Dollar Index is setup for longs based on COT and other fundamental underlying conditions.

Based on price action analysis utilizing market structure and a variety of trend change confirmation tools, I am looking to long dips in Bitcoin.

Crude oil is setup for longs based on fundamental conditions underlying the market place.

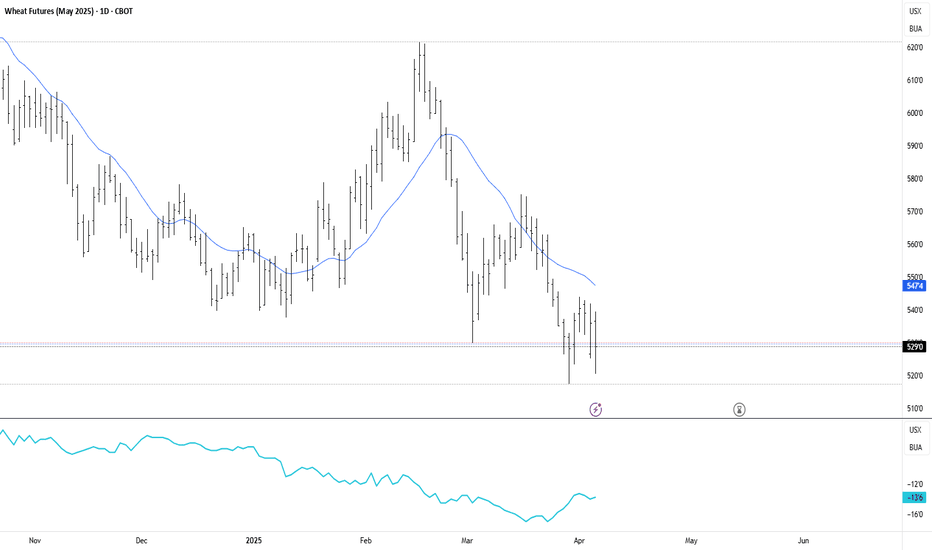

ZW (Chicago Wheat) is setup for longs based on COT positioning and other fundamental indicators.

I show you how to use simple market structure to determine a bias, 18 period moving average to confirm trend on entry timeframe, and how to use the %R to time your entries into the market in alignment with the dominant momentum.

Copper is setup for sells based on fundamental underlying conditions. We also see confirmations from accumulation measurements, seasonals & cycle analysis.

I show you my process from start to finish. How to identify: If a market is setup for a move of some significance. How to confirm a setup using accumulation/distribution measurements & seasonals. Finally, how to utilize technical methods to enter into a trade.

I show you my process from start to finish, the same process I use every week to profit from the markets. -Fundamental Setup -Confirmation -Technical Entry -Exit/Stop

Not financial advice. YM is setup for longs based on COT Commercial Positioning Extreme, Valuation, Sentiment & Seasonals.

Cocoa is setting up for a long trade upon a confirmed daily bullish trend change. The fundamentals underlying this market suggest a bullish move of some significance is brewing, and would confirm if we see a daily bullish entry trigger. Commercials at extreme in long positioning relative to last 26 weeks of positioning. Advisor Sentiment Index at bearish...

This weeks edition of the market matrix. How I'm looking to participate in the Gold, DXY, SP500 & Crude Oil markets this week. I throw in some COT analysis as well.

This weeks edition of The Market Matrix. Covering Gold, DXY, Nasdaq & Crude Oil.

Cotton, a seemingly unassuming commodity, is quietly aligning for a significant bullish move. But remember—this is not a prompt for reckless action. The entry is reserved for those who wait for the Daily timeframe to confirm the trend change. The Codes of the Cotton Conspiracy Code #1: The Commercial COT Index Commercials are not merely dabbling—they are at an...

There is a difference between seeing the market and truly understanding it. Most traders react. The enlightened anticipate. This week, the COT strategy has illuminated a setup so clear, yet so overlooked, that only those who understand the deeper language of the markets will act. Coffeewhispers a warning, and few are listening. The Codes Have Been Revealed: 🔻...

This weeks edition of The Market Matrix. Disclaimer The information provided in this content is for educational and informational purposes only and should not be construed as financial advice, investment recommendations, or an offer to buy or sell any securities or financial instruments. Trading financial markets involves significant risk, including the...

Follow Me Down the Rabbit Hole: The Soybeans Market Setup for Shorts What if I told you... the soybean market is on the verge of a paradigm shift? That the signals are all around you, hidden in plain sight, waiting for those who can read the code. The Commitment of Traders (COT) data is flashing red, and the truth is undeniable: the smart money is preparing for a...

This weeks edition of The Market Matrix. Disclaimer The information provided in this content is for educational and informational purposes only and should not be construed as financial advice, investment recommendations, or an offer to buy or sell any securities or financial instruments. Trading financial markets involves significant risk, including the...

The Wheat Revelation: A Privilege to See the Code "You’ve always felt it—the hum of something deeper beneath the markets, the unseen forces at play. Today, you are invited to glimpse the truth." The Commitment of Traders (COT) strategy has unveiled another red pill: the Wheat market is primed for a bullish move. This is no ordinary signal; it is a rare alignment...