arama-nuggetrouble

Options are cheap for this. Showed up on my straddle index. Im guessing this is getting ready to explode and fill those upper gaps. Trade 1/3 Targets and Stop are listed.

Inflation rate timeline because TradingViews does not have this data. Feel free to verify on your end and let me know what you think. ------ Inflation Rate: 1972, 3.27% increases to 1981, 13.55% Inflation Rate: 1986, 1.90% increases to 1990, 5.40% Inflation Rate Peaks in 2008 at 3.84% M1 and M2V both rise in 2009 - 2011, Inflation Rate increases from -0.36% to...

I am conducting an experiment here. How accurate are these sine waves? Sinusoidal waves are pervasive throughout nature, one may even argue that energy travels in these waves. From musical notes, planetary orbit/rotation, etc... It may just be a mathematical construct that helps us explain phenomenons in nature. But, I believe it can help guide us in trading. I...

I use Sine waves kind of like a mean reversion indicator, it is not great at telling the exact time a move will happen or price levels but, it tells you if a big move is in the horizon. I am expecting this to shoot up at least some time before April. This chart honestly looks like it can explode at any time. UVXY refuses to close below the $10 level (my average...

I hear the saying "Money printer go brrrrrr" often but, I think people have the wrong idea. When the Bank "prints" money it can only buy assets/securities or in other words "provides liquidity for existing debt". They are not creating new debt. Do you see the difference? One leads to deflation the latter leads to inflation. THE ONLY WAY THAT MONEY CAN BE USED...

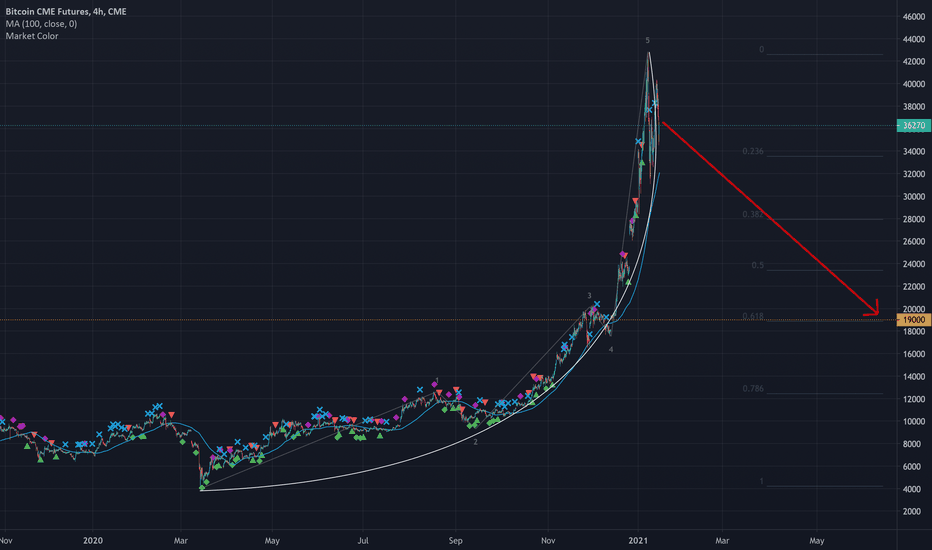

The dollar is rallying, BTC has some horrible gap downs. We saw the upside volatility now let us see the downside equivalent. BTC hoddlers will be wetting their pants soon. Will the btc whales sell and take their profits. I am envisioning a lot of gaps down. Parabolic arcs like this come crashing down!!!

If Gold can predict the movement in interest rates then, interest rates can predict the state of the stock market. Gold represents a hedge against inflation. Inflation is characterized by high interest rates because of currency devaluations. When Gold is sold it represents incoming deflation. Tighter financial conditions lead to a decrease in interest...

The dollar starting to rally should be very concerning for speculators in risk assets. The bond market has been heavily shorted and a short squeeze might be in order here. Look at how they bought a the rips and sold the dips since April. Back in January of last year we saw this same price action. The CTA are gonna start buying if we see the bottom hold that would...

DXY has the look like it's rallying, TLT has the look like it is rallying. VIX looks like it is gonna rally. GOLD is faltering. Stocks have reached a major resistance. I no longer feel comfortable in the market and prefer to have 90% cash instead. The other 10% is evenly distributed in DXY, TLT, UVXY. I will add more to these holdings if DXY shows that this is...

A very pivotful moment in the future of the world economy will be represented by TLT's move over the next weeks. The RED FALLING WEDGE shows a short term bearish path. This will be indicative of a major bubble as all stocks move higher. A market crash will occur after, TLT will gain in price after the red falling wedge completes. The GREEN UP TREND LINE IF...

SNOW looks like it is trending up!!!! When SNOW goes up, it usually happens pretty quickly and violently. There is an apparent 1-2, 1-2 nest. My stop is at 294 so, this is a very low-risk trade setup. We should see 320 pretty quick. SMAs are turning, all signs point to bullishness. The upper gaps are exciting

The reason I am still not sold on GOLD and Metals is because of.... the dollar. In my last idea, I explained why the dollar would be seeing a small run to the upside. To about $94. Gold is dollar-denominated so, you really need to focus on what the dollar is doing. A rising dollar is not gonna push Gold prices it will weaken them. The 1500-1600 area is the buy...

The DXY is pulling back today and is the reason GOLD/SILVER/S&P/Commodities caught a bid today. I believe it was just a correction before DXY moves higher. I'm expecting DXY to stay above 90 and hit 94 in the next 1 - 2 months. After the dollar completes this move up, I will move into Metals and Commodities very heavily.

Looks like it is nested 1-2 1-2. We should see a pretty powerful wave up to new highs so, there will be no upper resistance.

Options are relatively cheap for Amazon plus it looks like it is finishing up a triangle correction. I think amazon will finally join the rest of his QQQ friends and move up before the impending market correction... This type of consolidation pattern is pervasive in wave four corrections

The 22 - 24 level is the dip to buy. Or you can wait for price to break 27 for a less riskier entry. The EV market has some okay companies that are receiving a lot of hype: fsr, ride, wkhs, nkla, li This is a play based on the current market landscape, I believe these stocks are not proven yet and are not profitable.

FSR and RIDE are two EV positions I am in for a swing trade. They are both in consolidation.

I will be a big buyer of silver if it falls further to $21. Its called value investing.....