GitLab Inc. (GTLB) is demonstrating potential bullish momentum, with a significant weekly gap around the $50 level. A breakout above the $55.26 level could indicate further strength, positioning the stock to target the $69.47 resistance. This trade setup offers an attractive risk-to-reward ratio, with a stop-loss set at $48.40 to manage downside risk. The...

Nike Inc. (NKE) is currently testing the bottom of a significant weekly gap around the $66 level. A breakout above the $72 level could signal further strength, positioning the stock to target the $88.66 resistance. This trade setup offers an attractive risk-to-reward ratio, with a stop-loss set at $59.30 to manage downside risk. The Relative Strength Index (RSI)...

Lululemon Athletica Inc. (LULU) is exhibiting potential bullish momentum, with a daily gap around the $310 level. A breakout above the $367.15 level could signal further strength, positioning the stock to target the $485.83 resistance. This trade setup offers an attractive risk-to-reward ratio, with a stop-loss set at $296.43 to manage downside risk. The...

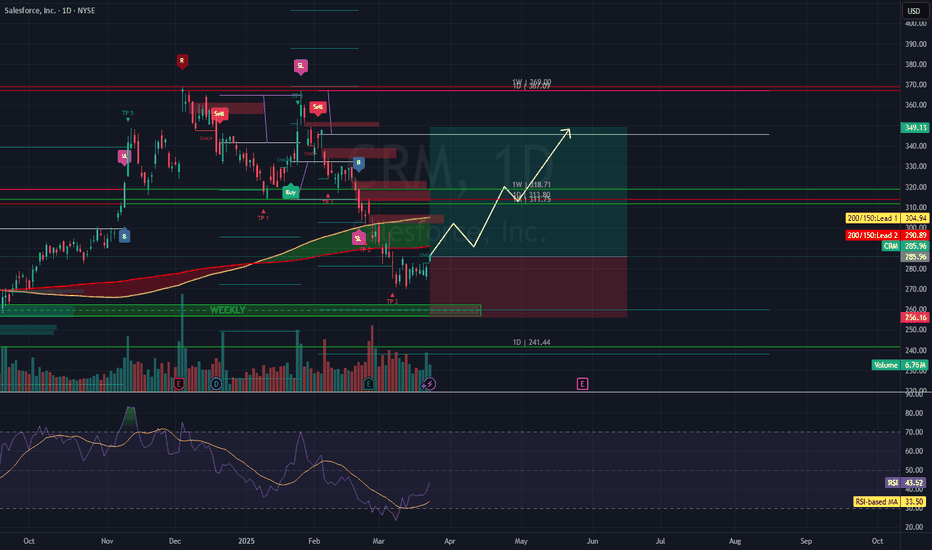

Salesforce Inc. (CRM) is exhibiting potential bullish momentum, with a notable weekly gap around the $260 level. A breakout above the $313.80 level could signal further strength, positioning the stock to target the $349.13 resistance. This trade setup offers an attractive risk-to-reward ratio, with a stop-loss set at $256.16 to manage downside risk. The Relative...

Walmart Inc. (WMT) is exhibiting potential bullish momentum, with a notable weekly gap around the $82.50 level. A breakout above the $96.18 level could signal further strength, positioning the stock to target the $105.30 resistance. This trade setup offers an attractive risk-to-reward ratio, with a stop-loss set at $82.48 to manage downside risk. The Relative...

Target Corporation is exhibiting signs of potential bullish momentum, with a notable weekly gap around the $100 level. The stock is currently trading near its 52-week low of $103.46, suggesting a possible rebound opportunity. A breakout above the $120 level would confirm further strength, positioning the stock to target the $139.68 resistance. This trade setup...

Amazon.com Inc. (AMZN) is exhibiting strong bullish momentum, with a notable gap forming around the $196 level. A breakout above the $216.20 resistance would confirm further strength, positioning the stock to target the $233.00 resistance. This trade setup offers an excellent risk-to-reward ratio, with a stop-loss set at $188.65 to manage downside risk. Analyst...

CRISPR Therapeutics AG (CRSP) is exhibiting strong bullish momentum, with a notable gap forming around the $40.00 level. A breakout above the $58.07 resistance would confirm further strength, positioning the stock to target the $73.90 resistance. This trade setup offers an excellent risk-to-reward ratio, with a stop-loss set at $29.52 to manage downside...

e.l.f. Beauty Inc. (ELF) has recently experienced a significant pullback, with its stock price decreasing by approximately 20.91% over the past month, currently trading around $70.68. This decline has created a gap at the $63 level, presenting a potential buying opportunity for investors. Analyst sentiment remains positive, with a consensus rating of "Moderate...

WNS is exhibiting strong bullish momentum, with a gap forming around the $52.00 level. A breakout above the $65.03 resistance would confirm further strength, positioning the stock to target the $94.96 resistance. This trade setup offers an excellent risk-to-reward ratio, with a stop-loss set at $49.58 to manage downside risk. According to analysts, the average...

Qorvo Inc. is exhibiting strong bullish momentum, with a gap forming around the $72.00 level. A breakout above the $86.84 resistance would confirm further strength, positioning the stock to target the $98.91 resistance. This trade setup offers an excellent risk-to-reward ratio, with a stop-loss set at $67.56 to manage downside risk. Analyst consensus reflects...

Alphabet Inc. has been exhibiting bullish momentum, with a notable gap forming around the $170 level, indicating renewed investor interest. This technical setup suggests the potential for a significant upward move, with the stock eyeing the $175 resistance level as a pivotal point. A successful breakout above this threshold could propel GOOGL toward the $191.79...

Tesla has recently demonstrated bullish momentum, with a notable gap forming around the $280 level, indicating renewed investor interest. This technical setup suggests the potential for a significant upward move, with the stock eyeing the $373.04 weekly resistance level as a pivotal point. A successful breakout above this threshold could propel TSLA toward the...

CAR is showing strong bullish momentum, recently establishing a key gap at the $90 level, signaling renewed buying interest. This technical setup suggests potential for a breakout, as the stock gears up for a significant move. The next major resistance is at $112.40, a critical weekly level that could act as a trigger point for further upside. A breakout above...

FHTX is showing strong bullish momentum, recently forming a key gap at the $4.00 level, signaling fresh buying interest and accumulation. This setup suggests potential for continuation, as the stock builds strength for its next major move. Adding to the bullish case, NVIDIA (NVDA) has been supporting FHTX, providing strategic backing that could further fuel...

KURA is showing strong bullish momentum, recently forming a key gap at the $7.50 level, signaling growing interest from buyers. This gap-up suggests potential continuation to the upside, as the stock builds strength for its next move. The key inflection point to watch is $9.49, a major weekly resistance level that could trigger a breakout. A confirmed push...

GLUE is showing strong bullish momentum, recently forming a key gap around the $6.20 level, a critical zone where buyers have stepped in. This gap-up suggests strong accumulation and potential for continued upside. The stock is now approaching the $10.86 weekly resistance, a key inflection point that could determine its next move. A breakout above this level...

Alliance Entertainment (AENT) is showing strong bullish momentum, with a gap forming around the $4.50 level. A breakout above the $8.60 daily resistance would confirm further upside, positioning the stock to target the $12.23 resistance. This trade setup offers an excellent risk-to-reward ratio, with a stop-loss set at $3.49 to manage downside risk. As a key...