USDCHF has officially broken out of the 0.82485 consolidation zone. Based on structure and momentum, we could be seeing a deeper pullback toward 0.83366, which has been a key level historically and would make sense for retesting the bearish structure. If price fails to reach that level or rejects sooner, I’ll be watching for continuation setups below 0.81394 and...

AUDCAD Update – April 23 We got the clean pullback to 0.88139, which held beautifully and gave the bullish continuation we expected. However, price is stalling now at the key level of 0.88879. A break above this opens up a 60-pip move to 0.89509. We're also pressing against the top of the daily trendline structure. Watch for either a breakout or a strong...

Yesterday’s price action and the Asian session saw Gold break cleanly through the 3225 and 3230 buy zones, pushing over 600 pips to a new all-time high of 3291. With this kind of extended move and news expected later today, Gold will stay on the watchlist until a proper pullback forms. Key levels to watch for buy setups are 3265 and a deeper retest around the 3238...

After rejecting 3196 yesterday, Gold (XAUUSD) has slowly crept back into bullish structure — with the 4H now showing clear higher highs and higher lows. Key levels to watch today: Buys above 3225 & 3230 → Targeting 3238 If we hold above 3220, bullish momentum remains intact However, a break below 3206 opens room for a deeper pullback to 3196 Today’s...

USDCHF Update – Swing Setup in Play After a massive 150+ pip move to the downside yesterday, USDCHF is now retesting the 0.84482 zone. This level will be key for the next leg: Sell Opportunity if 0.84482 holds as resistance Break of 0.83981 confirms continuation to the downside Target: 0.83366 (90+ pips from confirmation) ⚠️ A break back above 0.84482 could...

XAUUSD Analysis – 4H Outlook Gold briefly broke below 2988.00 following tariff headlines but quickly snapped back above the psychological 3000 level ahead of London open. The 4H candle just closed above 3013 — a strong resistance that’s held firm all week — indicating bullish pressure. A break of the previous 4H high opens up a move toward 3041 (+176 pips)....

AUDCAD Analysis AUDCAD has tapped and rejected its 3-quarter low of 0.85930, a level that’s held since April 2009. The 4H chart shows consolidation in a 50-pip range between 0.85930 and 0.85342. We’re watching for a bullish 4H candle close above 0.85930 for safer entries. The safest confirmation comes above 0.87060, which would confirm a break of both a key...

GBPNZD has maintained a strong bullish structure since 2023, forming consistent higher highs and higher lows. After each new high, we’ve seen 400–600 pip pullbacks before price continues bullish. With a fresh high now in at 2.26481 and signs of exhaustion showing, I’m eyeing potential swing sell setups to target the previous intrahigh at 2.17900 (approx. 550...

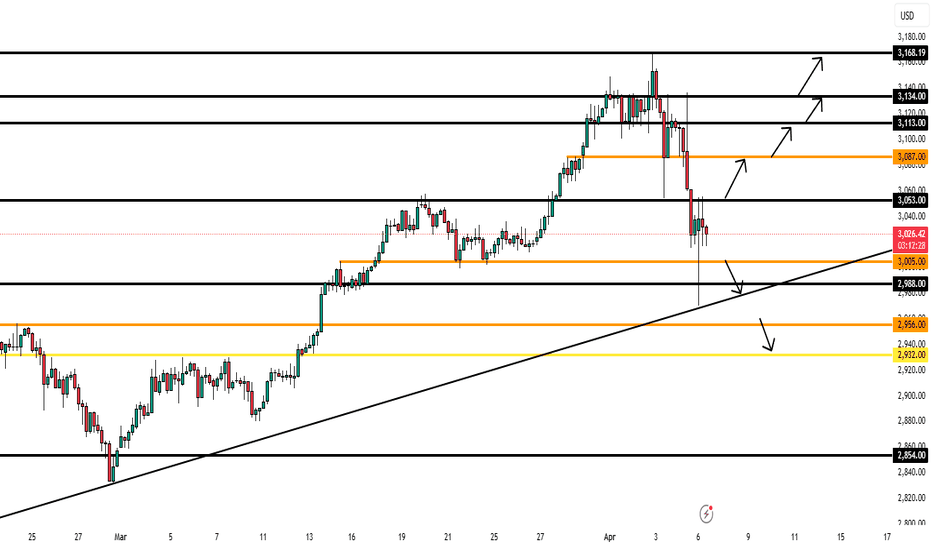

Gold (XAUUSD) Price has moved nearly 900 pips so far today with huge volatility. While the daily and higher timeframes remain bullish, lower timeframes show a bearish pullback after rejecting 3053. Bearish path: Targeting 3005–2998 if the pullback continues. Bullish path: A break/retest above 3053 opens 3087 as next target. No catalyst? We may see deeper...

Friday saw a pullback to 3014, with multiple rejections at that level. A 4H close above 3025 would confirm strong intraday bullish momentum toward 3047. However, with slowing fundamentals and a bearish 4H structure, breaking this key level is crucial. If we pull back to 3012, a deeper move to 2999 could follow. Patience is key!

After hitting a new high Wednesday, Gold has pulled back to 3021, a key intraday level. Given it’s Friday, we may see ranging or a continuation move. Looking for buys above 3032, with 3035 & 3039 being the safest intraday entries. First target: 3047 before reassessing.

Gold remains range-bound (2919-2909) after a weak bearish close Friday, despite mixed NFP data. We’ve already retested 2902 and are approaching the range high again. Given how long we’ve been in this range, I’m only trading breakouts: A 30min break & close above 2919 could give a push to 2926 (+80 pips). Sells only below 2893, targeting 2882 due to 4hr...

GBPNZD has been in a strong uptrend since the start of 2024, forming consecutive higher highs and higher lows. We've just hit a new high at 2.26481 and are starting to see rejection. This sets up a high-risk, high-reward swing trade targeting the previous higher high at 2.17900. Nearly 1000 pips of potential! Waiting for further confirmation before entering.

Gold remains bullish after rejecting 2834 last week. Asian session saw a retest of 2882, but we've been ranging between 2882-2892. My plan is to buy above 2893 on a break & retest, with targets at 2907 & 2919. If we break back below 2882, we could see a deeper pullback to 2862 or even 2834 before resuming the uptrend. Waiting for confirmation.

EURUSD has already filled the gap, and now I'm looking for continuation sells. If we get a pullback to 1.04271 and see a rejection, that would be an ideal risk-reward entry. Otherwise, a bearish 4H close will be the confirmation to sell, targeting 1.03500 first. Staying patient for the setup.

Gold remains bullish overall but is pulling back due to month-end flows. Asian session attempted to break 2882 but failed. On the 4H, we’re at a key level—break below 2856.77 could send us to 2834 before resuming bullish. Otherwise, I’ll wait for a break above 2882 for buys targeting 2908. No trades for me between 2861-2882. Staying patient for the clean setup.

USDCAD appears to be forming a double top on the daily, rejecting 1.43500. If today’s news gives us a body close below 1.43100 or breaks yesterday’s low, that will confirm my entry for a longer-term swing trade. Since this is a swing setup, I won’t be looking at anything lower than the 4H for entries. My plan is to enter and hold as long as price respects the...

EURUSD is still in the same range as yesterday. We had a bearish daily close, but once again, we failed to break the prior daily low. With news today, we could finally see a breakout that gives a clearer swing trade opportunity. Until then, I’m sitting on the sidelines, waiting for confirmation.