Since the last update on Gold, the price hit the target yesterday at $3,337. Not only has it been awesome buying and investing in gold stocks, but also trading Gold upside with day trading has been a dream. So why has gold been going up and what's next? 🏦 Central banks are buying tons of gold, especially China — big demand! 🌍 Global tension’s heating up...

Not only is the world markets showing downside to come, but so are many different commodities. With so many investors flocking out of natural gas, stocks and even crypto they are most likely trying to find the safer havens to invest in these times. Right now it looks like Natural Gas wants to come down a whole lot more due to. 🔻 Demand's lower 'cause winter's...

With trading it's not about certainties but probabilities. And in this case I was soo optimistic about the rand breaking its Inverse Cup and Handle and heading to R16.50. But instead the USD/ZAR rallied to R19.74. Apart from the negativity kicking in with the US, there is one thing I didn't really consider. And that is the US Dollar is going to hurt - no...

Since we posted the analysis on Gold - it smashed through the psychological $3,000 level and has been rallying since. We did have the normal correction where liquidity was tested at $3,000, but clearly there was more buying than selling. Now, we can expect gold to continue up for a number of reasons. 🏆 Why Gold Is Rising (and Could Climb More) 1. ⚔️...

From the last UPDATE - The Nikkei formed an extensive Rectangle Formation with an M Formation in the interim. We then had a large correction which has now resulted in a somewhat recovery. However, is the recovery on the way or are we just waiting for the next big down leg on the markets. Let's look at the fundamentals first 1. 📉 Profit-Taking After Record...

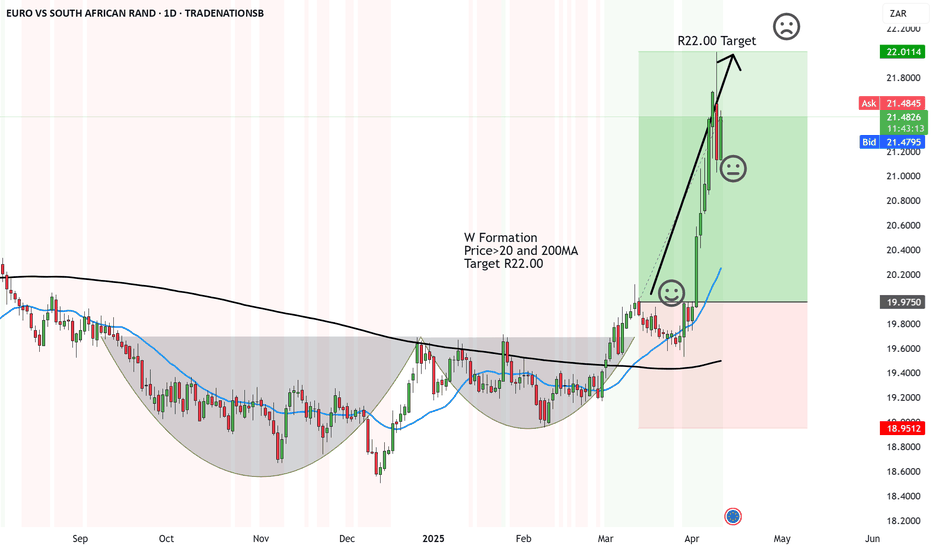

Nothing to celebrate here. It was one analysis I wish I was wrong and yet, here we are. The Cup and Handle was text book, the Tarrifs hit SA hard. And the sad thing out of all of this is that South African rand will probably hurt more than what will happen to the US Dollar. So what now? Now I think we will see R22.00 again. And we could even see R25.00 in...

With Tariffs on pause for 90 days EXCLUDING Canada, Mexico and China - This is going to have a major negative effect on the Canadian Dollar. We are already seeing it come down and the news gets worse, because Tariffs are just one thing fuelling this fire. Others include: 1. Oil's Looking Weak 🛢️📉 Since Canada’s economy is tightly linked to oil exports, the...

Cronos has been in a major Twilight Zone since September 2023. And yet it's been making lower highs each time. THere are a few reasons for the downside including: 1. Profit-Taking Following Strategic Reserve Proposal In early March 2025, Cronos proposed reissuing 70 billion previously burned tokens to establish a strategic reserve, leading to an initial...

The operational costs are rising sky high for Litecoin which is becoming very expensive to mine. And based on the Crypto Depression, it seems like there is more downside to come for the alt coin due to some of the following: 📉 Weak On-Chain Activity Fewer active wallets and transactions lately—shows low interest. 🔻 Bearish Price Action LTC just broke key...

The EUR/USD is looking somewhat positive. I assume because the Exports to the US is under 1 -2% per country, it won't cause major havoc for Europe's GDP even though it's still not great. Investors are finding a safe haven within the EUR and out of the USD. Other reasons for the EUR/USD include: 🇺🇸 U.S. Tariffs & Uncertainty Trump's new 104% tariffs...

Cardano is another Crypto that is falling flat due to the tariff implementation. And we can expect it to do so as long as price remains below 20 and 200MA> Here are some reasons why we can expect a continued downside. Escalating Trade Tensions: President Donald Trump's recent tariff announcements have intensified global trade disputes, leading to a broader...

Even with better than expect numbers with NFP. The matter remains that the world is not on great terms with MAGAs Tariff plan. Tariffs are in an indirect way a threat when it comes to trade wars. Because, there'll need to be reciprocals and larger measures to make up for the mess. Apparently, the calculations of the tariffs was to make up for the trade...

Stellar or XLM is in major trouble as it fights for its life in the crypto world. If Bitcoin, Ethereum crashes - the alt market does tend to follow similar to major stock indices versus minor. And there is no exception for this. Now there are a few other reasons for Stallars downside to come including: 💥 1. Crypto Market Crash A broader sell-off across...

France is another European market that seems to be outperforming many of the large markets in 2025. There are strong catalysts apart from foreign investments to Europe compared to the US. Including: 1. 🛡️ France boosts defense spending €1.7B added to support the military. 2. 💰 Strong French earnings Big companies like L'Oréal beat forecasts. 3. 💶 Euro...

It seems like it's the year for Europe and Spains Index. I love tracking Spain because it has a similar motion and momentum with the JSE Top 40 in South Africa. Well Spain is finishing up the Cup and Handle and once it breaks out of the brim level, then we can expect upside to come. 🇪🇸 Strong Spanish Economy Spain's growth outpaces the eurozone, boosting...

Looks like it's the Euro time to rally. With an unstable presidency and erratic party with America, it seems like Europe is finding it's feet and there is upside to come for it's currency. Here are five reasons why and then we'll get into the technicals. 🇩🇪 German Stimulus Boosts Euro Germany’s €500B spending plan lifts euro confidence. 📉 Weak U.S. Data...

Here is the update with Standard Bank. The price broke up and out of the Brim level of the Cup and Handle. The price is also above the 20 and 200 MA - Bullish by nature. It then rocketed up which I said, the target was on the way to R251.68. It's an unusual situation as the general JSE has been coming down as of late, and yet banks signal a bit of a...

Inv Head and Shoulders formed on Anheuser Busch Inbev and now we are waiting for a SOLID break to the upside above the Neckline. We also see bullish signs with the Moving Averages. Price> 20 and 200 So we can expect the first target at R1,384.54 But remember, Neckline needs to break first.