Wainainarobert

📈 Fundamental Outlook: Investors are closely watching the Federal Reserve’s next policy decision. With interest rates expected to remain stable, the market is anticipating a shift toward more accommodative monetary policies. This creates a favorable environment for risk assets like Bitcoin. 🔍 Technical Analysis: Bitcoin is sitting at a strong demand zone,...

Trade Recap: GBP/CAD Long Position Trade Details: Entry: January 15, 2025, at 1.75042 Stop Loss: 1.73868 Take Profit: 1.8251 Pips Gained: Approximately 1008 pips Technical Analysis: Trend: Upward momentum observed Oscillators: Oversold conditions indicated a potential reversal Fundamental Analysis: GBP: Positive outlook due to higher government and consumer...

🔥 Why Sell? ✅ Momentum Fading – Buying pressure weakening ✅ Supply Zone – Strong resistance at 1.1330 ✅ Stochastic Overbought – Price may reverse ✅ Range Market – Stuck between 1.1100 - 1.1330 📊 Fundamentals 🇬🇧 UK: Neutral 📈 🇨🇭 CHF: Bullish 💪 ⚠️ Risk Management: Stay alert for news! 📢 💬 What’s your take on GBP/CHF? Comment below! 👇🔥 #Forex #Trading #GBPCHF #ForexSignals

GBPAUD Swing Trade Recap: 952 Pips Bagged 🚀 🎯 Trade Overview: 📍 Entry: 1.96049 (Jan 21) 🎯 Exit: 2.05543 (Feb 15) ⏳ Held for: 25 days 📈 Total Move: +952 pips 🔍 Why I Entered: ✅ Uptrend Intact – The market was climbing like a hiker pushing toward the summit. ✅ Oversold Conditions – Price dipped too low, like a spring being compressed, waiting to bounce. ✅ GBP...

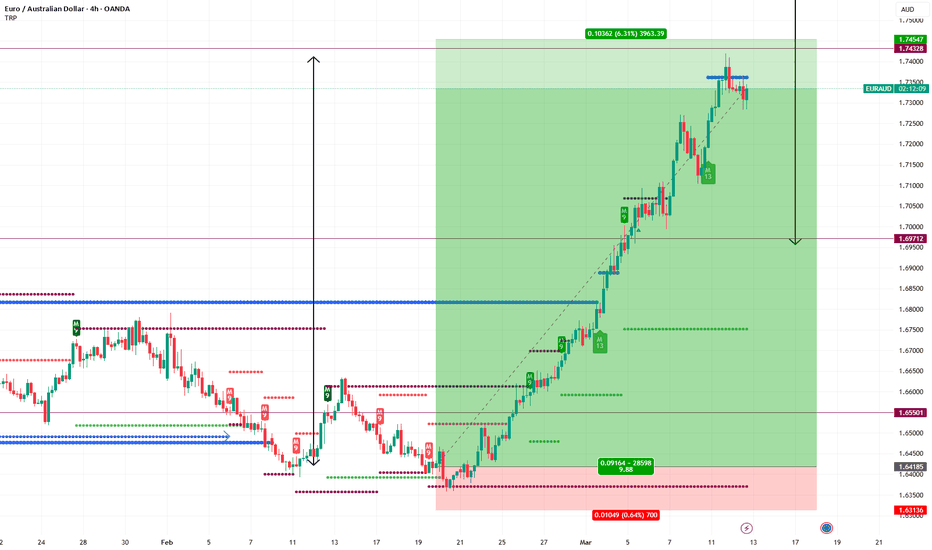

EURAUD Swing Trade Recap: 916 Pips Secured 🚀 📌 Trade Overview: Entry: 1.64185 (Feb 20, 2025) Exit: 1.73345 (Mar 13, 2025) Duration: 21 days Pips Gained: 916 ✅ Stop Loss: 1.63136 📊 Why I Took the Trade: Uptrend Confirmation 📈 – Higher highs & higher lows on the daily chart. Oversold Conditions 🔄 – RSI signaled a potential bounce. Bullish Pattern 🏆 – Symmetrical...

EURNZD Swing Trade Recap 📈 📍 Entry: 1.82182 (Feb 21) 🎯 TP: 1.90454 | 🛑 SL: 1.81372 📊 Pips Gained: 830 ⏳ Held: 1.5 weeks 🔹 Technical Reasons ✅ Uptrend continuation ✅ Oversold bounce ✅ Bearish COT NZD vs. Bullish COT EUR 🔹 Sentiment & Fundamentals 📉 NZD Neutral | 🇪🇺 EUR Moderately Bullish Closed the trade, but the market still looks strong—might’ve left money on...

**AUD/JPY Short Trade Recap – 30-Day Swing Trade** I recently exited a **30-day swing short trade** on AUD/JPY, capturing a well-structured move based on multiple confluences. ### **Technical Reasons for the Trade:** - 📉 **Trend:** Clear **downtrend** alignment. - 🔴 **Oscillators:** **Overbought** conditions signaled exhaustion. - 📊 **Price Action:**...

AUDCHF Short: Trade Closed ✅ | +240 Pips | 8R This trade was built on a strong confluence of factors: 📉 Trend Analysis – Downtrend confirmed a sell bias 📊 Overbought Conditions – A prime reversal setup 🔻 Sell Story – Price action aligned with short positions 📈 COT Data CHF: Bullish positioning from institutional traders AUD: Bearish positioning, reinforcing...

1️⃣ Trend Analysis ✅ Market in an Uptrend 2️⃣ Oscillators 🔹 Stochastic – Oversold, suggesting a potential bounce 3️⃣ Price Action 📌 A strong buy signal has appeared at a key level 4️⃣ Volume Analysis 📊 Demand area identified, signaling buyer interest 5️⃣ Commitment of Traders (COT) Data 📈 Commercials are Extreme Long on AUD 📉 Commercials are Moderately Long on...

Considering a long position on BTC/USD, supported by the following fundamental and technical factors: Fundamental Factors: U.S. Strategic Cryptocurrency Reserve: President Donald Trump announced plans to establish a U.S. strategic cryptocurrency reserve, including Bitcoin, Ethereum, XRP, Solana, and Cardano. This initiative signifies substantial governmental...

AUD/USD Long Trade Idea Considering a long position on AUD/USD, supported by the following fundamental and technical factors: Fundamental Factors: Commodity Prices: Australia's economy is heavily reliant on commodity exports. Recent stability in commodity prices, particularly iron ore and coal, supports the Australian dollar, as sustained demand from key...

Considering a long position on AUDNZD, supported by the following fundamental and technical factors: Fundamental Factors: Monetary Policy Divergence: The Reserve Bank of New Zealand (RBNZ) recently reduced its benchmark interest rate by 50 basis points to 3.75% to stimulate the economy. This aggressive easing contrasts with the Reserve Bank of Australia's (RBA)...

EURNZD Long Position Update On February 20, 2025, I entered a long position on EURNZD at 1.82182. As of March 5, 2025, the pair has reached 1.8788, resulting in a gain of approximately 570 pips. I had previously shared this trade idea, and it's rewarding to see the analysis materialize as anticipated. Note: All trading activities involve inherent risks. Past...

EURAUD Long Position Update On February 23, 2025, I initiated a long position on EUR/AUD at an entry price of 1.64185. As of March 4, 2025, the pair is trading at 1.6919, reflecting a gain of approximately 500 pips. ECB.EUROPA.EU Key Observations: Trend Analysis: Since the entry date, EUR/AUD has exhibited a consistent upward trend, moving from 1.64185 to...

GBPJPY Long – Key Factors Supporting the Trade 📌 Volume: Buy volume is increasing, signaling accumulation and potential upside momentum. 📌 COT Data: Commercials are extremely net short JPY, suggesting institutional positioning for JPY weakness. GBP commercials are net long but fading, indicating mixed sentiment but not outright bearishness. 📌...

I’m currently holding a long position on EUR/NZD, backed by strong fundamentals and technicals: 🔹 Eurozone Strength – Solid GDP growth and a trade surplus support EUR. 🔹 NZD Weakness – Commodity dependence and cautious RBNZ policy weigh on NZD. 💡 Staying in the trade as long as fundamentals align. Let’s see how it plays out! #Forex #EURNZD #TradingUpdate...

Why the Swiss Franc (CHF) is a Strong Buy Amid Geopolitical Tensions Global instability is driving investors toward safe-haven assets, and the Swiss Franc (CHF) stands out as a top choice. Here’s why: 🔹 European Security Concerns – Ongoing Russia-Ukraine tensions are unsettling European markets, increasing demand for CHF. 🔹 Middle East Instability – Conflicts...

Why Stay Long? 📌 UK Strength: GDP growth remains stable, showing resilience in economic activity. Inflation concerns could keep the Bank of England from easing too soon, supporting GBP. Industrial production and business sentiment remain positive. 📌 NZ Weakness: Retail spending has been declining, signaling weaker consumer confidence. Business PMI remains in...