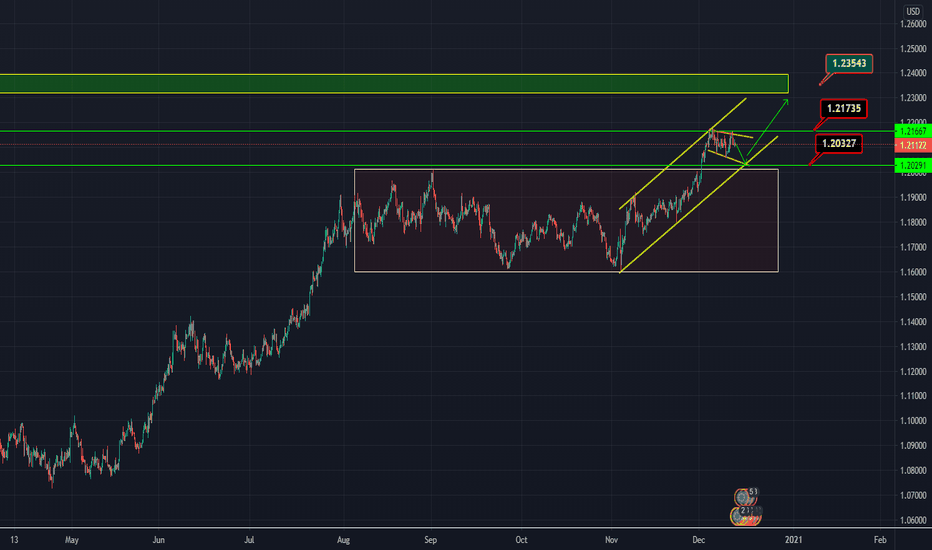

Indeed, the EURUSD started in the bearish correction as we indicated in the selling opportunity this week, as the pair moves during the downside correction within a technical pattern, which is the widening triangle, targeting the uptrend and retesting the previous resistance at 1.2030, and thus a good opportunity to buy targeting 1.2354. Buying is possible after...

The DAX is trading near the historic peak at 13812, as it is moving inside a rising channel, and the index is near the upper side of the channel, which may push it to correct to the downside. The best selling prices are 13488 and 13616. However, if the pair manages to breach the historical peak at 13812, then it is a good opportunity to continue the rise. The...

The Australian dollar pair continued its rise to July 2018 levels, taking advantage of the great weakness of the US dollar and the recovery of commodity currencies, either as a result of the positive economic news from China, or whether it is near agreement on the US stimulus package. Technically, the pair reached the upper bound of the ascending channel with...

After the big drop that the dollar-Canadian pair knows, the pair is moving inside a triangle based on an hourly frame, and thus awaiting the realization of one of the scenarios. The first is a breakout of the upper leg of the triangle and the pivot point of 1.2825 and pushes the pair to the upside, and that is supported by the pair’s failure to break the bottom...

After the strong rise of the NEW ZEALAND DOLLAR / U.S. DOLLAR pair, due to the big push that the dollar experienced against most of the major currencies. The correction started after the reversal candle on the weekly frame, which actually supports the presence of a down correction. In the short term, the pair was able to break an ascending channel on the hourly...

Possibility of an inverse head and shoulders pattern on the AUSTRALIAN DOLLAR / NEW ZEALAND DOLLAR. Waiting for the right shoulder and a breach of 1.0570 is a good opportunity to buy towards the target 1.0748

After the pair succeeded in breaching the triangle, the pair is looking towards the resistance at 82.0, which breaching it is a strong buying opportunity towards the strong resistance at 84.00

After a long downward , the 4-hour uptrend was able to stop this downward movement and the pair formed a similar triangle that was able to break it, as the pair formed a strong demand area, which is a good opportunity to buy back the pair from the 1.7092 area with the targets shown on the chart.

After the pair succeeded in breaking the sideways channel in which the pair was in during last period, and it was considered as a consolidation process. An opportunity to buy from the demand area at 1.6292 in line with an uptrend. As for the targets, they are shown on the chart

After a long downward , the 4-hour uptrend was able to stop this downward movement and the pair formed a similar triangle that was able to break it, as the pair formed a strong demand area, which is a good opportunity to buy back the pair from the 1.7092 area with the targets shown on the chart.

The pound's pairs consumed the positive news at the beginning of the week about an agreement between Britain and the European Union on Brexit. The pound dollar pair continued to rise and reached a resistance area , where the bullish wave really seemed to be confined, as the pair failed to close above the ascending channel , and the corrective descending wave...

Like most currencies, the euro has benefited from the great weakness that has caught up with the dollar, and was able to gain new points, and continued its rise to the top. Technically, the pair was able to close on the wedge pattern and achieved the first target, as we indicated in previous analysis. Currently, we are waiting for the price to breach 1.2026 and...

The Australian Yen pair is at a resistance area that could push the pair down, as the pair moves inside a similar triangle, where the point 76.50 represents a pivotal point for further decline. If the pair could breach the resistance area at 77.09, then it is a buying opportunity.

The EURO / CANADIAN DOLLAR pair is moving inside the falling wedge pattern in the long term and the pair is near the upper side of the pattern, while on a 4-hour frame the pair was able to form a smaller descending wedge pattern whose upper side overlaps with the upper side of the larger wedge. Thus, the breakout of the two models and the pivot point 1.5563 is...

The NEW ZEALAND DOLLAR / JAPANESE YEN pair is moving inside a right triangle and thus the possibility of a Downward corrective wave, in case the lower bound of the triangle is broken and the uptrend at the point of 72.88 is a selling opportunity towards the target of 71.53. And about the buying scenario, it begins with a penetration of the upper side of the...

The Australian pound is moving sideways on a 4 hour frame, which constitutes a possible consolidation area to start buying. A break through the upper part of the Wyckoff gathering area at 1.8513 is a good opportunity to enter a long position. But if the price returns to the bottom of the consolidation area, it is an opportunity to enter early buying from 1.7714

Under the condition of uncertainty in the Brexit update between Britain and the European Union, this could cause a collapse in the pound currency, and on the other hand the New Zealand currency is witnessing a clear improvement and strength, and this is due to the investor’s appetite for higher-yielding currencies. Technically, the pair moves in the form of a...

The Australian Yen pair is at a resistance area that could push the pair down, as the pair moves inside a similar triangle, where the point 76.50 represents a pivotal point for further decline. If the pair could breach the resistance area at 77.09, then it is a buying opportunity.