Hi Everyone! Cardano (ADA) may have completed a Test of Support after a Wyckoff Spring event we potentially saw in June, 2023. However, I'm not going to assume this is for a fact the case. Remember, I'm careful not to make flat statements. It's still possible to fall further to around $0.1830. If we do, THAT would be our Wyckoff Spring event in Phase C of...

Hi Everyone! The 20-minutes allowed for video publications ran out during the creation of this video. Which means I will pick up where I left off with a "Part Three" video. I will follow up with screenshots shortly to allow you to see charts covered in this video. Then, I'll work on Part Three video and pick up where I was "cut off" in this video.

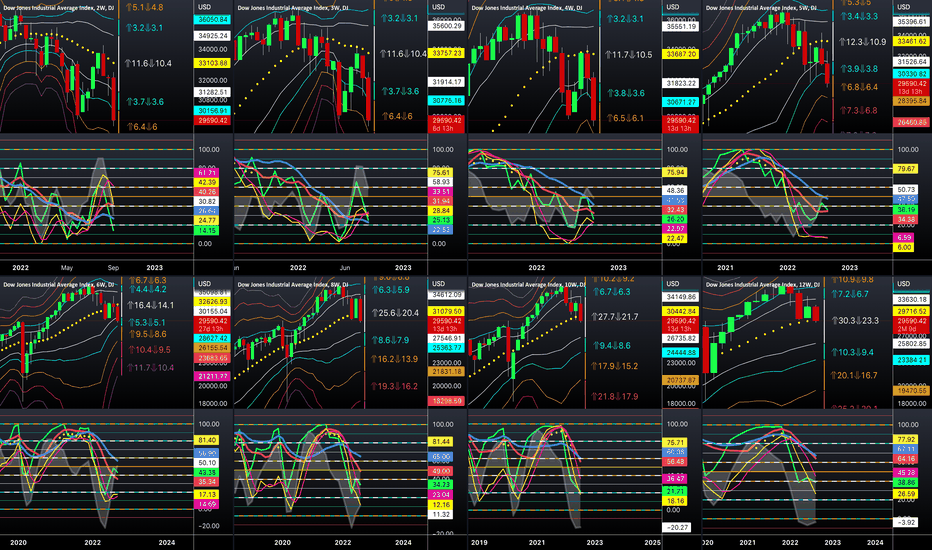

Hi Everyone! If you have not watched my three (3) part series on Distribution and Re-Distribution, you would likely find it very interesting. The Red and Blue Lines within Phoenix Ascending and PARXCES indicators are below Yellow Level 50 in every single time frame (12h, 24h, 2-Day, 3-Day, 4-Day, 5-Day, 6-Day and 1-Week). Depending on the time frame; we see...

Hi Everyone! I picked up where I left off from the Part Two video. This video provides an explanation as to what will determine if we are in Phase E of a Descending Wedge Accumulation Schematic OR if we are in Phase C of a Two Tiered Accumulation Schematic. Here is the 2021 to 2022 chart along with POTENTIAL 2023 Re-Distribution: Why am I saying "POTENTIAL...

Hi Every0ne! I wanted to cover 2018 Distribution and 2019/2020 RE-Distribution before creating another video on 2021/2022 Distribution and "potential" 2023 RE-Distribution. This will be at least a Three (3) Part Series on Distribution and RE-Distribution with this being Part-1 of the Three part series. The purpose of covering 2018 to 2020 is to provide examples...

Hi Everyone! I pointed out in this video how we finally ended up seeing Expansion Down once the Red Line, Blue Line, Green Line and White Energy finally "all" fell below Yellow LEvel 50 in the Weekly time frame. It was the Weekly that was holding us up from seeing a significant move to the down side to my price range mentioned in the previous video...

Hi Everyone! Yes, we have a Wyckoff 2.0 Spring Event in Phase C. However, it's POSSIBLE this "Spring" event may not be over yet. It's possible to continue falling down to around $0.1457 but no guarantee it will continue falling down to that price point. In order to avoid continue falling down further, we need the Red and Blue Lines in the 12-hour to rise...

Hi Everyone! We are about to make our transition from Phase D into Phase E of Distribution with a Sign of Weakness (SOW) Event. This first SOW in Phase E will likely take us down to the 0.236 FIB Retrace at 3,021. So, in my opinion, we open a short and leave it open for quite a while right here. Happy Trading and Stay Awesome! David

Hi Everyone! Thought I should point out the increased odds for price action to continue going down over the next two weeks. We also have high odds of price action continuing down even lower the next 8-Week candle after this current 8-Week candle. We have 2 weeks remaining in the current 8-Week candle. Target range of 27,525 to 45,350 is taken from the White and...

Hi Everyone! After further investigation in historical price data with my indicators, I've determined I should change the requirement for the level of the Red Line in my proprietary indicator from greater than level 20 to greater than level 10 for the 4-Day, 5-Day, 6-Day and 1-Week. I'm leaving the requirement at greater than 20 for a long position in the 3-Day...

Hi Everyone! This is a potential Simple Rally event in Phase B of a Wyckoff Method 2.0 Accumulation Schematic we could be working on for ALGO. Near Term Group of time frames with focus on PARXCES indicator: Short Term Group of time frames with focus on PARXCES indicator:

Hi Everyone! The entire Near Term Group of time frames suggest we are still in a period of downward pressure; except for the 24-hour time frame. Yes, we see upward pressure currently in the 24-hour. However, do not assume this upward pressure can continue for any kind of sustained period of time at present. Why? Because the Red Line is no where near crossing...

Hi Everyone! Fantom (FTM) appears to have potential for momentum to build up for a long SWING signal. I pointed out in the video we still lack the Red Line in the 6-Day rising above level 20. We also need the Green Line and Yellow Energy in my PARXCES indicator to rise above Level 50. However, judging by what we see in the 5-Day time frame and lower; we have...

Hi Everyone! We do not know yet if we are in Phase E of a Descending Wedge Accumulation Schematic or if we are in the begin of Phase C in a 2-Tiered Accumulation Schematic.. We need to see how much of a pullback we experience; if any pullback; before we can draw a conclusion as to WHERE we are on the MACRO. Keep in mind, the 3-Day, 4-Day, 5-Day, 6-Day and...

Hi Everyone! I wanted to provide analysis for Alt-Coins before getting into Bitcoin. Why? Because I believe the indicators for alt-coins help provide a better understanding of WHERE we are on the MACRO. I'm of the opinion we are in Phase C of Macro Accumulation. Have we seen the bottom yet in Macro Accumulation? Well, the indicators in the 2-Week, 3-Week,...

Hi Everyone! The indicators in multiple groups of time frames suggest we may be on the verge of a transition from Phase C of Re-Distribution into Phase D of Re-Distribution with a "Sign of Weakness" event. This "Sign of Weakness" may take us down to a price range between $22,550 to $21,550; within the Orange Shaded area on my Wyckoff 2.0 Schematic chart. As you...

Hi Everyone! This is simply an update on current price action with a little more in depth on Exponential Rallies in Accumulation includes period of Re-Distribution and 2-Tiered Schematics

Hi Everyone! I hope everyone has been doing okay. I wanted to provide an update. In part 1 of this update, I wanted to focus on where we could potentially "over-extend" down to during this period of RE-Distribution. HOWEVER, It is important to point out we may not necessarily "over-extend" down to the price ranges mentioned in this publication. Instead, we...