TradingBrokersView

PremiumS&P500 is sinking under its MA50 (1w) and is headed straight to the next support level, the MA100 (1w). Last time it touched this level was in October 30th 2023 and that's alone a great buy signal. It's the RSI (1w) you should be paying attention to as it is approaching the 33.00 level, which since August 2011 it has given 5 buy signals that all touched the MA100...

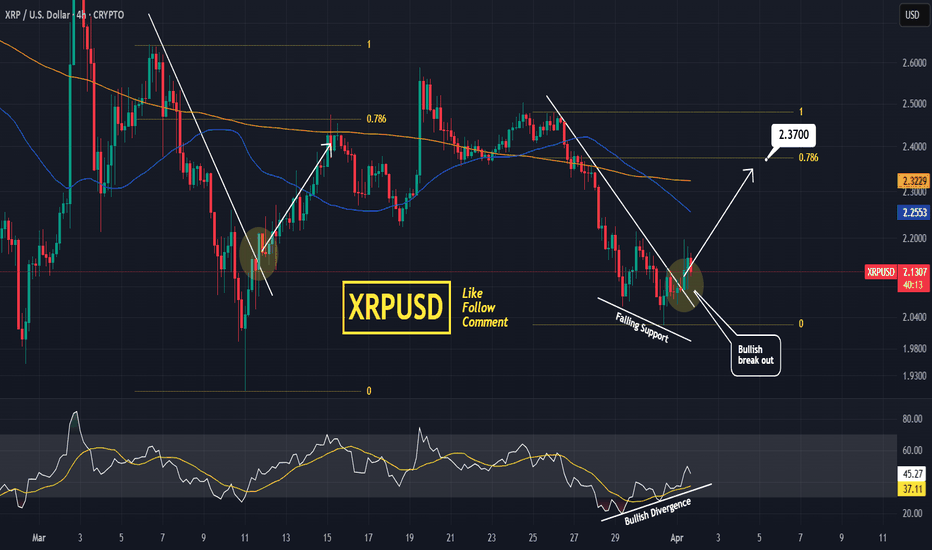

XRP broke above its Falling Wedge pattern. Being under the MA50 (4h) means that this is still a good short term buy opportunity. Last time it had a break out like today's (March 11th), it hit the 0.786 Fibonacci retracement level. Trading Plan: 1. Buy on the current market price. Targets: 1. 2.3700 (the 0.786 Fibonacci retracement level). Tips: 1. The RSI (4h)...

Nasdaq is on a strong 3 day correction that has almost erased the recovery attempt since the March 11th low. That was a higher Low inside the 8 month Channel Up and the current correction may be a bottom formation attempt like September 6th 2024. Trading Plan: 1. Buy before the closing market price. Targets: 1. 23350 (the 1.382 Fibonacci extension). Tips: 1....

Bitcoin is trading inside a Channel Up since the March 11th market bottom. The recent 2day pull back is a Bull Flag that just hit the 0.5 Fibonacci retracement level. Ahead of an emerging Golden Cross (4h), this is a triple buy signal. Trading Plan: 1. Buy on the current market price. Targets: 1. 94000 (the 2.0 Fibonacci extension). Tips: 1. The RSI (4h) is...

EURUSD is trading inside a (1h) Channel Down pattern, which just reached its bottom. Last time that happened, the market rallied by 1.25%. Trading Plan: 1. Buy on the current market price. Targets: 1. 1.09200 (+1.25%). Tips: 1. The RSI (1h) is trading on higher lows, which is a bullish divegernce in contrast to the price's lower lows. Standard bottom signal. ...

Gold is trading inside a Channel Up, where it just priced a new Higher Low today. The MA50 (1h) held and the price should now kick start the new bullish wave. All previous ones have been at least +2.05%. Trading Plan: 1. Buy on the current market price. Targets: 1. 3085 (+2.05%). Tips: 1. The RSI (1h) is trading inside a Channel Down that has already started a...

DAX is trading inside a Channel Up since the October 15th 2024 High. Since March 11th 2025 it is on a MA200 (4h) rebound and the last time it did so was on January 13th 2025. It then initiated a +9.12% rebound, which throughout the Channel Up pattern, has been a quite common bullish wave. Trading Plan: 1. Buy on the current market price. Targets: 1. 24200...

S&P500 crossed today above both the 1 month Channel Down and the MA200 (1h). The latter was intact since February 21st. The MA100 (1h) has the potential to turn now into the short term Support. Trading Plan: 1. Buy on the current market price. Targets: 1. 5900 (the 0.618 Fibonacci retracement level). Tips: 1. The market just formed a MA50/100 (1h) Bullish...

Nasdaq has formed a Golden Cross on the (1h) time frame while also crossing above the Falling Resistance of the last 3 weeks. This is a bullish reversal break out. Trading Plan: 1. Buy on the current market price. Targets: 1. 20370 (the 2.0 Fibonacci extension from the last high). Tips: 1. The RSI (1h) as already been on a Rising Support, hence bullish...

GBPJPY is basically consolidating around its MA50 (4h), staying under the January 24th lower highs trend line. The pattern is very similar to February 4th, which shortly after collapsed to the 1.618 Fibonacci extension. Trading Plan: 1. Sell on the current market price. Targets: 1. 186.500 (the 1.618 Fibonacci extension). Tips: 1. The RSI (4h) is also priting...

Dow Jones is trading inside a Channel Up but lately finds itself on a pull back. This pull back is about to test the MA200 (1d) at the bottom of the pattern. The MA200 (1d) has been holding as Support since November 3rd 2023, so overall that makes it a buy opportunity. Trading Plan: 1. Buy on the current market price. Targets: 1. 46400 (the 1.382 Fibonacci...

EURUSD crossed above its MA200 (1d) and is headed for the top of the long term Channel Down. A rejection similar to September 2024 is highly likely (which pulled the price to the 1.382 Fib), especially since this week's rise has been huge and based solely on geopolitics. Trading Plan: 1. Sell on the current market price. Targets: 1. 1.000 (the 1.382 Fibonacci...

Gold is about to complete a Cup and Handle pattern on the (1h) time frame. The buy confirmation will be a break above Resistance (1). Trading Plan: 1. Buy after the break out happens. Targets: 1. 3030 (the 2.0 Fibonacci extension). Tips: 1. A Golden Cross (1h) has just been completed. Last time it happened was on January 2nd and was a strong buy signal. ...

BTCUSD is trading inside a Channel Down pattern, which almost hit today the MA200 (1d). The last time Bitcoin traded on this level was October 14th 2024. Technically, this is not just a short term Channel Down bottom buy signal but also a long term buy opportunity for the remainder of the Bull Cycle. Trading Plan: 1. Buy on the current market price. Targets: 1....

Nasdaq is trading inside a Channel Up in 2025 and today the price reached its bottom. At the same time it marginally crossed under the MA100 (1d), making today's low the best technical buy opportunity since January 27th. Trading Plan: 1. Buy on the current market price. Targets: 1. 22370 (+6.92% rise like the previous two bullish waves). Tips: 1. The RSI (4h)...

S&P500 is trading inside a Channel Up that just hit its MA200 (4h). This is a strong short term buy opportunity for the next bullish leg. Trading Plan: 1. Buy on the current market price. Targets: 1. 6200 (+3.29% rise like the previous bullish leg). Tips: 1. The RSI (4h) got oversold. The last 3 times this happened, the price immediately rebounded. Please...

Dow Jones hit today its MA200 (4h) and rebounded. This has come too close to the bottom of the Rectangle pattern that dominates the price action in the past 3 weeks. Trading Plan: 1. Buy on the current market price. 2. Buy again if the price closes above the Falling Resistance. Targets: 1. 44450 (MA50 4h and Falling Resistance). 2. 45000 (top of...

Bitcoin is trading inside a Channel Down and today the price almost hit its bottom. This is a similar buy signal with February 9th and 12th, when the price reversed to hit at least the 0.618 Fib. Trading Plan: 1. Buy on the current market price. Targets: 1. 96700 (the 0.618 Fib). Tips: 1. The RSI (4h) is oversold, which is always a strong technical condition...