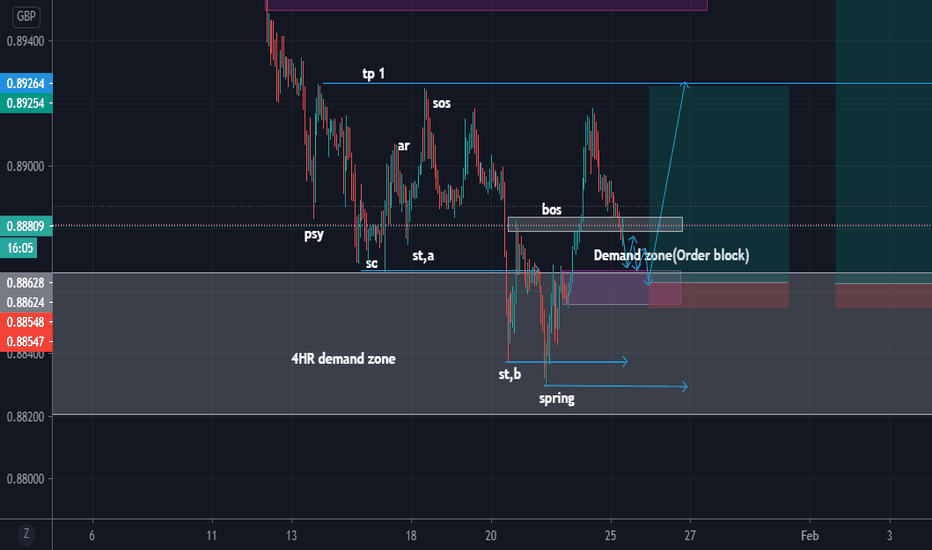

Looking t the 4hr chart price tested the demand zone and rejected it. We are now seeing a potential 1hr accumulation play out with a break of structure to the upside. the current retracement is lacking volume showing a lack of bears in the market. so if price respects the 1 hr demand zone or accumulate in their then the trade is valid. Target equal highs from...

looking at Usd Jpy, the price has been testing a trendline and started accumulating with divergence. When structure breaks the test of the supply zone would be a good entry for a short-term move to the downside to clear some liquidity from last week.

Last week we caught a nice move to the up side after that accumulation. Eur jpy at the moment seems to be ranging and leaving equal highs on the 15 min time frame. If price can take the liquidity created and break structure then the trade would be valid or if it keeps breaking structure to the down side then we would look for a possible entry on a retracement.

EUR JPY tested the demand zone and started accumulating. Break of structure confirmed the accumulation. Entry on the test of the utad.

EUR CAD has been testing a demand zone on the 4hr time frame. Structure break on the 1 hr timeframe. The trend is changing momentum gradually. targets equal highs created 3 weeks ago.

EUR CAD currently testing a demand zone on the 4 hr time frame. break of structure to the upside on the 1 hr time frame. target equal highs created 3 weeks ago.

USD JPY has been showing bearish momentum. with the recent break of structure a supply zone(order block ) was created. possible short to the imbalance on the 1 hr tf. Let see what happens.

There has been a break of structure in the trend. bullish momentum to the upside. if there is an accumulation or break of structure on the smaller timeframe then the tree is valid. If not we leave the setup. target the imbalance left by price on the move down.