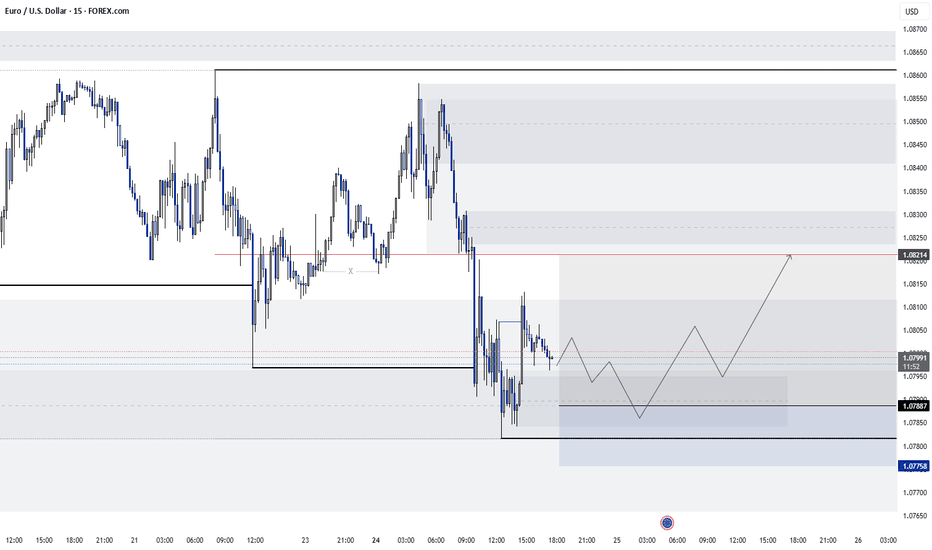

It is true that the order flow is bullish on the daily timeframe, but on this timeframe, the price has reached an order block. Considering the price reaching a P/D array on the 4-hour timeframe, I expect the price to move towards clearing the liquidity of the internal range on the 15-minute timeframe after clearing the liquidity of the external range.

The weekly order flow is bearish and the daily is bullish. But let's take a closer look at the EUR from the monthly timeframe: On the monthly timeframe, the price has hit the middle of the swing structure and has also filled the FVG. Regardless of the seasonal tendencies that slightly favor the monthly bullish candle, on the weekly timeframe, the price has hit...

Today I am here with another analysis. Thank God, so far, about 85% of the analyses I have presented on the Trading View platform have reached their goal, and I expect that with your support and introducing this page to your friends, I will be able to focus on newer analyses with more energy. So let's move on to Bitcoin analysis. Before this analysis, I had...

Given that the order flow is bullish on the daily and 15-minute time frames, we expect a temporary correction to begin. Of course, it should be noted that Trump’s recent speech has caused erratic price movement, but my view is that the price hit the daily order block during this speech and collected liquidity above the 4-hour order block. Therefore, we will soon...

Given the LV filling up and the FVG remaining on the high timeframe, as well as the SMT between NQ and SPX, we can expect the price to make a short move upwards to clear the liquidity.

Considering the price reaching the four-hour order block and reaching the low of the 15-minute structure and seeing signs of a pullback, the price could probably reach the 1.08214 range on an intraday basis.

Given the CH the 4-hour timeframe, we expect further correction. Given the signs on the 15-minute timeframe, it seems that today we are witnessing a 4-hour pullback. The price, moving up, can clear the liquidity before the order block at 1.08596 and bring itself to the order block. If we see a CH on the 15-minute timeframe in this order block, we can open sell...

Given the bearish order flow on the lower timeframe and the bullish order flow on the upper timeframe, we expect the price to make a small correction to the middle or bottom of the 15-minute timeframe structure before continuing the upward movement on the upper timeframe. You can consider this brief and useful analysis in your trading today. Be profitable

Considering the DXY and the formation of a correction on the 15-minute timeframe, this correction could probably be deeper. In my opinion, today's price could move down again after clearing the Asian High liquidity and reaching the order block in the range of 1.09046 to 1.09144. If the price breaks 1.08358 even with a shadow, this correction will probably be...

Given the flow of bearish orders on the daily and lower timeframes, the SPX is still in a bearish trend. Of course, if the weekly candle closes below 5771.3, the structure on this timeframe will also become bearish. So in this situation, opening short positions is better than long positions. Note that any upward movement can only be a small daily correction. We...

Given the resistance zone on the upper timeframes (weekly and daily) and the signs of a correction on the lower timeframes, we will soon have a deep correction to reach the discount areas on the upper timeframes. Of course, the analysis needs to be updated in the future and for now we will focus on the short-term price movement.

It is true that the order flow on the daily and smaller time frames is bearish, but on the weekly time frame we are in an upward order flow. Recently the price has reached a support area on the weekly time frame, which could lead to a price reversal to the upside in the short term. Everything is indicated on the chart What do you think?

Given the bullish order flow on both the upper and lower time frames (except weekly), I expect a correction and then a move to the upside. It is possible that the correction will be deeper and this will depend on the economic data (CPI) released today. Be cautious today. Your view on the GBP is bullish unless the price breaks below 1.28615 even with a shadow. Then...

Given the flow of bearish orders on the higher timeframes (weekly and daily, four-hour), I think the price could move towards 1.44999 after a minor correction and liquidity clearing. This move is just a pullback on the higher timeframes, and with this move, the price is trying to reach the fifty percent level of the structure on the higher timeframe.

It is true that the order flow is bullish on the higher time frames, but this analysis is a short-term one. The price could drop to $2863 in the first step. There the analysis needs to be updated again.

Given the bullish order flow on the lower timeframe and the decreasing strength of bullish candles on the upper timeframe, we are likely to see another attempt to form the last swing of the three-drive pattern on the 4-hour timeframe. The price is expected to move higher after the correction on the 15-minute timeframe to more penetrate the daily order block.

Given the bearish order flow on the daily and weekly time frames, CHoCH on the 1H time frame, I think the AUD could move to a strong bottom of the structure after a short and minor upward move. The upward move is just a minor pullback on the 1H time frame.

After the recent successful analysis, which you can see the link to on the right side of this page, I am here with another new analysis. Let me be honest. Bitcoin needs to break $99,500 to continue its upward movement. Otherwise, we expect Bitcoin to soon reach its last station, the $60,000-$65,000 range. This range is, in my personal opinion, the best range for...