Santhera is readying some news in the Spring timeframe and I've drawn out some targets. Next target up is 20% from the current level. I have been accumulating. In full disclosure, I have a son who would benefit from success of Santhera products - which is why I am aware of this company at this time. I am not in any way or any other way associated with this company.

I stopped out on Crispr at 173.50 and since then the stock has consolidated setting higher lows while unable to break through resistance at around 173-173.50. This has had a significant impact on ARK-G which fed off the strong up-moves Crispr has made over the last six months. It is believed that Crispr is the Apple of the future. Many times over Apple's price...

Running a morning scan on finviz (need to figure out how to do that here) came up with Aeterna Zentaris. One of those times it feels risky to buy a 10,000 shares at $1 and then at $3 you think, I should have bought more! Last February this would be worth 1000%. Hard to tell how the market will treat this opportunity one year later. No reasonable charting to do...

Marrone Bio shares surged this week when they released the statement, "Grower demo trials saw an average of a six-to-one return on investment with improved yield of 6.4 bushels per acre in corn and 3.3 bushels per acre in soybeans. " I'm not a big fan of crop bio but I agree with the company statement that this is a big market to tap into. I wonder how Monsanto...

I know there are more sophisticated forecasts but I always believe in the simple. For now Bitcoin is supporting an upward channel but a lower upward trend line remains below as a 'worst case' pullback. Let's see.

Not much to say here other than bio stocks are the place to be. Historically there is plenty of headroom on this stock. I bought in around $9 and yes I wish I bought more. ATH is $23.60 - although very very briefly. In the meantime, I need to figure out some better charting for this one. Wait for the test and continuation up on this one. It has been such a long...

I have a relatively small position in Blok. Most of the share growth comes from ownership of Microstrategy, a 'prominent' corporate owner of Bitcoin asset. It's safe to assume that as Bitcoin goes so does BLOK.

Silver needs to push through this key resistance level for a 'continuation. Or will we drop back down to the bottom of the upward channel. Only silver knows.

It will be interesting to see whether or not we follow a correction pattern as others have published here, or whether the culmination of several different trendlines provide a strong area of support. I lightened my position as we headed off our high earlier Sat. Again, we'll see if that was a wise choice or not.

Test, low, resumption off... so obvious now. BTCEuro first, BTCUSD next

Throwing this out there as I always have interest in picking up a low price stock with significant upside potential. (I once bought Catabasis at .10 / share and mistakenly sold it at .30 / share. Ha ha on me.) Here's another bio-magic company that may be a fun and low-risk play (if you consider losing a thousand dollars low risk). ADXS most recent high that it...

I entered a small position on Corbus Pharma at 2.60 following a stock screener alert. The stock recently pushed through a resistance trend line at 2.50. This is a long shot speculative position with about 200% upside potential. However nothing is a sure thing. Just putting this out there for folks that like to speculate for fun and sometimes profit. I am not a...

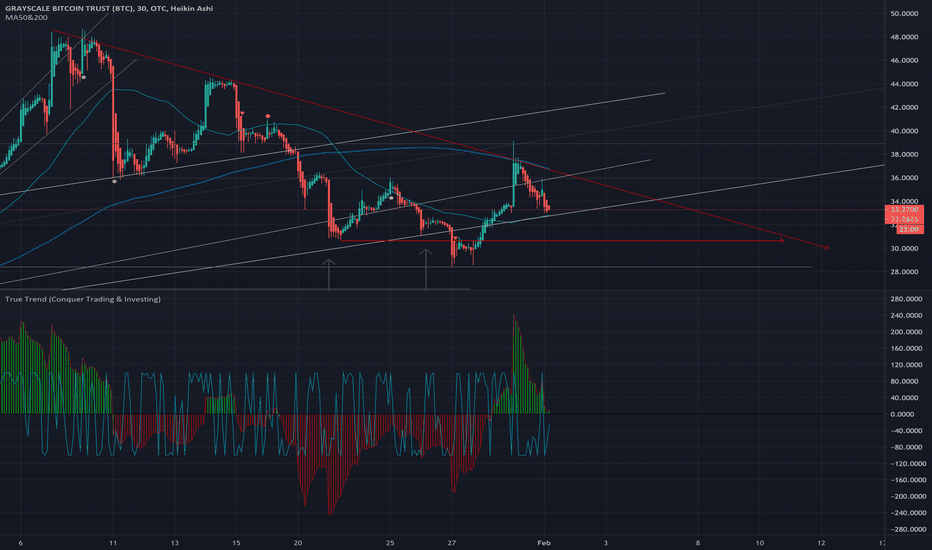

Another TradingView idea here suggested keeping track of BTC vs. GBTC for value. When GBTC lags behind BTC it poses a better value proposition.

Bitcoin takes groundhog day by storm and pushed through resistance and into a narrow upward channel. Will this hold? A lower trend line intersecting with the MA200 (1 hr) about 6% off today's high has been broken several times over the last week. Not fear mongering, just stating what is possible in the near term. There are so many places for speculation right...

It's my impression that financial tech will be a driver in 2021 regardless of how any specific crypto performs. You can see this chart that stepping back Cathie Wood and team have done a very good job maintaining upward momentum. Currently I only own a very small slice but am planning to buy in on pullbacks into the lower channel support trend line. Do your own...

An update here that although GBTC is holding a lower support trend line, the moment is shifting downwards in the near term. This could reverse and move higher however is less likely given BTC has not broken out above the current resistance.

In order of most activity or strongest to weakest. 1) An active horizontal area of support and resistance since Jan 1 (white lines). 2) Downward and upward trend lines forming a wedge pattern 3) An upward trending channel we entered in the last week of January and are trying to re-enter. Negative volume has subsided and it appears that we are more likely to...

I'm not sure we can put links here, but I thought this volume by exchange chart was interesting. data.bitcoinity.org