Valentasm

Why to Hit resistance with fakeout RSI close to 70 on 4h NZD rate cut is effect coming Possible to very reasonable retrace to FIB50 Eur PMI is still not in good shape May 8th bearish candlestick wick Eur have Brexit which also effect it Why not Eur could always surprise especially with political side since it have parliament elections Trade war could effect NZD...

Why to Keep rate dessication is good sign for CAD RSI high overbought Pair already proved to work box pattern to work Just me luch to catch with, but still good time to sell I see all cad pairs strong Why to Trade wars could impact WTI demand and it could impact CAD

Why to RSI oversold That daily wick got my attention Hit support OPEC always takes action to increase price Have you heard about "Druzhba pipeline losses". It is not very related to WTI, but also could make impact. It is very funny story with only possible caption "only in Russia" Why to Trade wars could impact WTI demand a lot Very risky trade

Why to RSI oversold Close to previous support on 2018. oct Rate cut should make impact Broke downtrend Good R:R Why not Trade wars intensifies Quite risky since any Trump action could hit SL

I try to catch small correction on OANDA:NZDUSD with nice RR Fundamentals Retail Sales is coming and forecast lower than previous, but previous was better than forecast. Hope this one will beat forecast since it is very low NZD just cut interest rates, so market dont expect much Trade war calming for a short time Technical Oversold Need small...

Inverted cup and a handle for UKX. Also touched support Deadline is so close for leaving EU. Like GBP brought EUR up, no EUR bring GPB down. Like no surprise for global slow down. And final. Good risk reward 1:3

* WTI oversold * Saudi Arabia in talks to cut oil output after US waivers hit prices * 60 is magical number to have strong support * Many is not happy with such oil prices * Worldwide oil demand is still hight * Look at previous days candles. All them wanted to push price up, but bears won. * Risk Reward is fabulous. * BTW winter is coming :)

GBPAUD short on brexit news and strong AUD

XAU nice weekly hammer. Right time to enter. Good risk reward

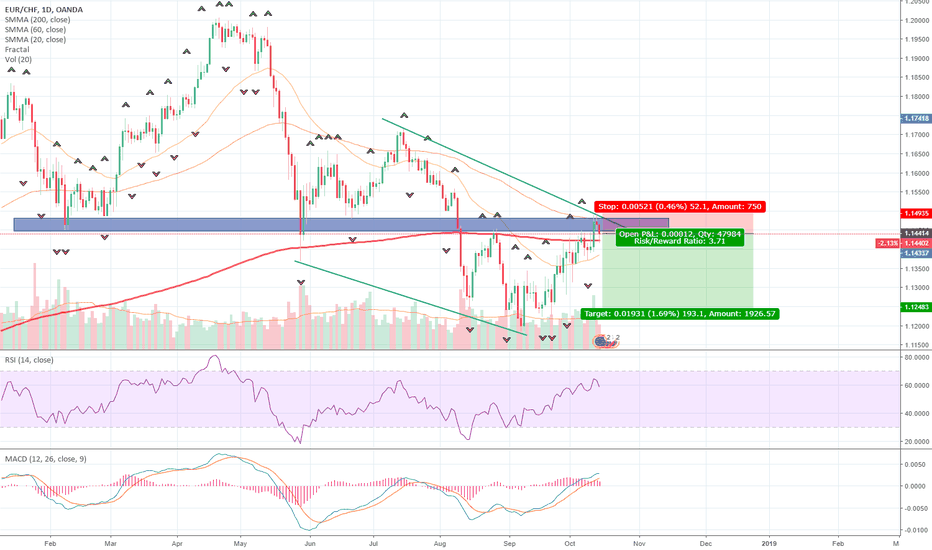

EURCHF short on resistance. Good risk reward ratio

EURCHF buy on dip. Risky due nervous markets CHF like safe heaven could show some potential.

Reverse cup and a handle . Also oil fundamentals

DAX buy on dip setup. Good risk reward. Good math with fib. Also political situation calming down

Why to * USD could not break resistance * After Fed Press Conference expected bigger market reactions * Downtrend tunnel line arrange quite nice * Trade wars not is more on CHN side * Fib lines up nice too

EURCAD reverse downtrend Why to * CAD left same interest rate * Weak oil prices. Also some distraction from OPEC member * Strong support * Intension from Italy it calming down * Eur have strong economic data * Oversold * Downtrend line cross