aibek

It could be a-b-c double zigzag in large wave A. We got a and b in place and wave c already kicked off. It's amazing that the trendline support wasn't broken yet.

This is a hot trading opportunity as price could retest the all time high. +45% from the current level

Gold got stuck in an extended consolidation of wave 4, which shapes double three WXY. The completion of the last wave Y down is expected at the low of wave W around $1658. Then the last wave 5 , that was widely expected long ago could kick off finally. The target area is highlighted with a blue box between 1805 and 1921.

Earlier I posted an updated map where I was expecting a simple ABC correction down to hit 31-32 (see related) It emerged as double three WXY instead and the wave (X) ran deeper to retest the start of wave (W) making it classic flat correction. It looks finished as wave C of (Y) unfolded as an Ending Diagonal. It was broken up now and the calculated target is...

We got the first strong move down after a huge impulse up that more than doubled crude oil price and hit the target set at 36.90. The wave C up in a correction could be over soon and crude oil then could drop into the blue box area of 31-32.

The structure became complicated and we see how strong oil affects this pair. It is possible that the upward cycle has been over already when it reached my first target. See related Now it will build corrective structure downwards.

The pullback could emerge as a double three WXY as wave W already nears completion. Another drop then could follow in large wave C down.

The crude oil completed minor correction in wave 4 of (5). The last wave 5 of (5) is pending now. It could hit the area between 36.90 and 38.80.

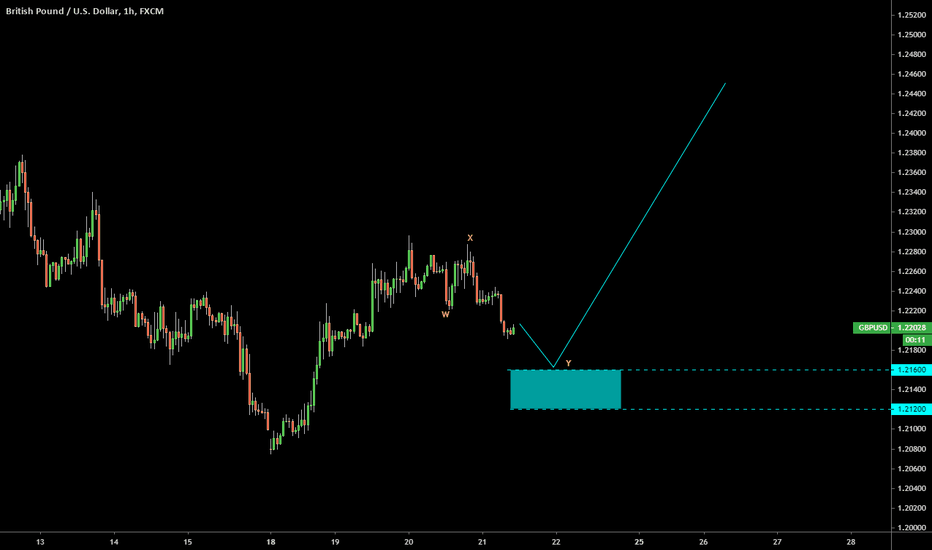

GBPUSD broke out higher and now it has been retraced naturally. Watch blue box area bounce.

The dollar index could be in the ending diagonal wave (C). Then the drop is expected

This structure looks better. The wave 4 finally I revealed the key for it as it unfolded with wave C as an ending diagonal.

The wave (X) took so long to unfold but at the end the structure is quite simple double three. Another drop should follow to complete the WXY correction.

The wave 4 that I was looking to unfold before could be over long ago as simple flat. The further seesaw structure that already distracted so many traders from the crude could be an ending diagonal wave 5 of (5) of ((C)). After it gets finished we could see a drop in 3 waves retracement.

It looks like the index is going to retest the former top as we got here the consolidation and not an impulse down as was expected before as retracement prolonged. Option 1 (blue) - we can see simple ABC 3-3-5 and A-B parts are done. Option 2 (yellow) - we can drop one more time in double (WXY) or even triple three (WXYXZ, not shown). The distance of the first...

The correction looks as done so we gonna retest the former valley as a minimum target at 2185.

Wave 4 emerged as triangle ABCDE. The price broke above the BD trendline / upside of the triangle. Target is between 1860 (Fib based) and 1880 (simple upside of trend channel).

Current consolidation shaped a beautiful triangular structure as all rules of EW triangle are complied. Watch breakout of triangle as CL1! futures could reach 30-34 area in blue box as target.

This is an updated map as we saw silver dropped into the abyss below the range. Overall structure remained unchanged as it is still a flat correction although the right valley was established low than the left one. The market is consolidationg within wave B of (Y) and it can dip between 14.23 and 13.24 into the blue box of Fibonacci retracement area. After...