Price stay near six month's high defy last Friday losses, futures pick-up above 3,370 during Tokyo session. Risk barometers recently gained from the news that the US Congress will reconvene later this week. Even so, the coronavirus (COVID-19) woes and the US-China tussle keeps the risk-on mood pressured. Technically we are still looking at bullish uptrend channel...

Bitcoin and other major cryptocurrencies are extending range trading over the weekend and price still hold steady above $11,000 Technically our main focus is price to hold above $11,000 towards $12,000 on uptrend channel, targeting price to break key level resistance on median line to go further on next resistance on upper line

Prices on WTI keep trading without clear direction but the target on upside remains at $44.00 mark per barrel Price steady holding above $40 per barrel and we are looking technically towards uptrend channel towards a retest on median resistance key level on this week

USDCAD drop to seven month lowest since January 30 with six week down channel and the decline of the US Dollar against all majors Technically it will try for another break towards 1.3190 key level support and our pitchfork is pointing downtrend channel and we are targeting price go further lower Break below key support level will bring another leg towards...

US Dollar fell against all other majors on last Friday after rise in USDJPY from 105.xx to 107.xx then fall back towards inside pitchfork channel Technically, price is currenty hovering inside channel and targeting towards support key level on median/lower line We expecting short-term range trading in place between pitchfork channel with US Dollar weakness and...

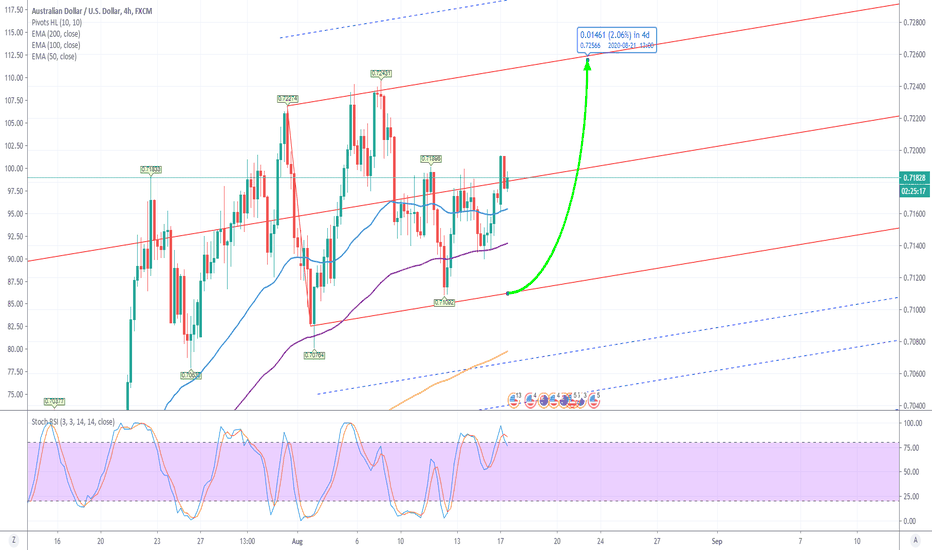

AUD/USD extends Friday's gains hitting 0.72431 last week highest since February 2019 still holding bullish bias. Looking at technical level price steady inside pitchfork channel and strong short-term range trading in place After price made reversal at support key level last week closing around median line last friday, opening this week targeting price to look...

GBPUSD steady above 1.3000 with current US dollar weakness favors the bulls Cable stay beyond short-term range trading inside pitchfork channel and we are still looking price towards moving uptrend heading to retest on median/resistance upper line

EURUSD holds on to its long-term bullish bias and for a second consecutive week, the pair is still closing with modest gains above 1.1800 level on greenback weakness supported On technical view price steady inside pitchfork channel with opening weeks breaking above median looking towards upper line key resistance level We are targeting price to hit upper line...

Gold remains on the back foot for the second consecutive day while ignoring the mixed catalysts. Price made strong reversal near $1,900 then seesaw around $1,950. We are looking at short-term range trading between inside pitchfork channel a break above $1,970 towards key resistance level at $2,030

US Dollar remain weak after bullish attempt last week hitting 93.91 and made reversal on upper line and return towards median line Current price is moving towards lower line after breaking below median support and we are still looking at downside remain strong Expecting ended this week towards lower line key level support

S&P 500 extend the latest bounce to 3,336 from 3,223 since last week opening with most of all major stock markets just keep on rallying. Technical looking at price moving strong towards uptrend channel and targeting towards key level resistance upper line.

Bitcoin is currently heading above $12k again amid broad-based crypto recovery. Price is also heading further towards upside on uptrend channel to move higher if it breaking above median line. Targeting key level resistance on upper line at around $13k

Last week, US oil jumped over 1% to regain $41.50 after Saudi Aramco’s CEO said that oil demand recovery is picking up amid easing lockdowns worldwide. We are looking to the upside as price is hovering on uptrend channel and targeting price to retest again resistance key level on 43.50 towards 44.50 upper line

USD/CAD extends its side trend consolidating Friday’s around 1.3400 resistance key level on upper line. Bulls struggle to extend the upside above the 1.3400, as the Canadian dollar continues par with the rally in WTI prices. However we are looking at price to run on downtrend channel if price fail to break above upper line and targeting key level support at 1.33...

Price to retest again key level resistance at 106. upper line and might pierce towards 1.618/2% fibo resistance and falls back towards downtrend channel as we see US Dollar likely to remain weak until the US economy resumes stronger recovery. Key level support is around 105. lower line if price to move below and running towards downtrend channel.

We are looking are price at sideline trading between key level resistance 0.72400 and support at 0.71000 as price is hovering inside the channel with the current market sentiment struggles for a clear direction. High probability trend is still on consolidation this week and might further trading on a tight range.

Price is still inside channel and had made reversal twice on upper line key level resistance and last week breaking lower below median. Currently we are looking at price to retest the support key level at lower line and if break below it might bring towards to retest fibo 1.618/2% support key level before moving back towards uptrend channel. Trend is clearly...

Looking at current trend is going on range trading between key level 1.19 to 1.17 after price made reversal an attempt which is unable to break the current high and now we are looking at price to retest key level support This week we might still see sideline trading after few weeks of upside rally