When trading the best wolfe strategy you will find that after the entry is triggered your position should show you an immediate profit. This is because the reversal pattern that emerges from the wolfe wave chart pattern is very violent. Once we’ve got the first five waves we have the general setup of the wolf wave . After the last wave has broken above the...

COME JOIN OUR FREE LIVE EFX TRADING SESSION THIS WEEK. USE THE EFC INDICATOR OR OUR FREE RSI 80/20 STRATEGY FOR LIVE SESSION. EFC INDICATOR SHOWS 1 - OPEN ENTRY SIGNAL 2 - STOP LOSS SIGNAL 3 - TAKE PROFIT SIGNAL

The weekly chart shows sup/res levels used to take profit levels. The 4h chart shows entry points. Bearish trades. 1st sell trade at breakout of triangle bottom @ 1.0663. 1st sell take profit at 1.0560. 2nd sell continuation trade breakout at sup level of 1.0560. 2nd sell take profit at 1.0450. Bullish trades. 1st buy breakout of top of the triangle. You...

Chart patterns found on weekly chart. Entries found on daily chart. Previous support at 4.75. 1st bearish trade entry on daily candle close below triangle bottom. 1st trade take profit at 4.80. 2nd bullish trade you determine entry. 2nd take profit at 80.00.

Step #1: Look for evidence of a prior bearish trend. For a valid bearish flag, you need to see a sharp decline. Just because you can spot the bear flag pattern, doesn’t mean you have to jump straight into the market and trade it. Remember, we need the right context and the right price structure needs to line up for a tradable bearish flag. So, the first step is to...

TRADING PULLBACK RULES 1 - Find Daily uptrend with HH's & HL's. 2 - Switch to the 1h Time Frame and Wait for a Pullback against the Uptrend. 3 - Place Fib between last swing high and low levels, prior to the pullback. 4 - Buy Anywhere Between 50% and 61.8% Fib. 5 - Place Stop Loss below Swing Low. 6- Take Profit at break above the ...

Advanced Triangle Breakout Indicator shows Short Trade Red Column Signal. Advanced Triangle Breakout Indicator shows Open Short Trade Entry Signal. Advanced Triangle Breakout Indicator shows Stop Loss Signal. Advanced Triangle Breakout Indicator shows Adjusted Stop Loss Signal. Advanced Triangle Breakout Indicator shows 1 x 2 risk/reward Take Profit Short Trade...

CADJPY BUY STOP @ 78.50 TAKE PROFIT @ 81.60 STOP LOSS @ 77.00 USDCHF BUY STOP @ .9520 TAKE PROFIT @ .9635 STOP LOSS @ .9440 These trade calls are for training purposes.

Breakouts are found using Trendlines - Horizontal Sup/Res Ranges - Channels. Finding the opportunity to see the 2nd or 3rd breakout increases breakout success. Use a tighter stop loss on a 15m chart helps reduce risk. If caught in a head fake - with a lighter stop loss - watch for another breakout setup. Hold for a longer intraday or daily trend move.

Emini Trend Following Strategies The Emini trend following strategy is probably the most powerful. Trend following has the potential to generate the biggest profits. One of the greatest traders of all time Jesse Livermore said that the big money is always made on the big market swings. We have identified two parameters that can be used to determine when we’re...

Emini Breakout and Momentum Strategies Profiting from breakouts and momentum trading is a favorite trading approach among Emini day traders. Emini momentum strategies often rely on capitalizing on a spike in momentum (order flow) activity. That’s the reason why Emini momentum strategies work best during times of increased volatility. Similar to momentum trading...

Bump and Run Trading Strategy – Sell Rules The Bump and Run trading strategy is one of the best reversal trading strategies that you’ll probably ever need to learn. The psychological reason why the Bump and Run reversal is such a powerful pattern is because it takes advantage of the result of excessive speculation. This propels the price too swiftly to the extreme...

The Best Momentum Trading Strategy using the Best Forex Momentum Indicator Our team at Trading Strategy Guides believes that smart trading is the way to build the best momentum trading strategy. In this regard, we don’t want to predict when the momentum will happen, but we let the market tips his hands and then react. One principle of the momentum indicator...

1D ASCENDING TRIANGLE BULLISH BREAKOUT. Wait for a Daily Candle Close above triangle. 1H PULLBACK TRENDLINE BEARISH CONTINUATION BREAKOUT. Wait for a 1H Candle Close below Pullback Trend line. Or wait for a Bearish Continuation Break-Hook-Go candle pattern.

Big Ben Indicator shows the Asian Session Range Big Ben Indicator shows 1H pre-London area Big Ben Indicator shows 1h London Open area Big Ben Indicator shows pre-London Stop Hunt Breakout Big Ben Indicator shows Sell Signal as London Opens Big Ben Indicator shows the Entry Price level Big Ben Indicator shows adjusting Trailing Stop Big Ben Indicator shows Take...

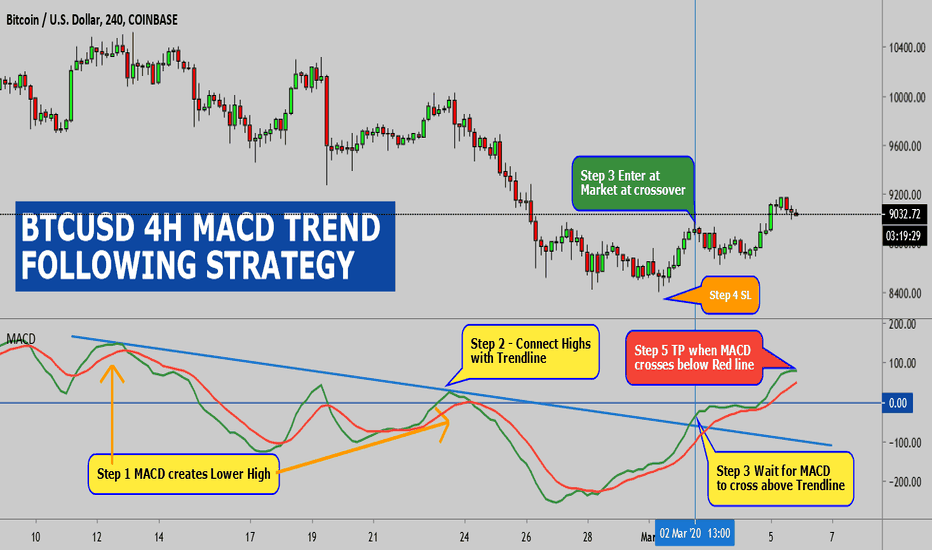

(Rules for A Buy Trade) Step #1: Wait for the MACD lines to develop a higher high followed by a lower high swing point. The first rule of thumb to recognize a swing high on the MACD indicator is to look at the price chart if the respective currency pair is doing a swing high the same as the MACD indicator does. A higher high is the highest swing price point on a...

Big Ben Indicator shows the Asian Session Range Big Ben Indicator shows 1H pre-London area Big Ben Indicator shows 1h London Open area Big Ben Indicator shows pre-London Stop Hunt Breakout Big Ben Indicator shows Sell Signal as London Opens Big Ben Indicator shows the Entry Price level Big Ben Indicator shows adjusting Trailing Stop Big Ben Indicator shows Take...

Tim's MA-X Strategy. This is a Moving Average Crossover or MA-X Trading Strategy setup. MA-X strategy consists of the 100 period simple moving average (SMA) in red, and the 20 period exponential moving average in blue. If the 20 ema is above the 100 sma then we only take buys or longs. If the 20 ema is below the 100 sma the we only take selss or shorts. *In this...