A look back on the KRAKEN:ETHUSD chart in relation to Bitcoin's halving dates can give a lot of perspective. Previously, 43 weeks post Bitcoin's 2nd halving (9 July 2016), Ethereum took quite a big dip (-73%) before resuming its upward momentum following Bitcoins bull run cycle. Now, 41 weeks post Bitcoin's 3rd halving (11 May 2020), Ethereum has taken...

The pound/swissy may be looking for another swing to the upside continuing in the higher time frame bullish bias. Price is looking to make support in a recent support zone liquidating out sell-side bears creating a Lower High followed by a bull rush to the upside. Take profit set at 1.2800 institutional figure. Due to low volume risk is at a low 1%. + Higher...

The Aussie looks like it will want to reach into 0.6885 price region. Beware of the strong fundamentals coming in from both Aussie and Dollar in the next few days, keep risk low. + Price expected to continue the short term trend and reverse at 0.6885 resistance level and follow the prevailing trend + Price adjustment with short term pullback gearing up for swing...

The Chunnel has been a descending staircase channel for since mid-October following gbp uncertainty. Price is expected to continue making lower lows after bouncing off short term resistance zone. + Lower lows with price bounce off recent resistance signaling a downward continuation + Secondary confirmation with head and shoulders formation on the 4H OANDA:EURGBP...

The EUR/USD has confirmed a downtrend on the daily trailing through and bouncing off a major point of support/resistance. Be aware of Interest rates scheduled to come out this Tuesday afternoon. + Lower Lows forming after Lower Highs + Broke through support and bounced off old support as resistance OANDA:EURUSD i do this for fun. if you trade this way, you...

NZDCAD showing new highs after bouncing off high lows in an upward staircase on the daily chart Expected HL (High-Low) then a move to the upside to creating a new HH (High-High). + Price moving in upward channel + High-low followed by higher-high formation on daily - Price expected to create HL bounce @ 0.8430 i do this for fun. if you trade this way, you will...

A trip to the downside on the dollar-yen with a couple of confirmations on the daily. + Double top near May resistance level with immediate rejection followed by a price reversal to the downside + Triple touch RSI divergence confirmation on the daily FX:USDJPY i do this for fun. if you trade this way, you will lose money :)

A short position with an R:R of 1:2. + Head and Shoulder formation on the daily. + Accompanied by a double top. OANDA:CADCHF i do this for fun. if you trade this way, you will lose money :)

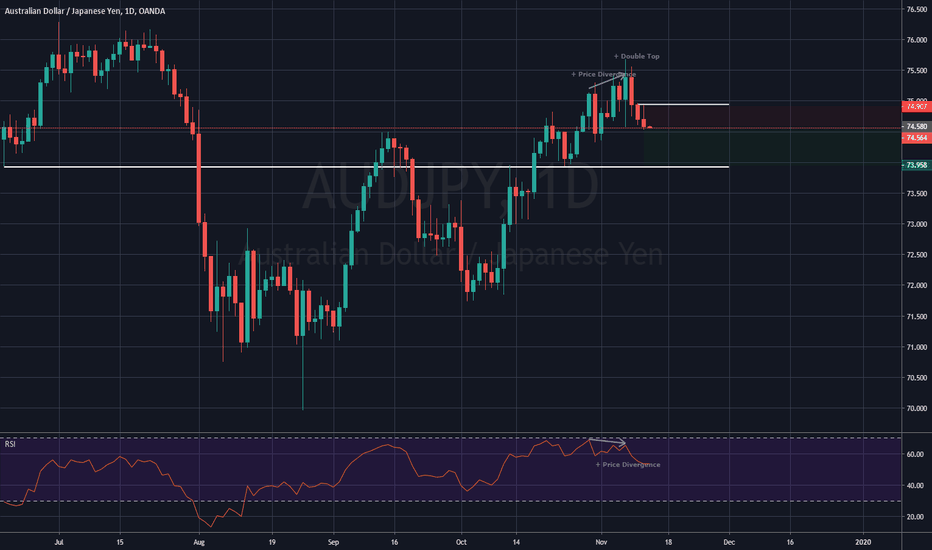

A strong indication of a trend reversal as price moving away from Monday market open. Price looking to touch June 18 low. + Double top on Daily + RSI divergence formation on the daily creating a nice R:R of 1:2 - trailing stop ahead of the AUD employment release OANDA:AUDJPY i do this for fun. if you trade this way, you will lose money :)

Possible double bottom reversal on the eur cad @ 1.4585 support level. Looking will likely retrace to closest resistance @ 1.4600 price level by New York open before continuing back down in downtrend. OANDA:EURCAD + Price hit major support level + Possible double bottom formation

Strong Brexit fundamentals carrying the pound up for the week. + Expected bearish trend reversal into and/or past 1.2550 @ London/Newyork Thursday open + RSI divergence in play as well + Short entry @ 1.2825 Tuesday and Wednesday highs formed. Expected manipulated correction to the downside. FX:GBPUSD

OANDA:USDJPY -overbought ( stochastic levels +70) -wedge formation