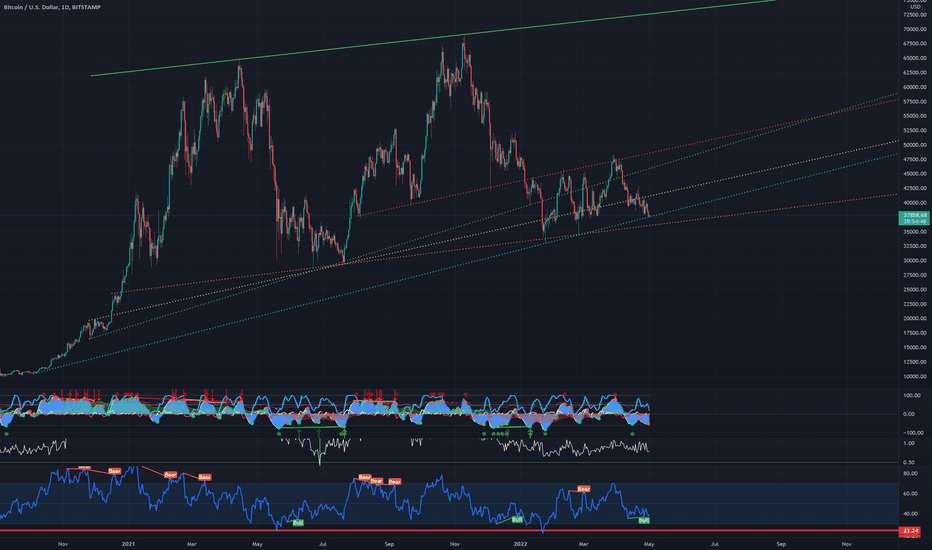

BTC hit the 4 on the fib retrace from high to low (of the 2017 cycle) to hit 69k. If BTC does the same thing for this cycle then the next ATH will be 230k. Time will tell.

This is another one of my total degen plays during this cycle. Zeroswap is testing a major trendline. Looking for a breakout soon. Seems to be a crosschain dex that is in active development and they have an active Twitter presence. Around 9500% from ATH so it has a lot of room to the upside.

ATOM has had a pretty stella day today along with the rest of the tokens in the Cosmos ecosystem. Once it breaks this resistance line I see a pump to the next fib 618 golden pocket and maybe a retest of the trend line as support. Then the next 1618 fib would be my next target. It's getting on airdrop season and ATOM is one of the coins that has provided an easy...

Scanning the charts I have found a potential breakout of SHILL on a 423 trend line. Seems to be a gaming token which is still active on their socials and have announced a new roadmap in the last month. They have been around for a few years with a very low marketcap. Buying a small bag for a potential large breakout under the current hot gaming narrative.

Sentinel are a decentralized VPN provider that have been around for years. Their usage has skyrocketed recently but there price is still stuck in the bear market range. The founder of Akash (AKT) recently tweeted about Sentinel's usage increase. When it comes to crypto its always good to follow the hype. AKT has recently seen a large pump due to its own AI, GPU...

Akash is doing a retest of the handle section of it's massive cup and handle pattern on the weekly. It's also coming out of the weekly oversold area on the STOCK RSI indicator. Akash also aligns with the AI narrative, it being a supplier of cloud based GPU services which will be in huge demand in machine learning and other AI based applications. All the signs...

Scanning the charts today and MCRT stood out from the rest. STOCH RSI is showing oversold in both the daily and the 4H Bounce off the 200EMA on the 4hr and 50EMA on the daily. Still hasn't broken out of the diagonal resistance line like so many other coins have so far. Looked at their website and seems to be a playable, multiplayer video game on both desktop and...

OVR looks to be breaking out of a falling wedge pattern. It's oversold on the STOCH RSI daily Coming out of a BBWP low volatility range on the 1hr

Cro is looking bullish with the following confluences: Bullish symmetrical triangle pattern playing out Oversold on the daily STOCH RSI and heading towards oversold on the 4H Bounce off the 382 fib retrace Bounce off 50EMA on the 4H

MKR hits a line off of support, oversold on the daily STOCH RSI and a nice bounce off of the 12 hr 200ema.

The BTC Puell Multiple has pretty much nailed the bottom of BTC for every previous market cycle. It's come up on the weekly but I'm going to wait for the monthly signal to show before going all in.

The ABC corrective wave has been completed when FTT hit the 1 target on the fib extension retracement. This doesn't mean it can't go down even further but this could be a big reversal point.

Looks like the next step is wave 5. Hopefully the market holds and BTC stays above 20k.

Looks like bitcoin has bounced off the last line of support. The trend based fib also shows that BTC has completed an ABC correction wave which hopefully means it won't go lower than C. .

Until it breaks below these support lines, BTC still looks bullish to me.

With the new ATH replacing the previous B wave target, this gave us a higher C wave target of around 49k. I was surprised it would be hit in such a quick, foul swoop as it did today. Since it was such a quick wick to C, I wouldn't be surprised if C got revisited. On my journey to learn the basics of Elliot waves, it seems they always eventually play out. It just...

If this ABC correction wave plays out, it looks like AKRO has bottomed out of its dip.

SNX has been lagging some of the other coins that have already pumped. Looks like it is catching up.