aibek

The structure of the current pullback shows that market is just correcting after recent breakout Watch breakup of 9590

Sometimes vision comes unexpectedly as we often are overwhelmed with the media buzz. This is one of possible options for Bitcoin price to unfold. As you see the final stage could destroy the price to the very low levels. Although there is another spike to retest the former top of 13880 in between.

We are in the first part of the second leg down. Y=W around 15.60

The corrective structure gets more complex. Another leg down could push the bitcoin to the $6000 mark in wave Z.

There is a reversal H'N'S pattern is in the making. Watch breakdown of the Neckline. Target is set at the distance of the height subtracted form the Neckline. Invalidation is above the Head of 7.1959

The corrective structure is in a progress.

I combined both H&S pattern with EW analysis. On EW side we see the 1st impulse down and now we are in a pullback ABC. The C wave is pending. It is probably the initial move down in gold within a huge drop down at least we could see 1200 again and it depends on what structure would unfold then. Pattern is simple and we should watch the breakdown of the...

Silver could have completed the simple abc zigzag correction to accumulate another bullish momentum. Watch breakout both of the trend line resistance and 50 on RSI.

The trendline was broken and retested at the 61.8% Fibonacci retracement level. Watch breakdown of current corrective structure. It could drop in between 16 and 17.

We are in the linking flat correction of wave b within wave Y. The wave c should unfold down to the 8000-7200 level.

Same thing in AMZN as in FB although it already broke down immediate support. Second leg down. Watch long term support and former bottom as targets.

We are in the second leg of a large flat correction. Price could bounce off the long term support but ideally it should tag the former bottom.

Copper is going to complete the deep correction within WXY structure. We are in wave c of Y to hit 2.23 area, where Y=W and correction reaches 78.6% Fibonacci retracement level. Stop 2.71 Entry market Target 2.25

Pound broke below trendline. It completed large corrective structure. Could tag the former low below 1.20. Entry order sell 1.2438 Target 1.2000 Stop 1.2513

There is a nice flag shaped and it was broken down and retested. Watch breakdown of 2992 for further drop. Stop 3003 TP 2962

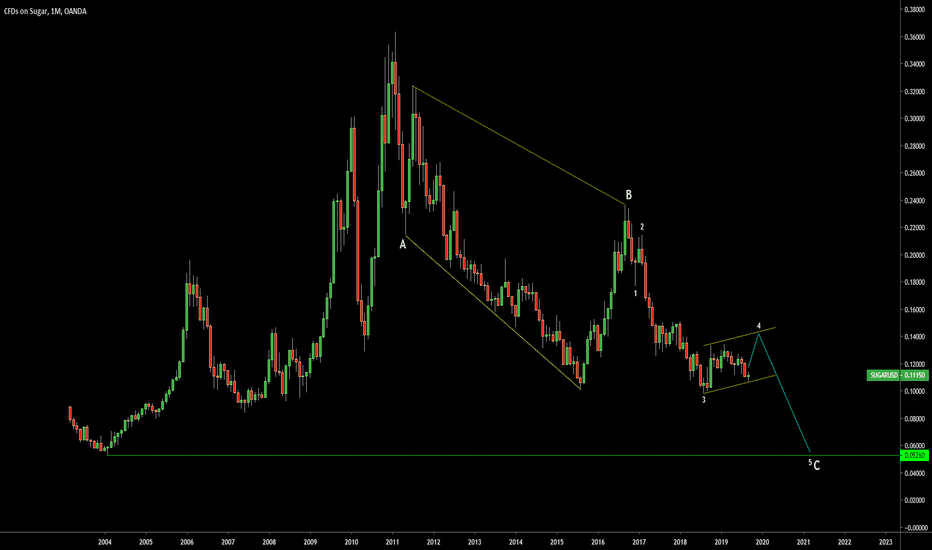

Beautiful structure as sugar price gonna complete the large correction to tag the multi-decade low of 0.0526 Wave C is 5 waves and it is in the second leg of wave 4 up before the last drop.

Gold could hit between 1587 and 1619 to complete the wave 5 there and the whole upside move. Watch if the downside support holds.

It could be one more up to complete 5 of C of (B) and then down to finish the whole large corrective structure. The drop could be limited by double support.