UnknownUnicorn3442968

Gold, XAUUSD Long, Buy Entry: 1465.21 Target: 1500 Stoploss: 1459 Risk: 0.42% Reward: +2.7% (13:04 UTC 11.15)

We'll be monitoring 98 as support and if broken will trade accordingly.

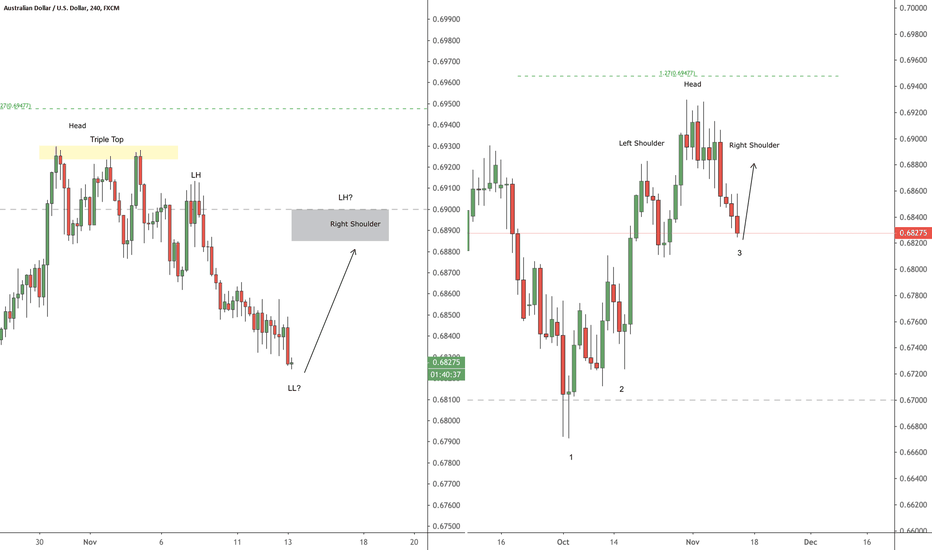

See linked charts, Currently hedged on this position both long and short, this bias is neutral. Price action suggested in the chart on the 4-hr time frame is bearish.We'll continue to hold both positions until at least prior to today's close at 5pm EST.

See linked charts below from this week,

Short, Sell USD/CAD Entry: 1.32547 Stoploss: 1.329 (-36 pips) Tp1: 1.315 (+107 pips) Tp2: 1.3 (+259 pips) 11:07 am CST 11.14

Price has reacted perfectly on longer time frames to be currently showing a morning star pattern on the daily time frame. See linked and previous charts below,

No entry yet for CJ. We'll be looking for the zone-colored green which is at the 127% extension of the current swing high-swing low and also at the 618% fib of the longer weekly swing low-swing high structure.

We remain ready to execute a long position following the correct rejection and price action of the zone colored green in the chart. You can click on the linked charts below to see this trade setup published earlier this week. We have just now had the first real true price action this week and we look to take advantage of any opportunities that may arise.

Entry, stop loss and target for this trade given in our telegram channel.

Our bias from Monday remains bullish. Since Monday, we've successfully called both setups for NZD/USD. We'll be looking for long entries at the lowest possible price before retracing higher to the upside target shown to make a new HH in the current llnger-term structure. See linked charts below,

Will be looking to enter long Euro following a daily rejection of 1.1. We expect some more downside price-action today and will be on the sidelines until the lower levels of support (1.096) are rejected. Key to this setup will be the daily price closing above 1.1. No entry until rejection is confirmed.

(20:12 UTC 11.13)

This chart is very simple for a reason; to show how easy and simple a historically successful strategy can be to execute and create. There are alot of confluences not included in the chart so keep that in mind. Ahead of CPI numbers, we'll be looking for an opportunity to long gold. We won't be interested in trading the news, only the reaction. This trade will be...

Will be looking to enter long with this setup, as we've tracked it's downward price action so far into our buy-zone shown in the original chart posted a few days ago. This entry will be provided in our telegram as a buy signal with entry, specific stop loss, account management info, and fundamental data. It's important to remember that CPI numbers come out in 1...

With this specific setup, there is not only a number of confluences in our favor, but price is at a critical point for us to consider. Taking into consideration our bias and comparing it over different timeframes can help you make more strategic choices on where to place your capital in the market. Confluences for this trade setup include a daily head and shoulder...

NU: 4-hr Head & Shoulder at Key Level (11.12)

Entires for this trade will be posted in our telegram channel,