The Dow Jones Industrial Average is currently approaching a critical juncture, as it risks breaking below and staying under the neckline of a potential double top pattern. A double top formation is typically a bearish signal, indicating a potential trend reversal after the price tests a key resistance level twice, failing to break higher. The neckline, which forms...

The expansion of the M2 money supply generally leads to increased liquidity in the market. As more money circulates, it must find a home, and some of it inevitably flows into speculative assets like Bitcoin. In previous cycles, when the money supply increased, Bitcoin tended to benefit from the added liquidity, which often drove up its price—especially during...

4-hour timeframe Gold is currently in a strong uptrend, consistently reaching new all-time highs. There are potential opportunities to enter long positions on Gold during this 4-hour pullback, with the $2950 level being a key area to watch for potential longs. This level has several confluences supporting it: 1. Support zone 2. Trendline 3. Fibonacci Golden...

Apple has officially started its daily downtrend. The $200 support zone is a level that has been respected often in the past, with a high confluence of the Golden Pocket. It is highly possible that Apple could revisit this level and make a strong bounce. Until then, there is a high probability that this level could be revisited until the downtrend is...

Today, the FED will decide on the interest rate in the USA. It is almost certain (99% probability) that the rate will remain unchanged. The most important aspect to focus on in this meeting’s minutes is the FED Balance Sheet. Will they stop tightening the balance sheet this month, or will they wait until mid-year as stated in January? Leading up to the FOMC...

What is the DXY? The DXY (U.S. Dollar Index) measures the strength of the U.S. dollar relative to a basket of six major currencies. A rising DXY indicates a strengthening of the U.S. dollar. This can have significant effects on cryptocurrencies, particularly in the short- and medium-term. Here are some of the key impacts: What does an increase in the DXY mean...

What is a rising wedge? A rising wedge pattern is a bearish chart formation that signals either a potential trend reversal or the continuation of a downtrend. It occurs when the price consolidates within two upward-sloping, converging trendlines, indicating weakening momentum. Key Characteristics of a Rising Wedge: 1. Higher Highs and Higher Lows – The price...

BTC Price Action Analysis Ahead of the Fed Decision In this analysis, we will discuss the current price action of BTC leading up to the Federal Reserve's rate decision later today. The Federal Open Market Committee (FOMC) is set to release its rate decision and Dot Plot. Following this, Jerome Powell will hold a press conference. Analysts expect the Federal...

In this analysis, we discuss BTC on the weekly timeframe in correlation with the RSI and the Stochastic RSI. Is BTC able to bounce from these levels, or are we heading to lower levels before the next bounce? I will explore this in the following analysis. After a long consolidation in 2024, BTC reached a new all-time high (ATH) at the end of 2024/beginning of...

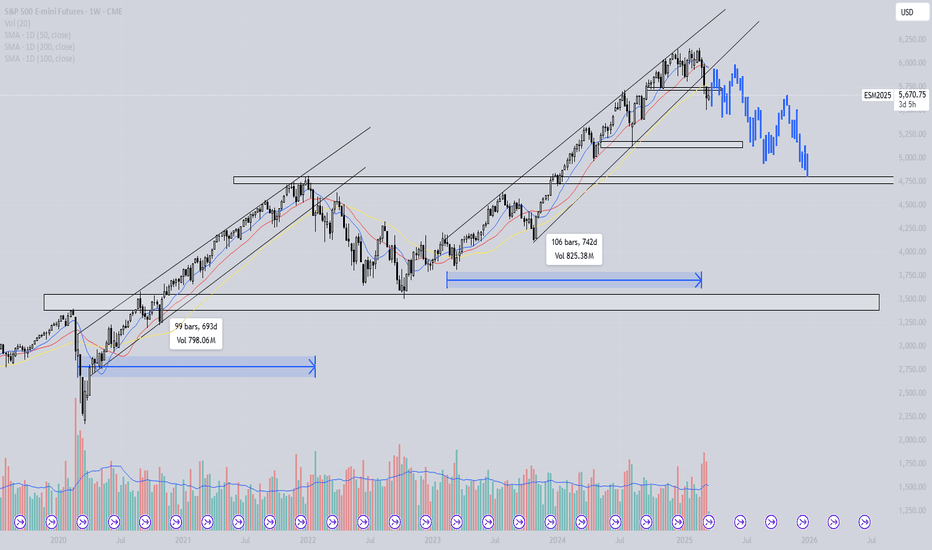

The S&P has been trading in a rising pattern for over 700 days, similar to the rising pattern observed in 2020 and 2021. In that instance, the price of the S&P broke below the support trendline and lost all SMA support, while also making a lower low. This has not occurred since the start of the current pattern. Could a deeper correction follow? Blue line = 50-day...

In this analysis, we are discussing the possible repetition of the last two cycles by the total 2 (Crypto Total Market Cap Excluding BTC) on the monthly timeframe. By comparing this cycle in conjunction with the RSI and the Stochastic RSI with the previous two cycles we could make a statement that the market might follow the same bearish signals. What did we see...