USD/JPY is technically oversold, current price has shown breaking below lower line key level support and will retest bottom support fibo level We are looking at fresh bottom would hit towards 2.618 fibo support for a retracement, strong bearish is confirm

Broad US dollar demands bring most major pairs lower as from our technical point of view, downtrend channel price heading lower towards for a fresh new key level support. Although trend looking towards the south trading on a range, expecting price to break below median line and the next key level support would be at lower line

GBP/USD drops below 1.2900, risk-off sentiment worsens and boosts the haven demand for the US dollar. UK’s health authorities mull lockdown restrictions. Chancellor Sunak may extend business support loans. Technically, price made a reversal on the key resistance level upper line towards median key support level. Break below median could bring price towards lower...

Technically, price made several attempts to break above the resistance key level but failed and we are looking at a downtrend channel. This week we are looking at high probabilities trend to move lower on US dollar demand and spike in coronavirus cases on europe Targeting a price break below key level support median line could bring price to move further lower...

Technically, pointing pitchfork towards downtrend after several failed attempt to break above upper line resistance key level Price will test to break below $1932 key level support towards median line, a break below median could bring price lower to next level support at lower line However price is looking trading towards south but an increase of demand in US...

Technically, US Dollar seems to have increase demand on earlier trading this week after re bounce/reversal made on lower line key level support Although the trend on consolidation a sideway trading looking for a fresh direction to breakout, price current pointing towards uptrend channel and we expecting to hit the previous high for a breakout above-median key...

S&P 500 extends its corrective setback and we see a bounce on key level support at 3.82 fibo major cycle targeting price to move back towards uptrend channel Technically on our weekly mapping, price hold steady above major key level support and expecting this week price correction before a change of trend towards bulls

Bulls strike back, price steady moving above $10k with price confirm its move towards inside channel nearing median key resistance level Targeting next level a break above median resistance could bring price heads towards $11k upper line key resistance level

Price is on consolidation trend and looking to drop further to retest key level support fibo 3.82 with our weekly mapping price is trading below median resistance indicates strong bearish in control Current global sentiment with Iran, coronavirus on Europe is rising and this week OPEC meeting could drive black gold to drop further lower as sellers in control

Price is currently above the channel and consolidating, we are looking at out of the box setup and high probabilities bullish trend amid of current situation with US OIL WTI dropping further lower Technically, market structure is bullish formation and we are targeting price to move towards fibo resistance 2.618 for another retest at this area

USD/JPY remains on the defensive amid a weaker tone surrounding the greenback near 106.00 mark Doubts about the US fiscal stimulus measures kept the USD bulls on the defensive. The risk-on mood undermined the safe-haven JPY and helped limit the downside. Technically, price is currently hovering below median resistance key level looking to further drop towards...

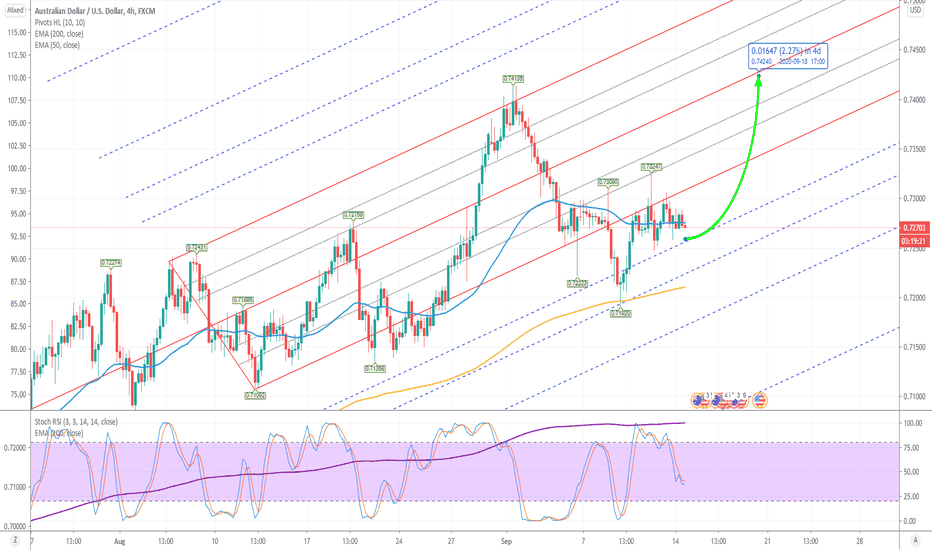

Price stuck in a range below 0.73000 and looking retesting below key level resistance, a break above could bring this pair towards median line resistance back to previous high 0.74000 Clearly AUD/USD pair lacked any firm directional bias and remained confined in a narrow trading band, Price would drop further lower with current trend which showing trade out of...

Technically view, price is entering into channel trading above 1.28 after consolidation dan made reversal on key level fibo support 1.618 Daily mapping view price hit towards major key level support and we are expecting price to re bounce this week, rising amid market optimism and ahead of a critical debate in parliament. MPs will discuss a controversial deal...

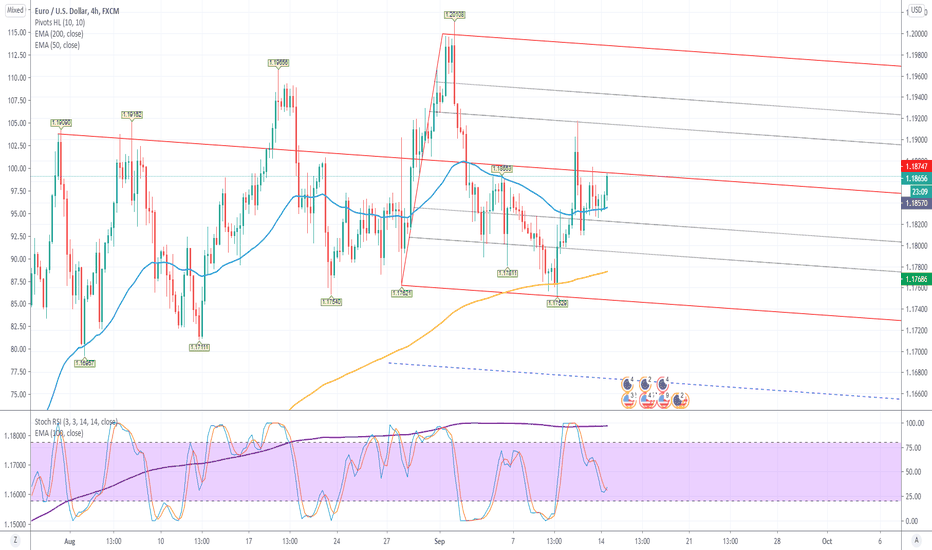

Price made reversal and several attempt on strong key level support lower line and currently steady around median line trading at around 1.1850, holding up its gains. This week markets are optimistic about a coronavirus vaccine and shrugging off rising European cases. Investors await EZ figures and the FOMC Fed rate decision. We are targeting price to hit...

Trend is clearly on a range, looking for direction & downside seems limited after reversal last week hit lower line key level support Bull trend fight back and move towards median line, price steady around $1950 and technically we are expecting trend to complete it cycle towards upper line key resistance level this week

Technically, Friday's candle close below resistance key level & pricing is still pointing towards downtrend channel (Weekly mapping) see link related to ideas We are still looking at choppy trading which is still trade below 94.00, price also made reversal on 2.618 fibo resistance key level on a downtrend channel Trend is strong bearish and current consolidation...

Price is holding strong bounce back towards inside channel lower line key level support and technically we are looking at uptrend channel Targeting price to climb back and moving towards median line resistance level

Price to drop further lower as price breaking below the key level support lower line. Confirmation of trading out of the box and targeting to retest key level support below $9,000 towards $8,500