$SNAP - Breaking down through support to fresh lows today. Next target = $4.00 by next earnings report in February. Note: Informational analysis, not investment advice.

$XLF Financials ETF - Looking oversold on the daily chart after closing red or flat for 8 straight trading days. Ending the day today right at a key support level just under $24. A bounce in the coming days definitely hinges on the FED not raising rates tomorrow . If they do nothing, I expect a near term price recovery in the XLF back to the $25-$26 range by year...

$EWU UK ETF - Breaking down out of long term consolidation pattern. Medium term target = $27.50

$BKNG Booking - Finding support today at the lower limit of the long term bearish channel. Playing for a near term bounce from this area. Targeting $1850-$1900 range by mid-January. Note: Informational analysis, not investment advice.

$TLRY Tilray looking extremely oversold with RSI approaching 10 on multiple timeframes. Expecting a near term bounce at least back to the mid-80s within 1-2 weeks. Note: Informational analysis, not investment advice.

$SAM Boston Beer Company - Bull flag which began back in July has formed on the weekly chart. Long term price target $425-$450 area by December 2019. Long term price projection dependent on continued strong earnings and market fundamentals into next year. Breakout to new highs next year will most likely require continued beverage innovation and possibly an...

$SIG Signet Jewelers now down 30% since earnings release last week. RSI deeply oversold and price at $35 long term support level from April of this year. Expecting a bounce in the near term from this area - targeting $44.00 by year end. Would like to see a close today >= $35.00 for confirmation. Note: Informational analysis, not investment advice.

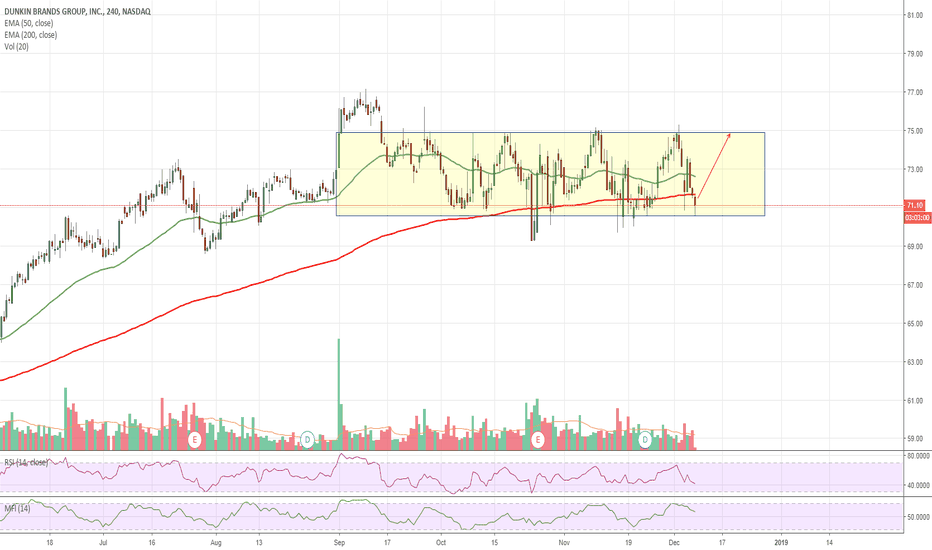

$DNKN Bullish hammer forming today at the bottom of the recent trading range. Playing for a move back to ~$75 level in the near term. Near term target - $75.00 by Christmas Note: Informational analysis, not investment advice.

$WDAY Bearish shooting star candlestick forming on weekly chart, expecting to close the week within upper channel limit (i.e. <= $165). The stock shot up from Nov 20th low of ~$118 to up over $170 within two weeks (44% gain)...eventually gravity catches up - retracement already underway. Targeting $140 level by mid-January. Note: Informational analysis, not...

$ULTI The Ultimate Software Group - possible Elliott waves on the weekly chart showing another leg down likely in medium term. HCM software a highly competitive space with some other major players, ULTI margins are already not the greatest. Targeting $220 (possibly lower) by February. Note: Informational analysis, not investment advice.

$SIG Signet Jewelers (Zales, Kay, Jared) reports earnings tomorrow pre-market. Not a good sign that a descending triangle formed on the daily chart over the last couple months. Options are showing an implied move post-earnings this week of ~15%. Smart money looks much more heavily weights on puts. There's an unfilled gap down around $44.00 (-12% from current...

$NIO holding trendline support this week, forming a possible ascending triangle on the hourly chart. Expecting another couple moves within triangle before breaking ~$8.12 resistance. Targeting $9.00+ by year end. Note: Informational analysis, not investment advice.

$A Agilent looking overbought approaching all-time high $75 resistance. RSI & MFI both entering overbought territory on 9th straight green day today . Playing for a near-term pull back setting up for a possible long term cup & handle breakout to new all-time highs if it's able to turn back up. Note: Informational analysis, not investment advice.

$AVAV Oversold finding support at $75. Playing for a medium term bounce. Targeting $85 by year end. Note: Informational analysis, not investment advice.

Z Zillow Overbought at resistance, RSI and MFI topping out - will be playing near-term for a 10% retrace by early December. Target = $33.00 Note: Informational analysis, not investment advice.

$PHM PulteGroup Homebuilders looking overbought approaching 200d ema line, expecting a near term pull back. Targeting $25.20 support by mid-December. Note: Informational analysis, not investment advice.

$GUSH - Falling wedge into long term $15 support level. Expecting a bounce from this level in near term. Targeting $29 October gap-fill by January. Note: Informational analysis, not investment advice.

$AMAT forming a possible bear flag on the daily with a rising wedge into 50d ema resistance. Expecting $36 resistance to hold this week. Two possible medium term targets on chart. Note: Information analysis, not investment advice.