UnknownUnicorn3397093

We have a possible bullish trend towards the upper line of the channel; but base on Elliott wave analysis it probably won't reach to the upper line. We have possible lower trend line that can be reached by price at 0.98440 level. This level is the 61.8% retracement of a-wave of a zigzag pattern which is the maximum retracement for the b-wave. Please remember to...

As we can see on the chart above y-wave with 7 wave is completed and second x-wave is passed the MA(50) but returned after it had reached to the MA(100). If we consider this move as a second x-wave we can see that its size almost equal to the first x-wave. The area between 0.9762 and 0.9745 can be considered as a potential support.

This pair is on the correction between a narrow range. I think we still on this range with the Z-wave of triple combination.

Long on 1H. Description is mentioned on the chart. Please view the idea for more details.

Pattern is creating the 3rd-wave of an impulse. As we can see there are 2 different target for short time: 0.6968 and 0.6876. Trend is Bullish and it will probably reach to the second resistance eventually. Good Luck

This pair has been recovering from the flash crash and despite the yesterday negative data for USD and today positive Nikkei Mfg PMI data for JPY, we still have a uptrend for this pair; but now price has reached to the 38.2% retracement and there is a good chance for the price to fall down. In this case we have a zigzag with a very small c-wave as a correction. It...

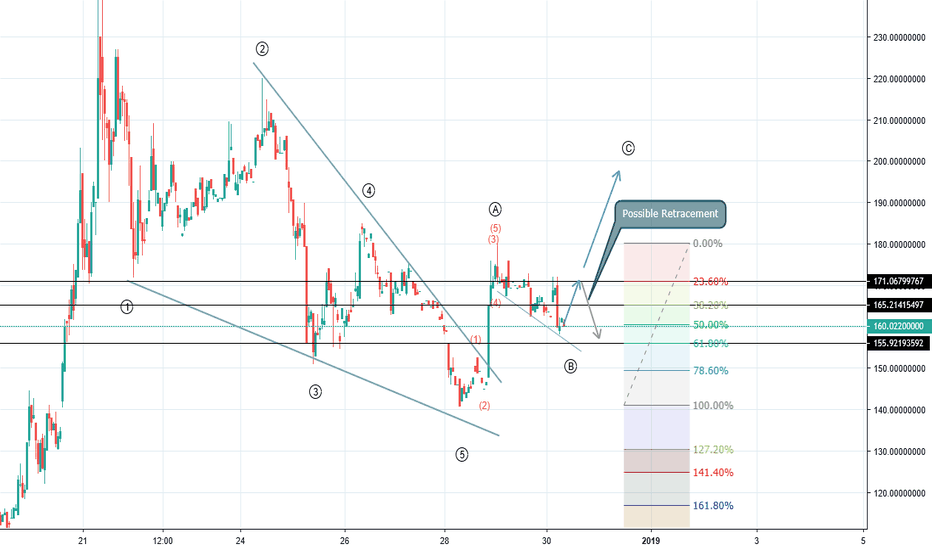

We have a bearish possibility for Ethereum. after (b)-wave it seems that we have a diagonal which could be leading diagonal ( first wave of an impulse) or ending diagonal ( (c)-wave). If we assume the second possibility, then we should have a close look to the 167.49 level which is the end of the ((i))-wave( note: wave ((iv)) can't reach to the territory of wave...

Long on 2H - Elliot wave analysis.

We haven't got good news and calendar data about USD and this has been a good news for the gold. Base on the data for ADP National Employment, Initial Jobless Claims for US which published yesterday and Elliot wave analysis I assume that gold is going up but there could be a short pullback on the level of 13000. This level is 123.6% Extension for both smaller and...

It seems that the 3rd-wave has been started and we assume that it will continue upward to the area between 95.919 ( 161.8% extension of the first wave of smaller degree) and 97.582 ( 50% extension of the 1st-wave of the larger degree). After that price probably return as a correction to complete the 4th-wave.

After a successful analysis(link below) about this pair it is time for another analysis. The long trend is bullish but we have a swing area between 8.32 and 7.45( or maybe less) that it is good to be considered for the short time forecast. It means that price could rise anywhere between 8.09 and 8.32 and then fall anyplace between 7.88 and 7.45; after this fall,...

Base on Technical Analysis and chart pattern, we have a descending triangle which is the sign of Bullish. Base on Elliott wave, we have a leading diagonal at the 1st-wave of an impulse wave which is also sign of the bullish trend for creating the 2nd-wave. It seems that we have a zigzag pattern as the 2nd-wave correction. It is difficult to say exactly that b-wave...

Litecoin is correcting the 3rd-wave by a zigzag pattern(4th-wave). The resistance could be any of the 3 levels ( 43.005, 47.965 , 49.825). Notice that the level of 49.825 is the last possible resistance for our 4th-wave. More than this level is the territory of 2nd-wave which can't be overlapped. Please remember to Like if you find the idea useful. Thanks and Good Luck

It has been more than 15 hours that Ripple moving sideways. As it is demonstrated on the chart we have a bullish impulse wave. but It is important to consider that there could be a pull back after a short time upward, to the 0.38240 level that is the end of the 4th wave in smaller degree. Although it is not mandatory, but it is important to keep it in mind. ...

Price has reached to the 116.00 support level as we expected and it had been mentioned at the last analysis. now it is time for Ethereum to rise beyond the level of 163.00 which is the end of the a-wave.

Gold has been rallying upward since November 13th with a few short correction on the way up. We have a 1284.012 level that could be a break point for trend to retrace about 50% of the uptrend. Although retracement could be 61.8% but not more than that.