Trader_Marvin

After the tariff issue was moderately cooled, gold returned to calm and volatility gradually narrowed! From the candle chart, although gold did not form an effective decline, the bullish momentum slowed down significantly! Since gold rose near 2970, it has reached a high of around 3246. The bulls did not get a respite. After the news returned to calm, gold may...

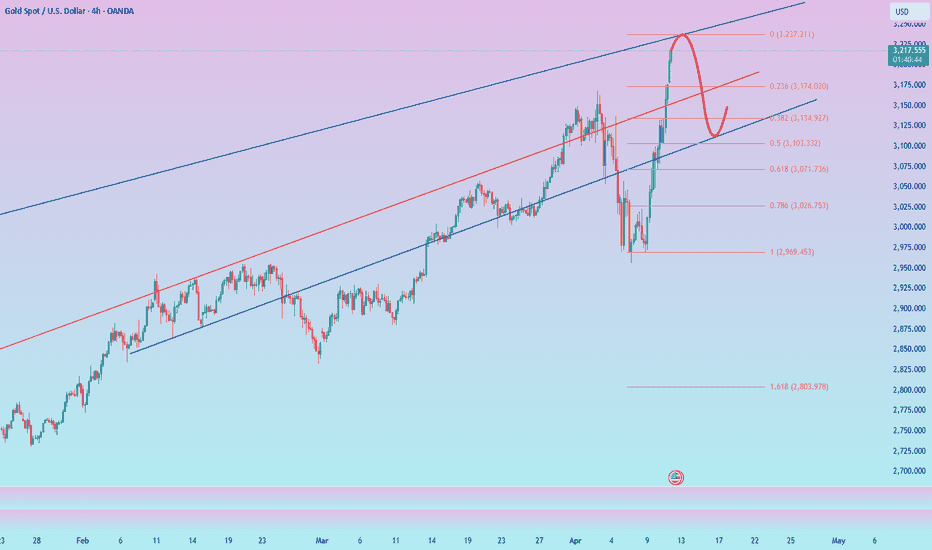

Gold fell below the 3200 mark several times during the test. Although it recovered above 3200 several times, the rebound momentum is gradually weakening, giving short sellers the opportunity to counterattack. From the perspective of the morphological structure, gold has perfectly constructed an arc top structure, laying a solid foundation for gold to usher in a...

At present, the highest price of gold has reached around 3244, but it soon fell back to below 3240; and the PPI data is obviously bullish for gold, but gold has not shown a significant upward fluctuation, indicating that as gold rises sharply, market sentiment tends to be more cautious, so that liquidity is insufficient. So from this point of view, gold still has...

To be honest, I must admit that I still hold a short position. I think there should be many people holding short positions now, but they are unwilling to admit that they hold short positions because they are losing money. I think it is not shameful to hold a short position now. Although gold has violently risen to around 3220, from the perspective of trading...

Gold rose sharply to around 3170 in the short term. Gold is in an obvious bull market. I think we should not be too optimistic! Don't blindly chase gold in trading!!! Although it is only one step away from the previous high, it not only faces the psychological resistance of 3200, but also multiple integer resistance. After the fundamental positive factors are...

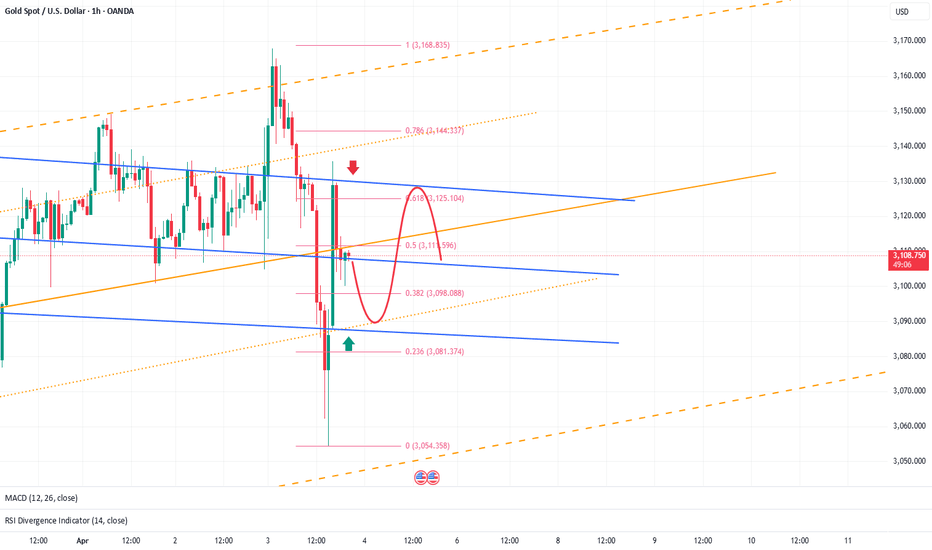

I have to say that gold is indeed in a bullish pattern at present. After all, gold did not even fall below 3110 during the correction process. However, the current fluctuations are relatively cautious, and we are waiting for the guidance of CPI data, which may exacerbate short-term fluctuations! To be honest, although gold is in a bullish pattern, the resistance...

Gold rose to the 3040-3050 area as expected. The tariff issue also stimulated the bullish sentiment in the gold market. The current price is not a good entry point for both long and short parties. Another point that everyone must be more concerned about is whether gold will rise again and break through and set a new high! I think it is not easy to draw a...

After a sharp decline, gold seems to have insufficient bullish momentum compared to before, but this is only in comparison. In fact, after gold hit the low point near 2957, the low and high points of gold are gradually rising. We can see that the bulls are gradually and implicitly picking up cheap chips. So now we can't blindly short gold. According to the...

Gold tested the support of 2985-2975 again during the correction process, but did not fall below this area during the test. Combined with the structural lows of gold yesterday, they were 2970 and 2956. Today, gold did not fall below 2970, so it is very likely that gold will form a head and shoulders bottom pattern at the technical level, which will help gold to...

Crude oil is currently in a short position overall, and the rebound momentum is relatively weak. However, in the short-term structure, oil has shown obvious signs of stopping the decline, and the support of the 60-59 area below is still valid. After hitting the low point of 58.9, oil began to rebound, and the rebound low gradually shifted upward. At present, oil...

Gold just fell to 2958, but quickly rebounded to above 2965. The short-term support of 2965-2960 was not effectively broken. Gold quickly recovered above the short-term support, proving that bulls still have room to fight back. I expect gold to at least rebound and test the 3000 position again, so in short-term trading, we should not be too bearish on gold. I...

Gold has been experiencing significant volatility driven by fundamental factors. While bearish sentiment appears to remain dominant, the recent downside move has already priced in much of the negative risk. As such, traders should avoid an overly one-sided bearish bias in the current environment. After bottoming out near the 2970 level, gold staged a strong...

The current fundamental environment: tariff issues and geopolitical conflicts are on opposite sides, so there are both bearish and bullish factors for the gold market, which have triggered fierce competition between long and short forces to a certain extent, exacerbating market volatility! At present, overall, the short forces have the upper hand, but the longs...

Good morning, bros! With the gold price falling by LSE:100H yesterday, there is no doubt that the market is currently dominated by bears! As the gold high gradually moves down, it is difficult to hold even 3100, further weakening the bullish momentum and exacerbating panic selling to a certain extent! Obviously, as gold completes the regional conversion, the...

Today's gold market can be said to have the largest intraday volatility since 2025! After experiencing violent fluctuations, the current trend of gold has once again become anxious. However, from the perspective of range conversion, it is certain that gold is currently operating in a weak position, and after the brutal and violent fluctuations, the market also...

A few days ago, I mentioned that BTC had the potential to surge towards the 90000-95000 range. Currently, BTC has already climbed above 87000 during its rebound, effectively opening the door to the 90000-95000 zone. From a fundamental perspective, with bearish factors becoming clearer, if Trump adopts a more lenient stance on tariffs, BTC could extend its...

Although gold did not fall due to the negative impact of ADP data, this does not mean that the risk of gold falling has been eliminated. As long as gold does not break through the recent highs, and in the fluctuations in recent days, the resistance strength of the 3135-3145 zone has been strengthened, gold still has a considerable risk of falling before breaking...

Gold rebounds from 3100, but is the bullish momentum truly revived? I don’t see it that way. Yesterday’s retracement to 3100 has already weakened the strong bullish structure to some extent, with 3150 likely acting as a key resistance level. I believe the current rebound is merely a technical retest of the 3150 zone, reinforcing it as a potential cycle high and...