Val-the_vagrant_Surfer

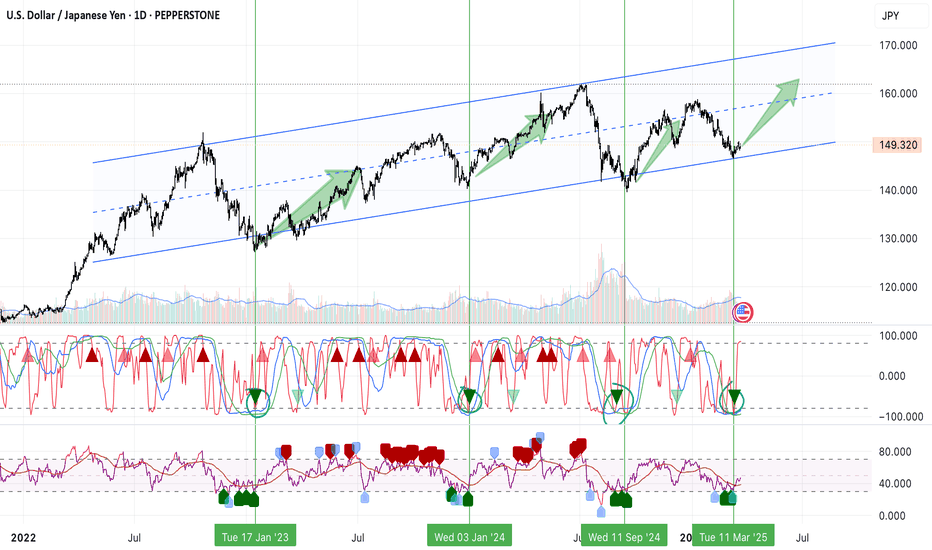

When the USDJPY is in oversold conditions, it typically retraces to the upside. Right now, it appears to be one of those moments, making a move to the upside very likely.

When USDT Dominance shows overbought signals, it might be time for a retracement. And when it goes down, the whole crypto market tends to go up. Right now, we are in such a moment. The next few days will reveal the direction.

The blue bullish pivot point signal has reliably indicated a retrace. Bullish momentum in Broadcom AVGO is very likely.

When USDT goes up, crypto tends to go down. USDT seems to be oversold at the moment, and a retracement is possible. This might only be a small retracement. There's no reason to sell, but it could be a good opportunity to buy more when crypto prices drop. Patience and a solid plan in advance are needed now.

ATOM found its bottom when the RSI was oversold and showed a bullish divergence, as indicated by the blue and green arrows at the bottom. The dark green triangle appears when the RSI dips below 30 and then rises again. The WVF indicator shows that volatility is slowing down, which suggests that the downward movement is coming to an end. The price finds support...

MATIC Network appears to have reached a bottom and is building momentum for an upward wave that could last approximately 150 to 300 days. What do you think?

It is not obvious how crypto moves, but it always comes in waves that can last for a year or two. If I interpreted the indicators correctly, the next big wave for XRP could come soon.

EURUSD is on its way to retrace down according to the signals. - On the RCI 3 Line indicator, the mid (blue) and long (green) trend lines have crossed. - On the RSI, the RSI has crossed below the moving average (brown). - The price has hit the upper level of the channel and made a tiny higher high, grabbing the sell-side liquidity resting above the previous...

Novavax, Inc. (NVAX) has recently bounced off a 5-year support line, potentially paving the way for a bullish move that could yield a 2,000% profit. 🚀 - The RCI 3 line indicator shows a bullish crossing of the middle and long trend lines. - The RSI spiked above the moving average. - A rare bullish signal has appeared below the chart. The last time this...

Moderna (MRNA) has touched the lower band of the channel. The price went outside of the Bollinger Bands (BB) and closed back inside. This could be the moment of a reversal...

The signs indicate a new wave to the upside for the EUR/USD. Everything is connected to everything. The U.S. Dollar and the Euro have an inverse correlation. If the Euro goes up, the U.S. Dollar goes down. If the U.S. Dollar goes down, crypto and stocks tend to go up. I predict a green month for stocks in July. Let's see if I'm right.

Based on the inverse correlation between USDT dominance and Bitcoin, Bitcoin could see a bounce soon. The indicators show a reversal in trend on a one-month timeframe. This can be very advantageous for swing trading.

This is just my personal trading setup so that I keep it in mind. Viking Therapeutics (VKTX) prepares for its next move. The following things need to happen for me to be bullish: On the 3D chart: 1. The RSI needs to move above the moving average. 2. On the RCI indicator, the mid-trend line (blue) needs to move above the long-trend line (green). 3. The chart...

On May 1st, the price reached a low point before preparing for a new upward movement. - There was a bullish divergence in the RSI on May 1st. - The middle trend line (blue) and the long trend line (green) on the three-line indicator crossed bullish. - The price broke above the purple trend line. We are now waiting for a retest of this line before potentially...

Hard to believe that BTC has reached its top and will have a strong retrace downward. When USDT dominance goes down, BTC goes up and vice versa. Right now, USDT dominance has reached a resistance trend line and tagged a previous low. A retrace for USDT dominance to the upside is very likely, which means Bitcoin is going to dump, and with it, all the...

If Broadcom breaks out of the resistance line (purple), wait for the retest on the same line and the next move is set. - The RSI is trending over the moving average, what indicates bullish momentum. - The intermediate trend line (blue) is soon crossing over the long trend line (green) on the 3 Line indicator. --> bullish. The next big move might happen soon....

Super Micro Computer (SMCI) is a good candidate to watch. When the RSI moves above the moving average, a significant upward movement is likely. Currently, the stock may still be in a consolidation phase, which could end by the end of August. When the Bollinger Bands move closer together, a breakout is imminent. The stock has been trending primarily in one...

Immunity Bio (IBRX) could bounce soon. - The price is touching the trend line that has served as resistance since October 2023. - The RSI is slowly moving above the moving average. - The RCI indicator shows a triple bottom with all three trend lines (short, middle, and long). - On the chart, the price is touching the lower line of the Bollinger Bands. The...